- United States

- /

- Software

- /

- NYSE:IOT

Will Samsara's (IOT) California Deal Reveal a Public Sector Growth Catalyst or Competitive Challenge?

Reviewed by Sasha Jovanovic

- Earlier this month, Samsara Inc. announced new software licensing program contracts with the State of California, enabling all public sector entities within the state to more readily adopt the company's platform for operational efficiency, safety, and regulatory compliance.

- This agreement streamlines the ability for California agencies to access real-time data insights and workflow automation, signaling potential expansion within the broader public sector segment.

- We'll explore how direct statewide access to Samsara's platform for California agencies could influence the company's growth outlook and recurring revenue opportunities.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Samsara Investment Narrative Recap

To be a Samsara shareholder, you generally need to believe in the company's ability to drive recurring revenue through the digital transformation of operations across sectors like government and transportation. The recent software licensing agreement with the State of California reinforces Samsara’s growing influence in the public sector, offering a potential catalyst for near-term growth by simplifying adoption for large-scale clients. However, it does not directly reduce the risk posed by elongated enterprise sales cycles, which remain a source of revenue unpredictability.

Of its recent developments, the deal with First Student to equip 46,000 vehicles stands out as a strong parallel to the California agreement, showing Samsara's expanding reach with major clients. Such milestone deployments support the company’s thesis of tapping into large, under-penetrated markets, though execution risks in integrating and rolling out technology at scale persist.

Yet, what investors should keep in mind is that despite increased access to government agencies, the challenge of unpredictable sales cycles remains a critical consideration...

Read the full narrative on Samsara (it's free!)

Samsara's narrative projects $2.4 billion revenue and $311.3 million earnings by 2028. This requires 21.2% yearly revenue growth and a $432 million earnings increase from current earnings of -$120.7 million.

Uncover how Samsara's forecasts yield a $48.20 fair value, a 21% upside to its current price.

Exploring Other Perspectives

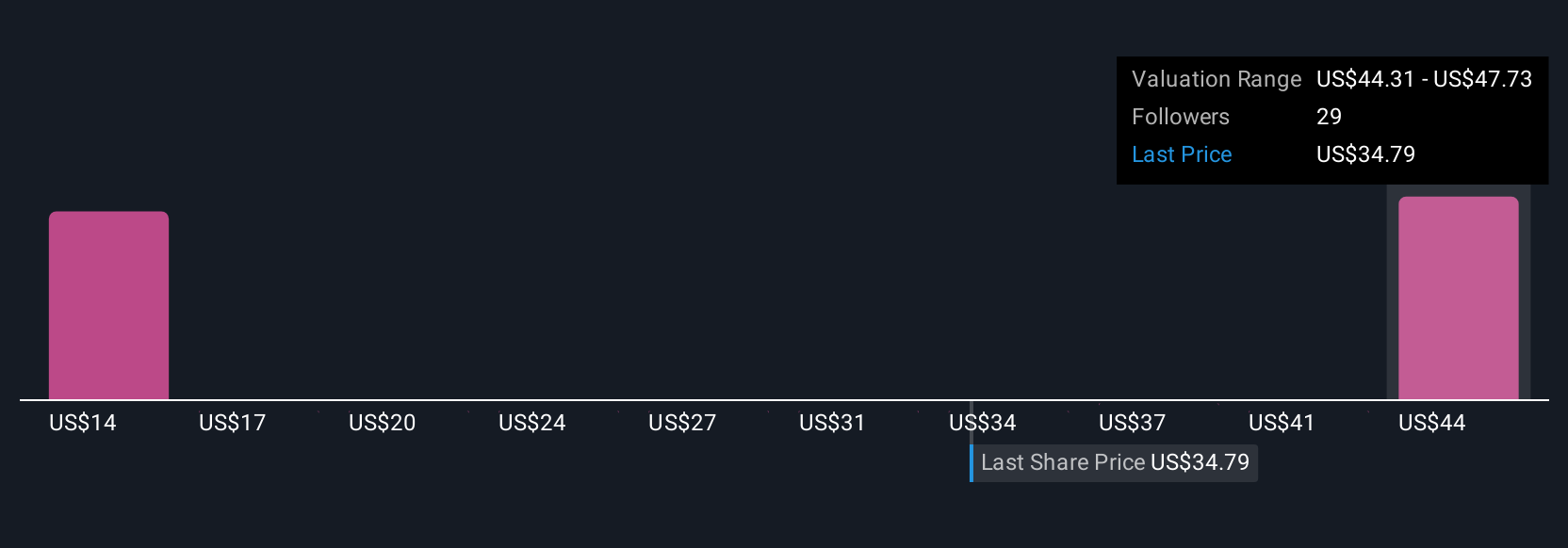

Fair value estimates from the Simply Wall St Community range from US$13.51 to US$59.16 across 10 different perspectives, highlighting broad disagreement. While some expect substantial revenue growth in new markets, others point to slow technology adoption as a caution.

Explore 10 other fair value estimates on Samsara - why the stock might be worth less than half the current price!

Build Your Own Samsara Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Samsara research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Samsara research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Samsara's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions to connect physical operations data to its connected operations platform in the United States and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives