- United States

- /

- IT

- /

- NYSE:KD

Kyndryl Holdings (KD): Evaluating Valuation on Recent Share Price Movement and Growth Signals

Reviewed by Simply Wall St

Kyndryl Holdings (KD) shares have shown some movement over the past week, gaining nearly 2% and extending their one-year total return to about 26%. Many investors are watching to see if recent trends can keep the momentum going.

See our latest analysis for Kyndryl Holdings.

Kyndryl’s 1-year total shareholder return of nearly 26% stands out, even as the share price has pulled back about 18% year-to-date. While momentum was softer over the past quarter, recent gains suggest renewed investor optimism as the company navigates fresh developments.

If you’re searching for more companies showing new growth signals, this is a great time to broaden your horizons and explore fast growing stocks with high insider ownership

But with Kyndryl’s shares still trading at a notable discount to analyst targets and recent growth in net income, investors may wonder if the market is overlooking long-term potential or if all future upside is already priced in.

Most Popular Narrative: 32.7% Undervalued

With Kyndryl Holdings closing at $28.92, which is well below the most popular narrative's fair value estimate of $43, the narrative points to substantial upside if key projections unfold as expected.

The accelerating adoption of hybrid and multi-cloud environments is fueling demand for Kyndryl's advanced integration and management services, as evidenced by a 44% year-over-year increase in signings and substantial growth in hyperscaler-related revenues. This supports ongoing revenue expansion and a higher recurring revenue base.

What drives such a bullish outlook? It all comes down to ambitious forecasts for revenue growth, margin expansion, and big moves in future profit multiples. Will Kyndryl deliver these numbers and reward bold believers? Only a deeper look inside the narrative reveals the projections behind this eye-catching valuation.

Result: Fair Value of $43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged reliance on legacy contracts and possible delays in winning new deals could still put pressure on revenue growth and margins going forward.

Find out about the key risks to this Kyndryl Holdings narrative.

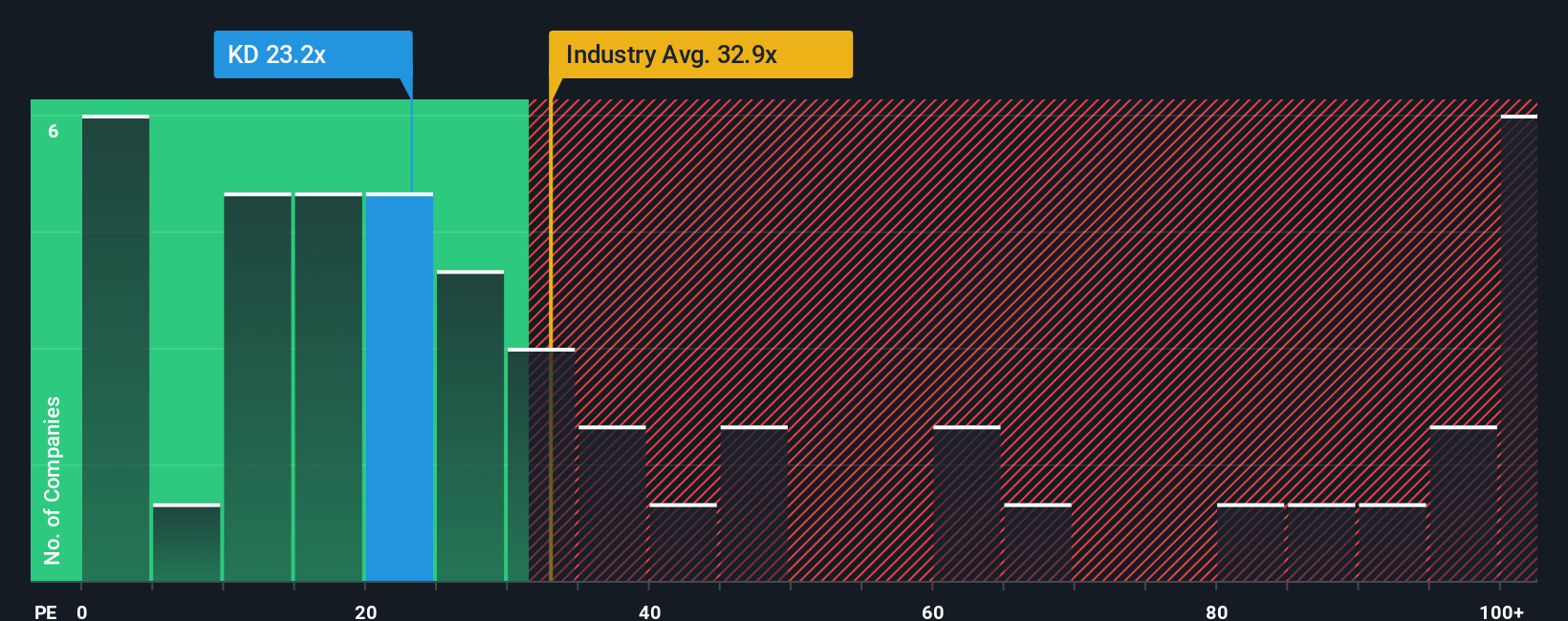

Another View: Market Ratios Paint a Different Picture

Looking at valuation through the lens of price-to-earnings, Kyndryl trades at 22.5x, which is higher than the average of 15.2x for its peers but below the US IT industry average of 29.4x. Compared to its fair ratio of 53.4x, the gap suggests potential upside, but also highlights valuation risk if sentiment shifts. Will the market eventually reward these multiples, or is caution justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kyndryl Holdings Narrative

If you see the story differently or want to dive deeper into the numbers, you can craft your own view in just a few minutes. Do it your way

A great starting point for your Kyndryl Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock a world of fresh opportunities with Simply Wall Street’s unique stock screeners. Don’t let today’s best ideas pass you by. Experience new possibilities in every market corner.

- Capture rising yield potential by targeting these 22 dividend stocks with yields > 3%. These offer robust dividends and consistent long-term returns that can strengthen your portfolio’s income stream.

- Fuel your growth ambition by targeting these 26 AI penny stocks. These are setting the pace in artificial intelligence breakthroughs and powering tomorrow’s technological advances.

- Tap into value with these 831 undervalued stocks based on cash flows. These may be mispriced by the market, putting you ahead of the curve when others are slow to react.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyndryl Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KD

Kyndryl Holdings

Operates as a technology services company and IT infrastructure services provider in the United States, Japan, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives