- United States

- /

- IT

- /

- NYSE:IT

Why Gartner (IT) Is Down 5.1% After Profitability Miss and AI Competition Challenge

Reviewed by Sasha Jovanovic

- Gartner recently announced updated 2025 guidance, projecting at least US$6.48 billion in consolidated revenue as well as increases to both Insights and Conferences segment growth expectations, while maintaining its Consulting and Other revenue forecasts.

- A sharp decline in profitability, significant goodwill impairment of US$150 million, and rising competition from AI-powered rivals have become key pressure points for the company's operations and outlook.

- We'll review how these profitability concerns and competitive pressures impact Gartner's investment narrative and future growth prospects.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Gartner Investment Narrative Recap

To be a Gartner shareholder today, you need confidence in the company's ability to adapt as enterprise digital transformation fuels demand for trusted research and advisory services. However, the recent guidance update confirms near-term revenue growth, but ongoing profitability pressures and the competitive impact of AI-powered rivals represent the most important short-term catalyst and the primary risk, respectively, neither appears to be materially reduced by current developments.

One relevant announcement is Gartner’s record share repurchase of nearly 4 million shares (about 5 percent of outstanding stock) for over US$1 billion in Q3. While this could support shareholder returns, its impact on the profitability and competitive risks facing Gartner remains limited for now.

Yet despite these reassuring capital returns, investors should also be paying close attention to rising contract cancellations and churn among segments most affected by new technology entrants...

Read the full narrative on Gartner (it's free!)

Gartner's outlook forecasts $7.4 billion in revenue and $821.8 million in earnings by 2028. This reflects a 4.7% annual revenue growth rate but a decrease of $478 million in earnings from the current $1.3 billion.

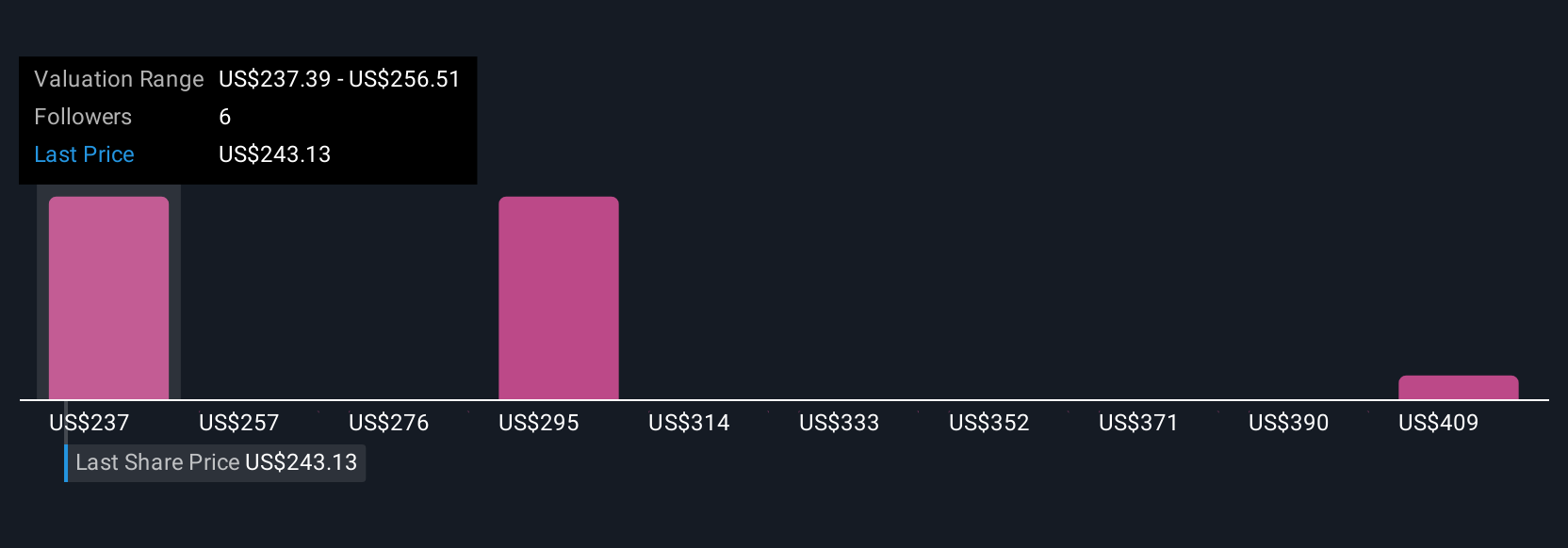

Uncover how Gartner's forecasts yield a $285.45 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range narrowly from US$284.56 to US$285.45 based on just 2 individual analyses. With intensifying competition from AI-driven upstarts, explore how other retail investors interpret Gartner's future potential and risks before making decisions.

Explore 2 other fair value estimates on Gartner - why the stock might be worth just $284.56!

Build Your Own Gartner Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gartner research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Gartner research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gartner's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IT

Gartner

Operates as a research and advisory company in the United States, Canada, Europe, the Middle East, Africa, and internationally.

Good value with limited growth.

Similar Companies

Market Insights

Community Narratives