- United States

- /

- IT

- /

- NYSE:KD

How Does Kyndryl’s Valuation Stack Up After Its Digital Transformation Partnerships?

Reviewed by Bailey Pemberton

- Ever wonder if Kyndryl Holdings is really worth what the market says? Pull up a chair, because we're about to put this stock under the value microscope together.

- Kyndryl's share price has climbed an impressive 24.1% over the past year and is up a staggering 236.2% over three years. However, it has slipped 0.2% in the last week and 20.0% year-to-date.

- Recent headlines have highlighted Kyndryl's progress on strategic partnerships and digital transformation initiatives, which are capturing investor attention and likely contributing to the stock's volatility. Industry watchers are taking note as the company leans into modernization, with several big wins reported in the cloud and infrastructure space.

- On our six-point valuation framework, Kyndryl currently earns a 4 out of 6 score for being undervalued. This suggests there’s substance behind the buzz. We’ll dive into these different valuation approaches, so stick around, because by the end of the article we’ll reveal what could be the most insightful way to judge Kyndryl’s true worth.

Find out why Kyndryl Holdings's 24.1% return over the last year is lagging behind its peers.

Approach 1: Kyndryl Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates Kyndryl Holdings' value by projecting the company’s future cash flows and then discounting them back to their present value. This approach aims to capture the real worth of the business based on its ability to generate cash over time, rather than just relying on current profits or assets.

Currently, Kyndryl Holdings reports Free Cash Flow of $216.9 Million, and projections show a significant ramp-up, with analysts expecting $360.2 Million by March 2025. Looking further ahead, ten-year extrapolations suggest that annual FCF could reach nearly $2.6 Billion by 2035. It is important to note that only the next five years are rooted in analyst forecasts, with subsequent years extrapolated for modeling purposes.

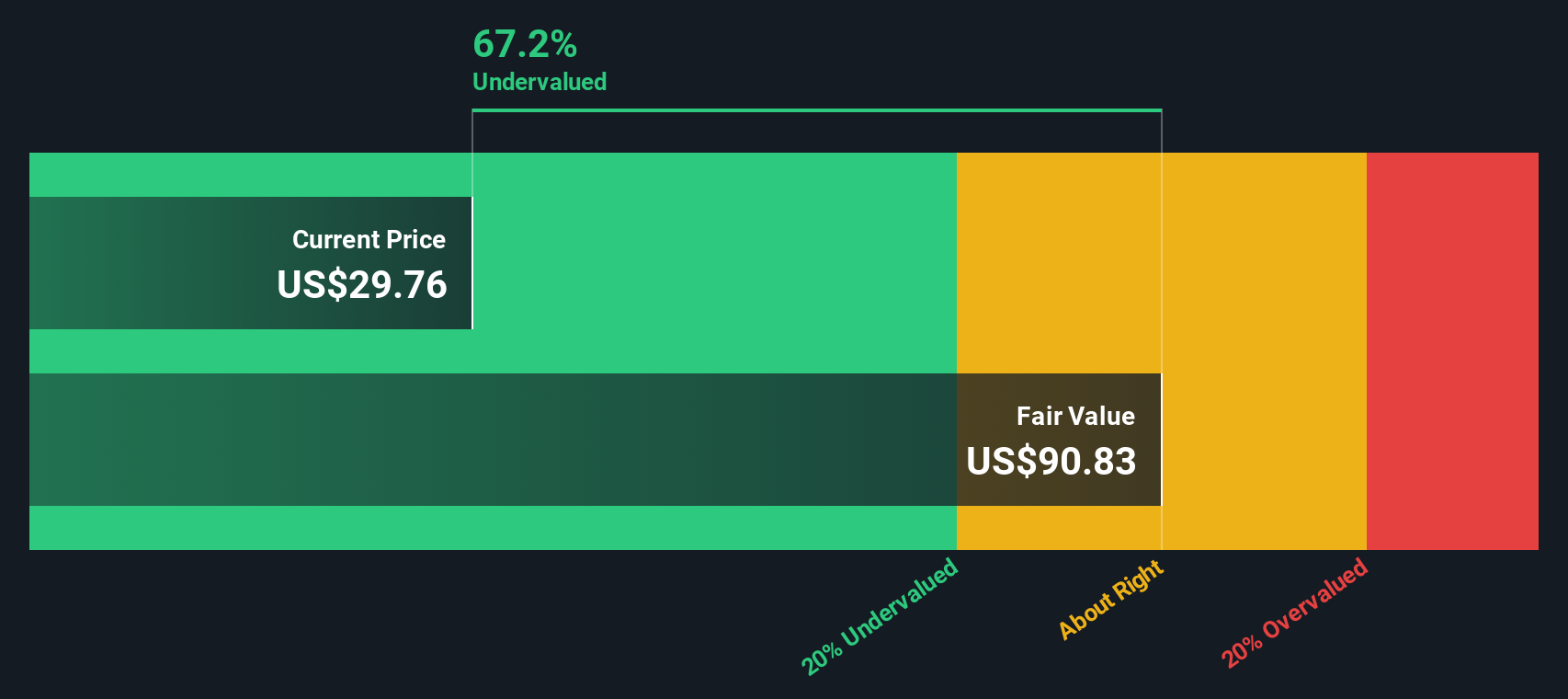

The DCF calculation results in an intrinsic value estimate of $88.37 per share for NYSE:KD. This is a compelling finding, since it implies the stock is trading at a 67.9% discount to its fair value based on long-term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kyndryl Holdings is undervalued by 67.9%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

Approach 2: Kyndryl Holdings Price vs Earnings

For profitable companies like Kyndryl Holdings, the Price-to-Earnings (PE) ratio is a trusted valuation metric because it directly relates a company’s stock price to the earnings it generates. This helps investors understand how much they are paying for each dollar of current profit, which is a practical way to judge whether a stock looks expensive or cheap.

What counts as a “normal” or “fair” PE ratio depends on factors like how quickly a company is expected to grow and the risks it faces. Companies with faster earnings growth, stable revenues, or lower risk profiles tend to justify higher PE ratios. More cyclical companies or those facing industry headwinds usually command lower multiples.

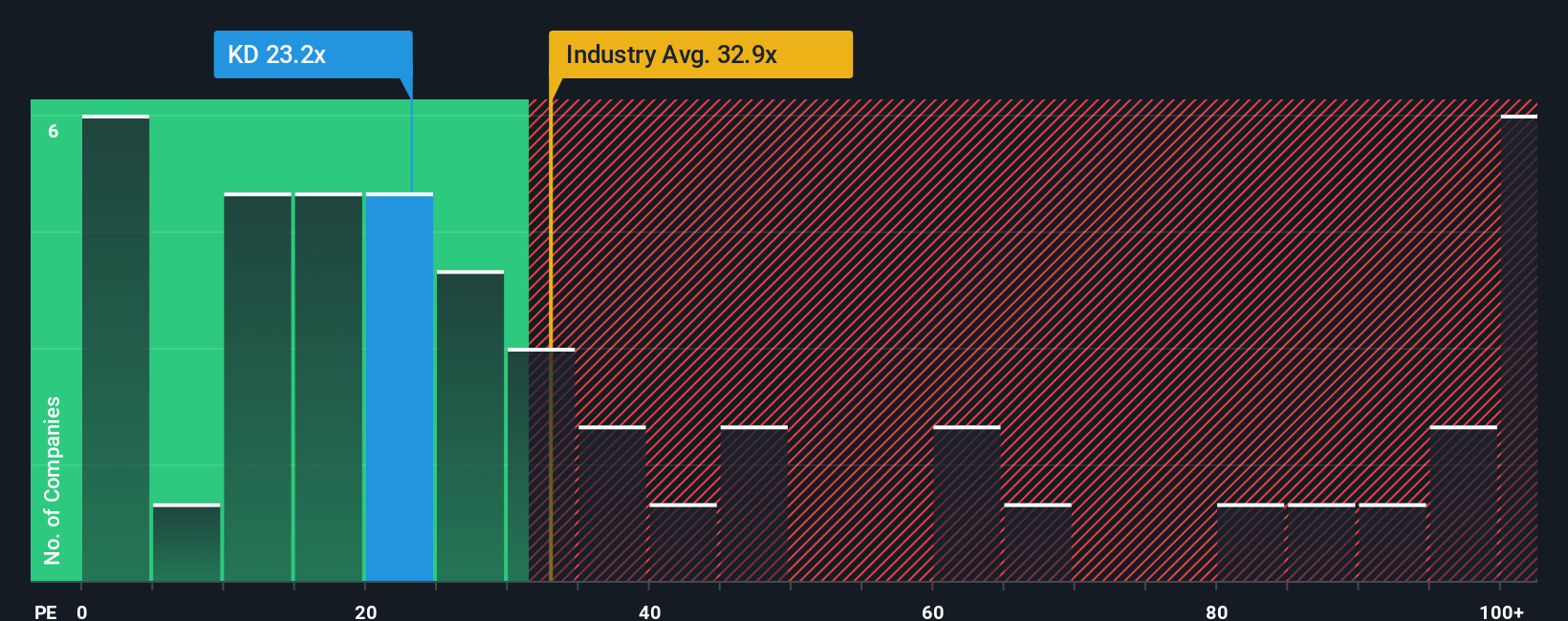

Kyndryl Holdings currently trades at a PE ratio of 22.1x. This is below its IT industry average of 29.3x and just above the peer average of 14.9x. At first glance, this might suggest Kyndryl is moderately valued within its industry context.

Simply Wall St’s proprietary Fair Ratio for Kyndryl, however, stands at 53.3x. Unlike standard peer or industry comparisons, the Fair Ratio is tailored to reflect Kyndryl’s own earnings growth prospects, profit margins, market cap, and company-specific risk factors. This makes it a more holistic benchmark and a potentially more effective tool for assessing the value on offer.

When comparing the 22.1x PE with the 53.3x Fair Ratio, it suggests Kyndryl Holdings is trading well below where it might be expected if all those factors were fully priced in. Through this lens, there appears to be significant potential undervaluation.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kyndryl Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about what matters for a company, including your outlook on its business drivers, estimated future sales and earnings, and where you believe its fair value really lies. Narratives turn these insights into dynamic forecasts, neatly connecting how a company's story shapes expected financial results and the fair value those prospects justify. On Simply Wall St’s Community page, millions of investors already use Narratives as an intuitive tool to track, share, and update their investment theses, giving users the ability to directly test their assumptions against the numbers.

When you set your own Narrative for Kyndryl Holdings, you can instantly see how your assumptions stack up. If your fair value is above today’s share price, it could signal an opportunity, while a lower fair value warns of potential risk. Narratives also stay relevant, with forecasts and fair values updating automatically when news, earnings releases, or business developments emerge. For example, some investors currently project a bullish fair value as high as $55.00 based on rapid digital transformation, while others are more cautious, estimating just $40.00 due to legacy contract risks. This highlights how your perspective shapes your investment decisions.

Do you think there's more to the story for Kyndryl Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyndryl Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KD

Kyndryl Holdings

Operates as a technology services company and IT infrastructure services provider in the United States, Japan, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives