- United States

- /

- Software

- /

- NYSE:IOT

Samsara (IOT): Valuation Insights as Fed Comments Boost Growth Stock Optimism

Reviewed by Simply Wall St

Samsara (IOT) saw its stock jump 5% after a Federal Reserve official signaled there could be more room for policy easing. This fueled investor interest in software and other growth-focused stocks.

See our latest analysis for Samsara.

Samsara’s share price has rebounded strongly on upbeat market sentiment, climbing 4.8% in a day as investors warmed to growth stocks after the Federal Reserve’s softer tone. Despite that bounce and waves of product innovation, including safety features, compliance upgrades, and new client wins, momentum has yet to fully recover. The year-to-date share price return stands at -16.5%, and the one-year total shareholder return remains down over 33%. Long-term holders, however, are up a remarkable 284% over three years. This highlights the company’s lasting growth story even through bouts of volatility.

If you’re curious what other software innovators are gaining traction in this market, now’s an ideal time to explore the See the full list for free..

With such a dramatic rally following recent Fed signals, investors now face a critical question: does Samsara’s current valuation leave room for upside, or is the market already reflecting all the anticipated future growth?

Most Popular Narrative: 23.8% Undervalued

Compared to Samsara’s last close price of $36.72, the most popular narrative values the shares at $48.20, suggesting significant upside if the outlined growth trajectory holds true. This valuation is built on analyst consensus around powerful drivers and forward-looking metrics.

The company is leveraging a vast data asset, processing over 14 trillion data points annually. This positions Samsara to enhance its offerings using AI, creating new products and services that can drive operational efficiencies and safety improvements for their customers, potentially leading to higher adoption and market share. Impact: Revenue and net margins.

What is fueling such a high estimate? The narrative hinges on bold assumptions about future expansion and margin gains, but not all the moving pieces are revealed here. Intrigued by how ambitious revenue forecasts, AI innovation, and industry shift predictions combine to justify this premium? Unpack the complete narrative and see what really drives this undervaluation call.

Result: Fair Value of $48.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty remains because longer enterprise sales cycles and emerging platform competition could challenge Samsara’s growth projections if market conditions shift.

Find out about the key risks to this Samsara narrative.

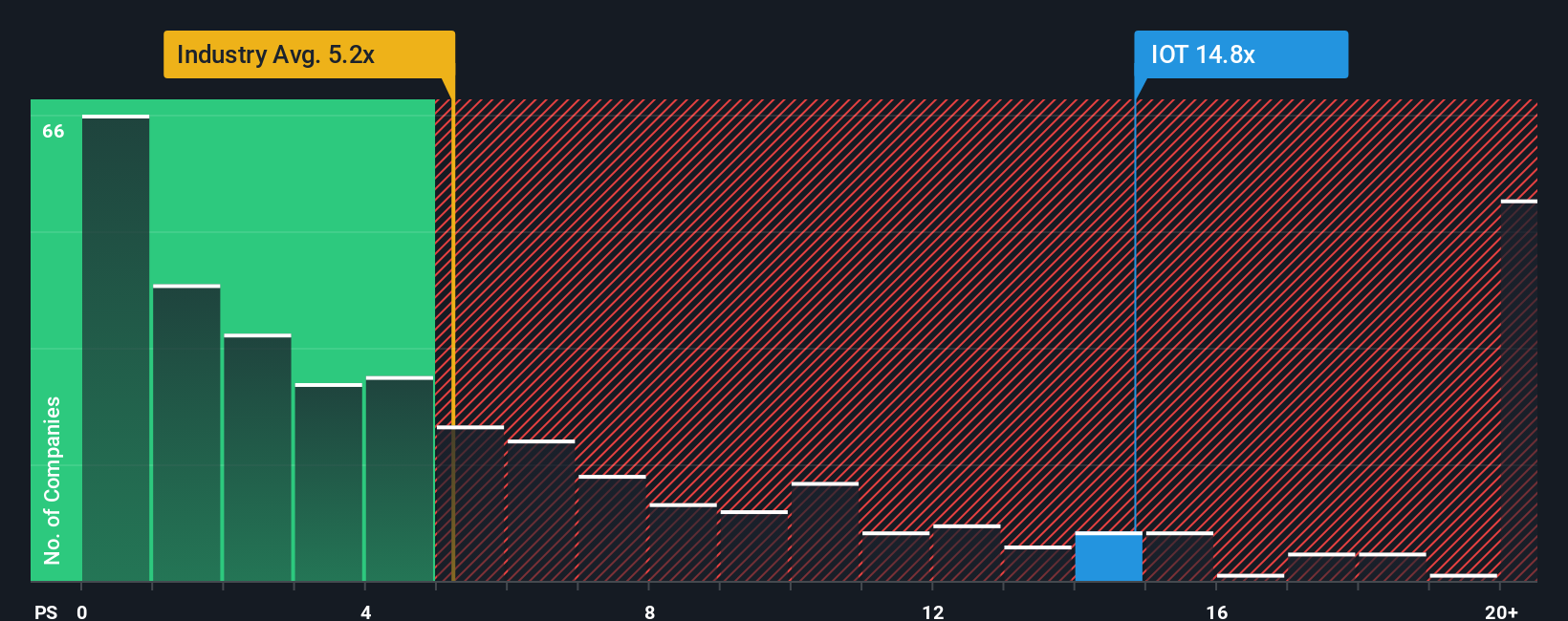

Another View: Market Multiples Raise Caution

While analyst forecasts point to significant upside, the current share price values Samsara well above its industry and peer averages in terms of price-to-sales ratio. At 14.8x, it stands much higher than the software sector average of 4.6x, the peer average of 7.4x, and even above the fair ratio of 11.1x. This suggests investors are paying a premium for anticipated growth, which could be a risk if those big expectations are not met. Is the market pricing in too much optimism, or is Samsara’s opportunity truly that exceptional?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Samsara Narrative

If you want to challenge the consensus or discover unique insights backed by your own research, building your own Samsara narrative is quick and easy. Give it a try with Do it your way.

A great starting point for your Samsara research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next opportunity pass you by. Use these handpicked stock ideas on Simply Wall Street to broaden your portfolio and seize fresh possibilities.

- Spot future tech disruptors by reviewing these 26 AI penny stocks, which are primed for AI breakthroughs and market leadership.

- Collect reliable income with these 15 dividend stocks with yields > 3%, which offer attractive yields and steady financial performance.

- Capitalize on innovation in digital assets through these 81 cryptocurrency and blockchain stocks, giving you exposure to blockchain and emerging cryptocurrency trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions to connect physical operations data to its connected operations platform in the United States and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives