- United States

- /

- Software

- /

- NYSE:IOT

A Fresh Look at Samsara (IOT) Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Samsara.

Zooming out, Samsara’s share price has rebounded recently, but it still sits below where it started the year. The 1-year total shareholder return is down 13%, even as recent momentum builds, and the 3-year total return has soared more than 315%. This reflects that investors continue to debate its growth versus valuation story.

If Samsara’s latest move has you thinking bigger picture, now’s your chance to discover See the full list for free.

With recent gains but still-negative returns over the past year, the debate now centers on whether Samsara’s current valuation leaves room for upside or if the market has already priced in its future growth potential.

Most Popular Narrative: 16.7% Undervalued

Samsara’s widely followed narrative sets a fair value notably above the recent $40.17 close, suggesting potential that may not be fully priced in by the market. The narrative justifies this premium with bold expectations around long-term growth, underlining robust recurring revenue and a fast-growing customer base.

"Samsara is experiencing strong growth in annual recurring revenue (ARR), evidenced by a 32% year-over-year increase. This growth is primarily driven by their success in landing large enterprise customers, indicating future revenue expansion opportunities with existing clients. Impact: Revenue growth."

What is the real catalyst behind this optimism? Underneath the headline numbers are aggressive assumptions about future margins and a major transformation in underlying profitability. Want to see which pivotal financial projections are shaping this impressive valuation? Get the full breakdown and uncover what drives consensus on Samsara’s future worth.

Result: Fair Value of $48.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty around slow tech adoption in key sectors and ongoing geopolitical risks could challenge Samsara’s growth trajectory and narrative in the future.

Find out about the key risks to this Samsara narrative.

Another View: Valuation Through a Sales Lens

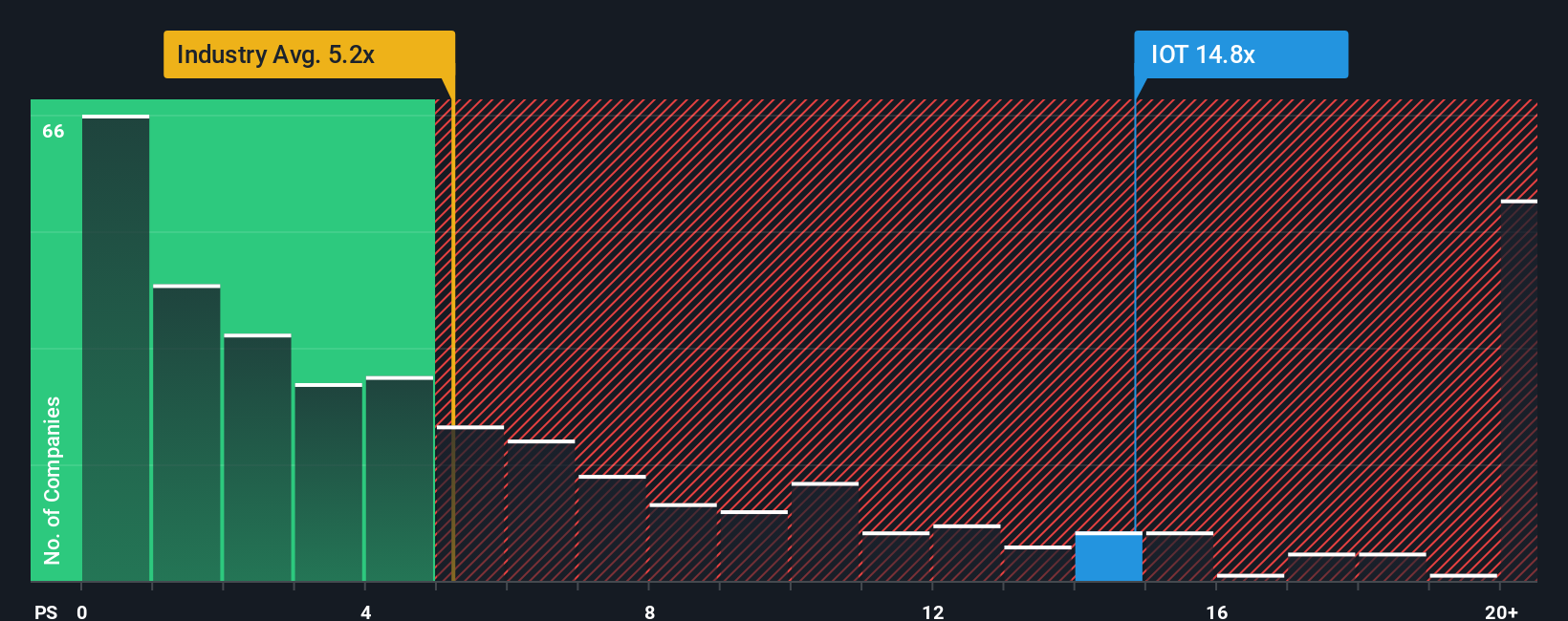

While the consensus narrative points to upside, a look at Samsara's price-to-sales ratio adds a different angle. At 16.2x, it is much higher than both the US software industry average of 5.2x and its peers at 10.5x, and it even exceeds what our model considers a fair ratio of 11.5x. This suggests the stock is trading at a premium level, not a bargain, raising questions about potential valuation risk if expectations shift. Does the current price reflect momentum, or is it running too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Samsara Narrative

Curious to dig deeper or take a different view? You can analyze the numbers yourself and form a personal perspective in just a few minutes, so why not Do it your way

A great starting point for your Samsara research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are always one step ahead. Strengthen your portfolio by tapping into fresh opportunities and trends that many others may overlook.

- Unlock new streams of passive income with potential standouts in these 22 dividend stocks with yields > 3% offering attractive yields above 3%.

- Capitalize on the AI wave by considering these 26 AI penny stocks that could disrupt industries and shape the future of automation.

- Stay ahead of the next market shift by exploring these 836 undervalued stocks based on cash flows companies primed to outperform based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions to connect physical operations data to its connected operations platform in the United States and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives