- United States

- /

- IT

- /

- NYSE:IT

Should You Take a Fresh Look at Gartner After Its 49% Drop in 2024?

Reviewed by Simply Wall St

Thinking About Gartner Stock? Here’s What You Need to Know

If you are wondering whether it is finally time to take a closer look at Gartner, or if it is safer to wait on the sidelines, there has been plenty of recent activity to consider. Gartner’s stock has seen significant movement in recent years, with around 87% growth over five years. However, the company has faced more challenging conditions recently. Over the past year, shares are down nearly 49%, with similar pressure evident over shorter periods. This suggests the market may be reconsidering Gartner’s growth potential or, at the very least, adjusting its risk assessment of the company.

Despite these fluctuations, some analysts are discussing the possibility of undervaluation. According to a set of valuation checks, Gartner scores 3 out of 6 possible points, indicating that it passes half of the key criteria for being undervalued. In practical terms, almost half the methods used to measure value suggest the stock may currently be trading below its estimated worth. This could signal a potentially interesting opportunity for investors who are willing to do further research.

If you are considering an entry or exit, understanding how Gartner stands from a valuation perspective is important. Here is a closer look at these valuation approaches to see what the data indicate. And stay tuned—there is an insightful method of tying all this information together at the end that you may find helpful.

Gartner delivered -48.8% returns over the last year. See how this stacks up to the rest of the IT industry.Approach 1: Gartner Cash Flows

The Discounted Cash Flow (DCF) model estimates what a company is truly worth by projecting its future cash flows and then discounting them back to today’s value. This approach provides investors with a sense of intrinsic value that is independent of market prices.

Gartner currently generates Free Cash Flow (FCF) of approximately $1.5 billion. Projections for the next ten years indicate moderate growth, reaching over $1.4 billion in FCF by 2035. These forecasts, based on analyst and internal estimates, form the foundation for the DCF calculation.

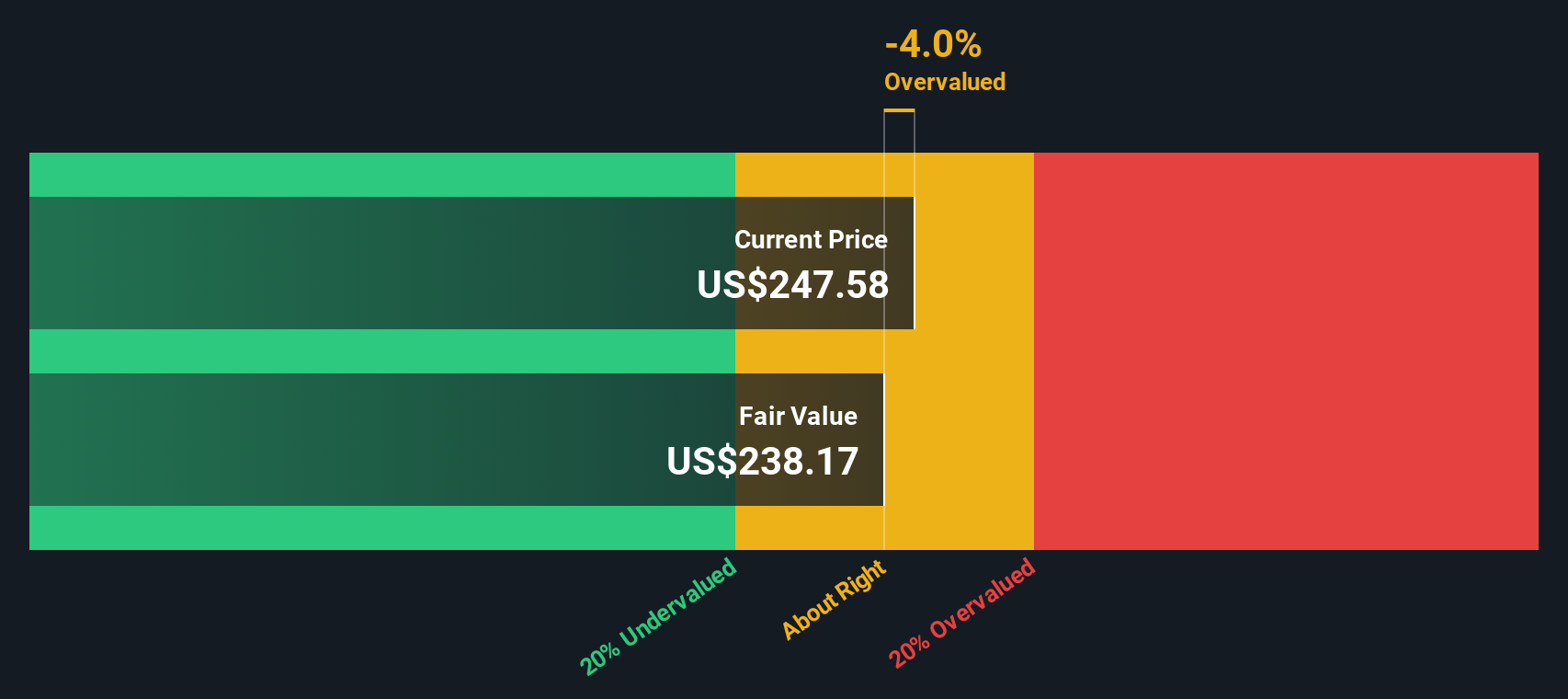

When all cash flows are accounted for and discounted to present day, Gartner’s intrinsic value is estimated at approximately $238.31 per share. Compared to the market price, this model indicates that Gartner stock is about 2.7% overvalued at present. In summary, the current share price and the calculated intrinsic value are closely aligned, with only a minor premium.

Result: ABOUT RIGHT

Approach 2: Gartner Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation measure for profitable companies like Gartner, because it directly relates a company’s market price to its bottom-line earnings. A “normal” or fair PE ratio for any stock is shaped by expectations of future growth and the perceived risk of the business. Generally, a company with higher growth and lower risk will trade on a higher PE multiple.

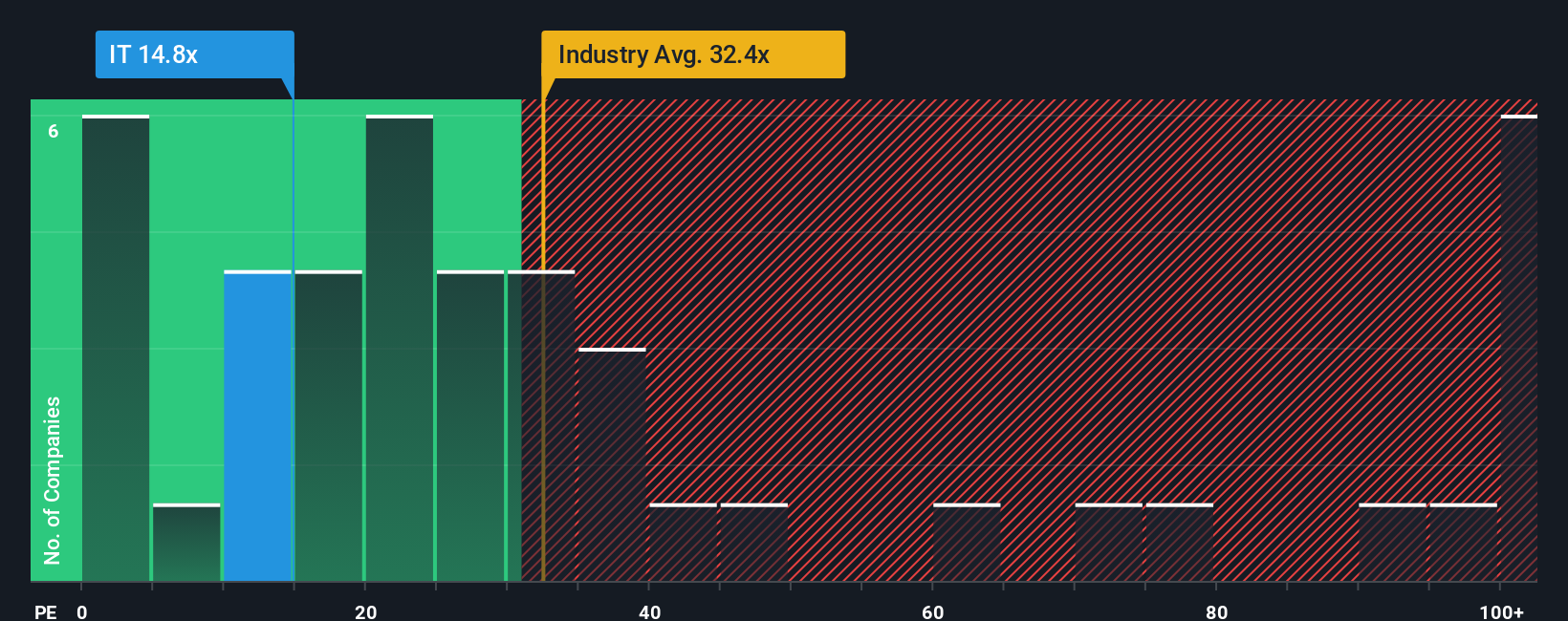

Gartner currently trades at a PE ratio of 14.6x, which is notably below both the industry average of 29.5x and the peer group average of 19.6x. This suggests the market is applying a significant discount relative to broader industry standards and similar companies. Simply Wall St’s Fair Ratio for Gartner, determined by looking at its earnings growth, margins, size and risks, is 24.5x. This indicates that, based on fundamental factors, a 24.5x multiple could be justified for the business.

Comparing Gartner’s actual PE of 14.6x to its Fair Ratio of 24.5x, the stock appears meaningfully undervalued using this approach. Investors may be receiving more earnings relative to price than both the industry average and what would be suggested by the company’s profile.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Gartner Narrative

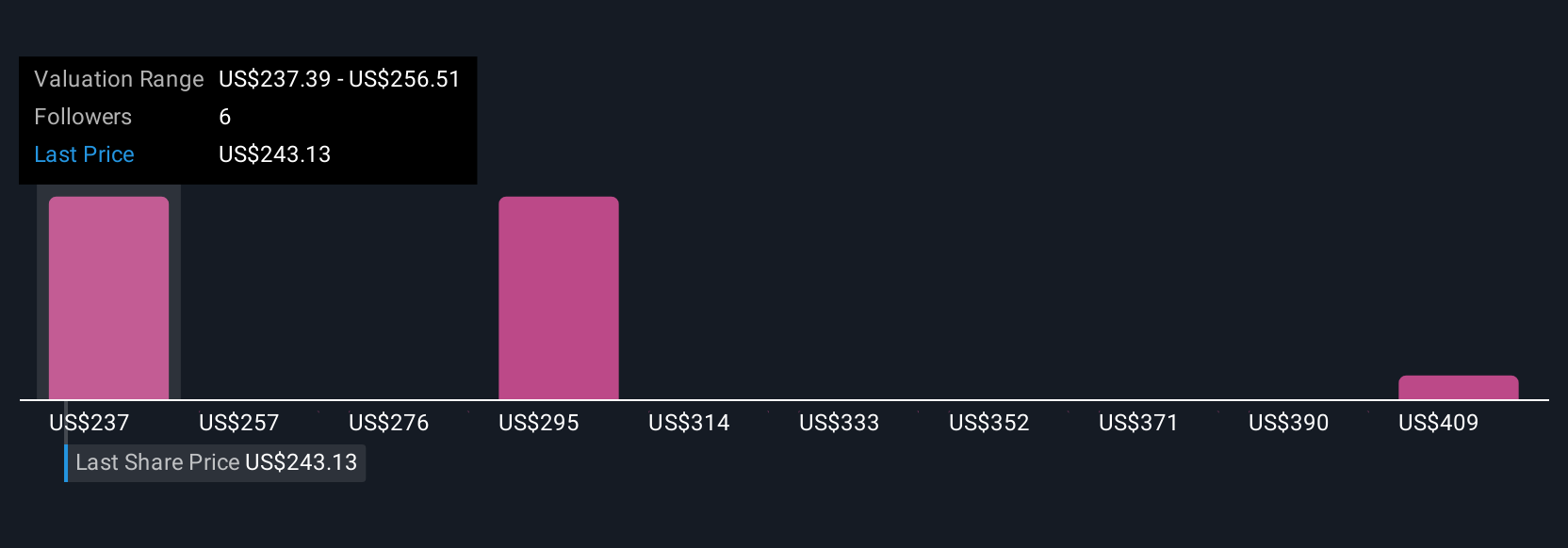

Narratives are powerful investing tools that let you connect your own story about a company, such as what you believe about its future prospects, earnings, and margins, to a clear financial forecast and an estimated fair value. Rather than just focusing on numbers, a Narrative gives you context for why those numbers might make sense, linking Gartner’s business developments and risks to a valuation that is both personal and data-driven.

Within Simply Wall St’s platform and vast community, Narratives are easy to use and make sophisticated investing accessible for everyone, regardless of experience level. They help you decide when to buy or sell by showing how your assumed fair value compares to the current market price, all while automatically updating as new facts, news, or earnings emerge.

For example, some investors see Gartner’s future fueled by enterprise AI and expect its fair value close to $457. Others, who are more cautious about risks in the subscription model, estimate fair value near $225. Narratives make these perspectives transparent and dynamic, helping you blend your view of Gartner’s story with the latest data for smarter, more confident decisions.

Do you think there's more to the story for Gartner? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IT

Gartner

Operates as a research and advisory company in the United States, Canada, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives