- United States

- /

- Software

- /

- NYSE:KVYO

Klaviyo (KVYO): Assessing Valuation Following Strong Q3 Results and Upbeat 2025 Revenue Outlook

Reviewed by Simply Wall St

Klaviyo (KVYO) posted strong third-quarter results, showing notable sales growth and a narrower net loss compared to last year. The company also lifted its full-year revenue forecast and shared upbeat guidance for the upcoming quarter.

See our latest analysis for Klaviyo.

Klaviyo’s upbeat earnings and raised outlook have brought a jolt of optimism. However, after a sharp 15.4% jump in the last month, the stock is still lagging for the year, with a -34.25% year-to-date share price return and a -20.55% total return over twelve months. There is renewed energy from recent results, but longer-term momentum has more catching up to do if confidence is really to build from here.

If Klaviyo’s rebound has you wondering what’s next for fast-moving growth stories, now's a great time to broaden your view and discover fast growing stocks with high insider ownership

With shares still far below previous highs despite surging sales and ambitious forecasts, is Klaviyo now an undervalued contender, or has the market already anticipated the company’s next phase of rapid expansion?

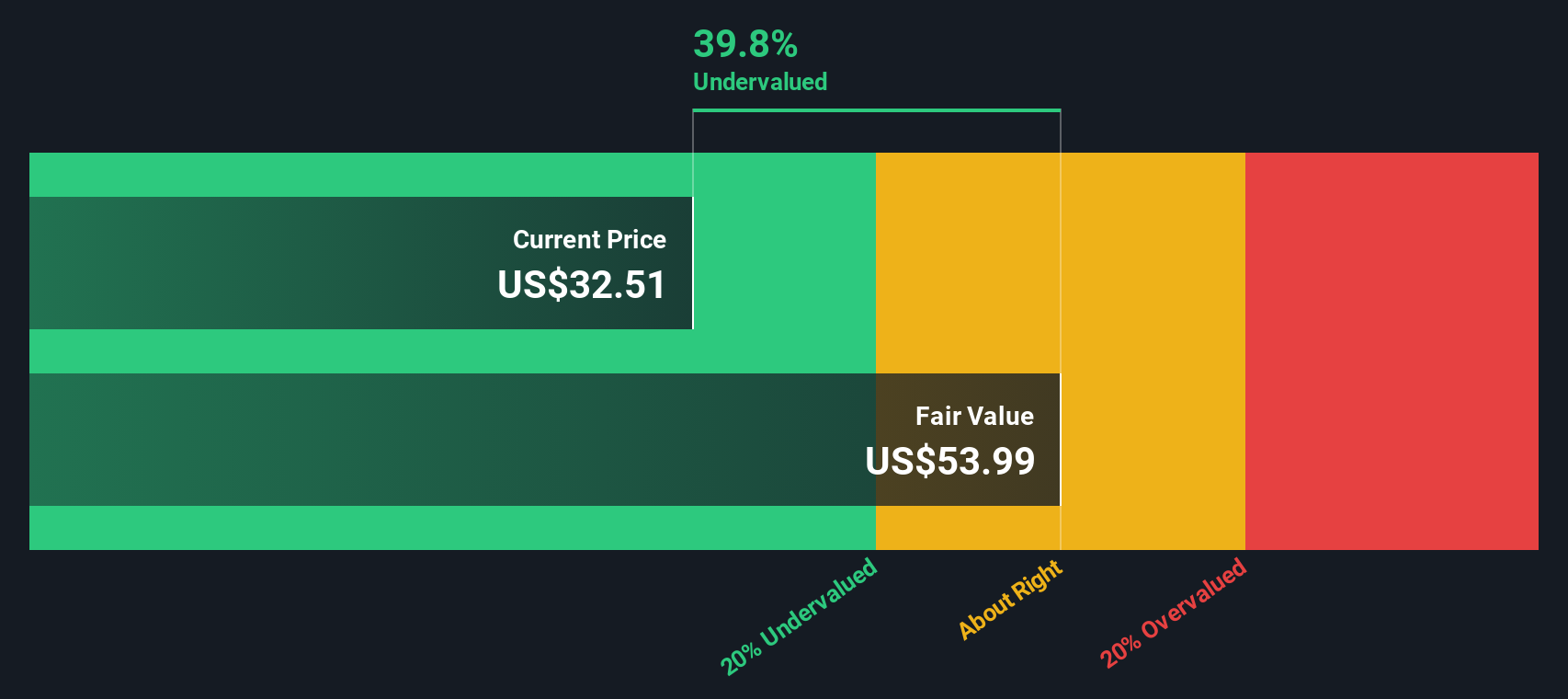

Most Popular Narrative: 37.3% Undervalued

With a fair value set at $43.68, substantially above the last close of $27.38, the narrative suggests that Klaviyo's current share price does not reflect its ambitious growth trajectory, according to the consensus view.

The rapid innovation and rollout of new AI-first products, including Conversational Agent, Helpdesk, and analytics, expands Klaviyo's addressable market from just marketing automation into broader B2C CRM and customer service. This sets up significant opportunities for higher ARPU and long-term revenue growth.

Want to know what drives this big gap between today’s price and the fair value? The narrative leans on bold assumptions about Klaviyo’s future margins, industry-defying profit shifts, and a growth pace that could shake up software sector expectations. Find out which numbers analysts are betting on to support this ambitious valuation.

Result: Fair Value of $43.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing challenges like rising infrastructure costs and persistent competition in AI-driven marketing technology could quickly put downward pressure on Klaviyo's positive outlook.

Find out about the key risks to this Klaviyo narrative.

Another View: Discounted Cash Flow Model

While analyst targets and multiples suggest Klaviyo might be undervalued, our SWS DCF model presents a different perspective. According to this discounted cash flow approach, shares are trading above their estimated fair value today. This raises questions about whether current optimism is already reflected in the price. Will the fundamentals align with the valuation, or is this a signal to proceed with caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Klaviyo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Klaviyo Narrative

If you think the story’s missing something or want to see the numbers your way, you can shape your own outlook in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Klaviyo.

Ready for Even Smarter Opportunities?

Don’t let today’s momentum distract you from tomorrow’s big winners. Use the Simply Wall Street Screener to target stocks that match your unique investing style and get ahead of emerging trends before everyone else.

- Maximize your search for future tech leaders by checking out these 27 AI penny stocks, which are shaking up the industry with innovative AI breakthroughs.

- Secure your next income idea by finding these 18 dividend stocks with yields > 3% with strong yields and solid financial footing, providing potential for lasting returns.

- Accelerate your portfolio with these 26 quantum computing stocks as quantum computing moves closer to making a real-world impact in high-growth sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Klaviyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVYO

Klaviyo

A technology company, provides a software-as-a-service platform in the United States, other Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives