- United States

- /

- IT

- /

- NYSE:KD

Kyndryl (KD) Turns Profitable, Challenging Bearish Narratives on Margins and Earnings Quality

Reviewed by Simply Wall St

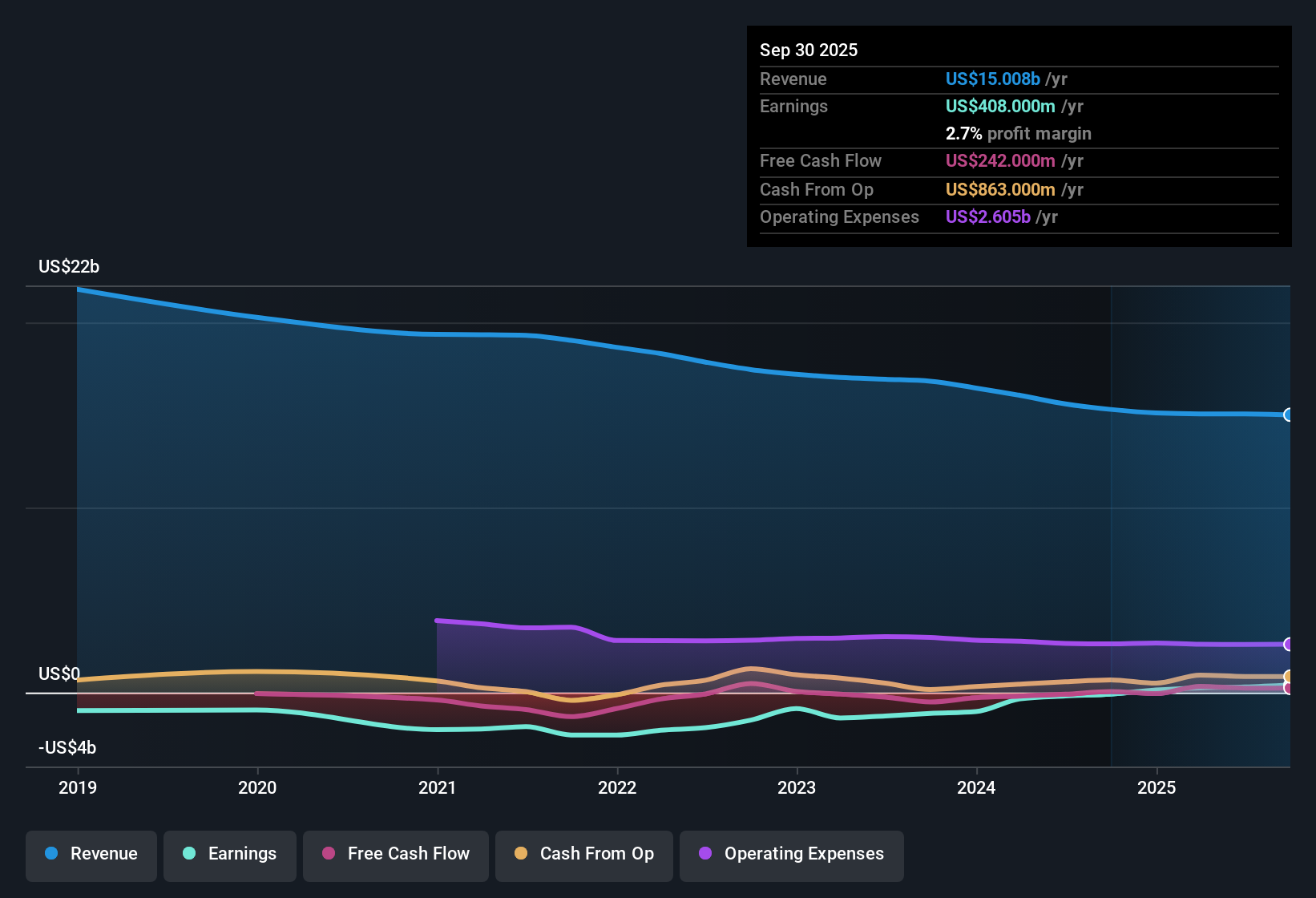

Kyndryl Holdings (KD) has turned profitable for the first time, reporting impressive annual earnings growth of 50.2% over the past five years. Looking ahead, earnings are projected to grow at 42.6% per year, significantly above the US market’s 15.8% average, while revenue is expected to rise at a more modest 3.5% per year. The company’s net profit margin has improved, making profitability the highlight of this latest release.

See our full analysis for Kyndryl Holdings.Now, let’s see how these results measure up against the dominant narratives and expectations in the market. Some stories may be confirmed, while others could face fresh scrutiny.

See what the community is saying about Kyndryl Holdings

Recurring Revenue Growth Drives Margin Expansion

- Kyndryl is shifting its business mix toward higher-margin, recurring revenue streams in cloud, AI, and cybersecurity, which are producing stronger profitability alongside a 44% year-over-year increase in signings for these advanced services.

- Analysts' consensus view highlights that these segment gains are boosting overall profit margins. Margin growth is expected to continue steadily, with profit margins forecast to rise from 2.0% now to 6.4% over the next three years.

- This trend supports the view that operational efficiency and contract improvements are reinforcing lasting financial performance.

- Consensus also notes that double-digit consulting growth and a shift toward post-spin, newer contracts further solidify top-line and margin momentum.

- What's driving analyst optimism? Get the full story in the consensus narrative. 📊 Read the full Kyndryl Holdings Consensus Narrative.

Exposure to Legacy Contracts Remains a Drag

- Roughly a third of revenues are still tied to older, pre-spin contracts, leaving Kyndryl open to ongoing revenue erosion and margin pressure as these contracts wind down or are renegotiated.

- Consensus narrative flags that these legacy relationships can create “lumpiness” and volatility in revenue and profits, as evidenced by Q1 revenue declines attributed to focus account reductions and delayed deals.

- The risk is that slow progress in replacing these legacy deals could limit how fast margins and earnings ramp up, despite gains elsewhere.

- Management acknowledges this revenue overhang will take a while to resolve, which could potentially constrain the pace of near-term margin improvement.

Valuation Disconnect Versus Fair Value and Peers

- Kyndryl’s current share price of $26.14 trades almost 75% above its DCF fair value of $14.98. Its 20.3x PE is higher than IT peer averages (15.0x), but lower than the broader US IT industry average of 29.7x.

- Analysts' consensus narrative notes a wide gap between analyst price targets and current value. The average analyst target stands at $41.25, about 58% above the current share price, but to reach these projections, Kyndryl must grow revenues to $16.7 billion and sustain higher margins, or risk missing the implied upside.

- These metrics highlight both the optimism priced in by analysts and the ongoing questions about whether current improvements are sustainable enough to justify the gap.

- Valuation remains a central tension, with the market granting some credit for future growth but not fully endorsing the long-term narrative just yet.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Kyndryl Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Turn your insights into a narrative and help shape the outlook in just a few minutes. Do it your way

A great starting point for your Kyndryl Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Kyndryl’s heavy reliance on legacy contracts and an uncertain path for recurring revenue leaves future growth and margin expansion vulnerable to setbacks.

If overpaying for growth stories worries you, use these 849 undervalued stocks based on cash flows to target opportunities that are trading below their intrinsic value and offer a better margin of safety.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyndryl Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KD

Kyndryl Holdings

Operates as a technology services company and IT infrastructure services provider in the United States, Japan, and internationally.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives