The 2020 COVID-19 pandemic has been a double-edged sword for companies like Mastercard Incorporated ( NYSE:MA )

At one side, it reinforced the shift toward electronic payments, but on the other it restricted international travel, hurting the total revenues.

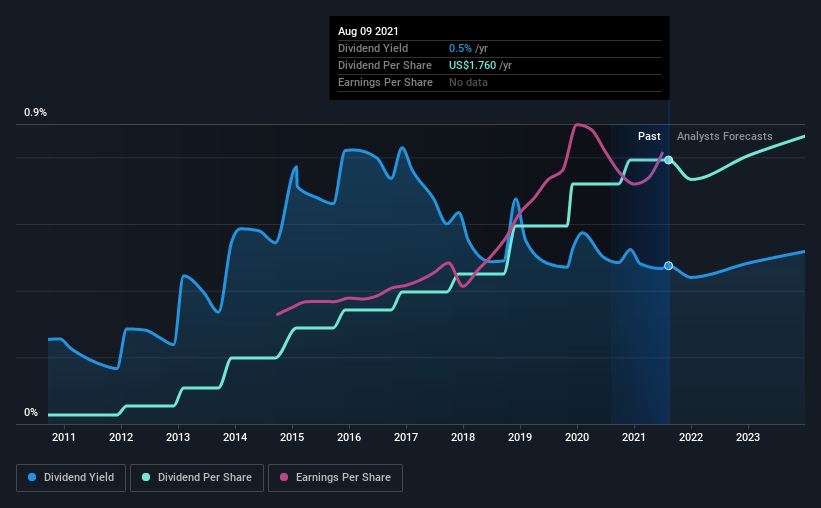

While the company has been paying a reliable dividend, the yield has been reasonably low compared to the industry average. We will examine why that is the case.

Strong Earnings in Q2

- GAAP EPS: US$2.08 (beat by US$0.33)

- Revenue: US$4.5b (beat by US$130m)

- Gross dollar volume: US$1.9tn (33% growth)

CEO Michael Miebach quoted domestic and cross-border spending as a reason for solid performance, and the recovering international travel as the source of the upside potential.

However, the company is not as generous with the yield. Even with the latest dividend hike , it still yields only 0.47%, with a payout ratio of just 25%. The company also bought back stock equivalent to around 1.7% of market capitalization this year.

Click the interactive chart for our full dividend analysis

Payout Ratios

Companies (usually) pay dividends out of their earnings. If a company is spending more than it earns, the dividend might have to be cut.Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable.Looking at the data, we see that 24% of Mastercard's profits were paid out as dividends in the last 12 months.We'd say earnings thoroughly cover its dividends.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Last year, Mastercard's cash payout ratio was 24%, which is relatively low and suggests that the dividend was thoroughly covered by cash flow.It's encouraging to see that the dividend is covered by both profit and cash flow.

We update our data on Mastercard every 24 hours, so you can always get our latest analysis of its financial health here.

Dividend Volatility and Growth

From the perspective of an income investor who wants to earn dividends for years, there is not much point in buying a stock if its dividend is regularly cut or is not reliable.During the past 10-year period, the first annual payment was US$0.06 in 2011, compared to US$1.8 last year.This works out to be a compound annual growth rate (CAGR) of approximately 40% a year over that time.

It's also essential to assess if earnings per share (EPS) are growing.Over the long term, dividends need to grow at or above the inflation rate to maintain the recipient's purchasing power.It's good to see Mastercard has been increasing its earnings per share by 16% a year over the past five years.Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

High ROCE Keeps the Dividend in Check

While examining the company's fundamentals, one thing that stands out is a high return on capital employed (ROCE).It is a metric that evaluates how much pre-tax income (in %) a company earns on capital invested in its business.

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.37 = US$8.8b ÷ (US$35b - US$11b) (Based on the trailing twelve months to June 2021).

So, Mastercard has a ROCE of 37%. In absolute terms, that's a great return, and it makes sense for the company to keep re-investing the majority of the capital instead of paying it out as a dividend.

Overall, Mastercard looks like a strong mixture of growth with some yield. At the right valuation, it could be a good story.

Market movements attest to how highly valued a consistent dividend policy is compared to a more unpredictable one.However, there are other things to consider for investors when analyzing stock performance. Taking the debate a bit further, we've identified 1 warning sign for Mastercard that investors need to be conscious of moving forward.

We have also put together a list of global stocks with a market capitalization above $1bn and yielding more than 3%.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:MA

Mastercard

A technology company, provides transaction processing and other payment-related products and services in the United States and internationally.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)