- United States

- /

- IT

- /

- NYSE:NET

Assessing Cloudflare (NET) Valuation After Widespread Internet Disruption Highlights Its Critical Infrastructure Role

Reviewed by Simply Wall St

A recent internet disruption that impacted popular platforms such as X (formerly Twitter) and ChatGPT stemmed from technical issues with Cloudflare (NET). While service has now been restored, the incident drew attention to Cloudflare’s foundational role in global internet infrastructure.

See our latest analysis for Cloudflare.

The recent outage aside, Cloudflare’s share price momentum has been striking this year, with a year-to-date gain of 75%. Short-term volatility has picked up, with a 5.7% advance this past week alongside a 13% decline for the month. Over the long run, Cloudflare’s total shareholder return stands at an impressive 97% over twelve months and over 300% in the past three years, underlining resilient growth expectations despite occasional bumps.

As disruptions in digital infrastructure draw attention, it might be the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

Given these strong headline numbers and the company’s pivotal role in today’s digital economy, should investors consider Cloudflare undervalued at current levels, or has the market already priced in all future growth potential?

Most Popular Narrative: 17.7% Undervalued

Cloudflare's last close price sits noticeably below the fair value calculated in the current most popular narrative. This sets the stage for a detailed look into the projected drivers fueling that valuation gap.

The accelerating adoption of AI, explosion in global web traffic, and proliferation of IoT devices are driving increased demand for fast, secure, and resilient cloud-native infrastructure. Cloudflare's core strength is evidenced by strategic partnerships with major AI companies and record-breaking DDoS mitigation. These factors position the company for sustained top-line revenue growth and strengthening customer retention.

Want to know which bold assumptions power that bullish valuation? Major AI deals, a projected business model shift, and ambitious revenue targets underpin a sky-high profit multiple. The underlying logic might surprise you. Explore the numbers behind this narrative to see what’s driving the gap.

Result: Fair Value of $239.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Heavy reliance on large enterprise clients and intensifying competition could challenge Cloudflare’s ability to sustain its current growth trajectory.

Find out about the key risks to this Cloudflare narrative.

Another View: Comparing Valuation Multiples

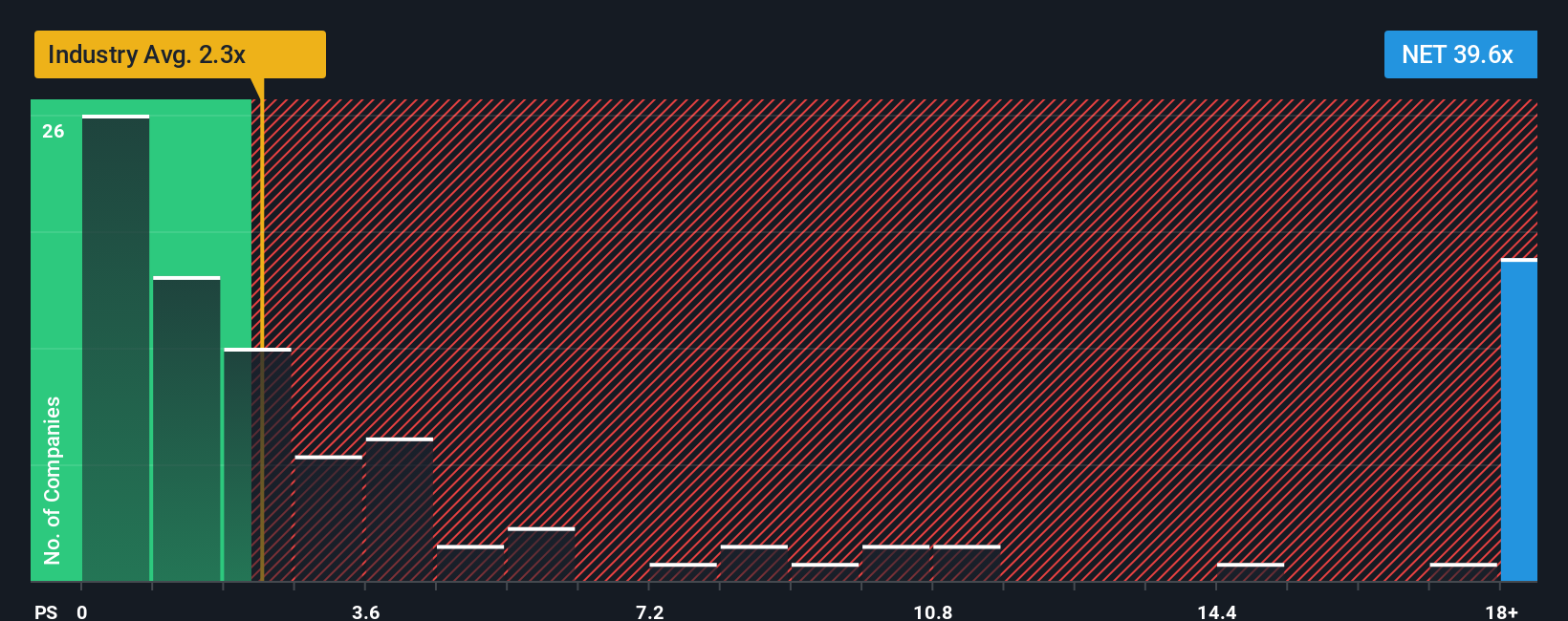

Looking at Cloudflare's price-to-sales ratio of 34.3x, the stock stands well above the US IT industry average of just 2.6x and its peer group at 16.6x. Even compared to the fair ratio of 18.2x, Cloudflare's premium is striking. That kind of gap can signal future valuation risk if high growth expectations are not met. Is the market expecting too much, or are investors paying for true potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cloudflare Narrative

If the narrative above doesn't match your perspective, you can easily dig into the data and build your own analysis in just a few minutes. Do it your way

A great starting point for your Cloudflare research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for greater investing success by tapping into new trends and untapped opportunities. Expand your watchlist with handpicked stocks matching your investment goals. The next standout performer could be just a click away.

- Boost your search for market outliers by checking out these 923 undervalued stocks based on cash flows and spot companies trading below their intrinsic value before the crowd catches on.

- Position your portfolio for the AI revolution by browsing these 25 AI penny stocks and find innovators at the forefront of artificial intelligence breakthroughs.

- Start building reliable returns with these 15 dividend stocks with yields > 3%, featuring companies delivering consistent income through strong yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Dentsply Sirona Stock: Dental Technology Built for Cycles, Not Headlines

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion