- United States

- /

- IT

- /

- NYSE:IBM

International Business Machines (NYSE:IBM) Partners With DBmaestro For Enhanced DevOps Automation

Reviewed by Simply Wall St

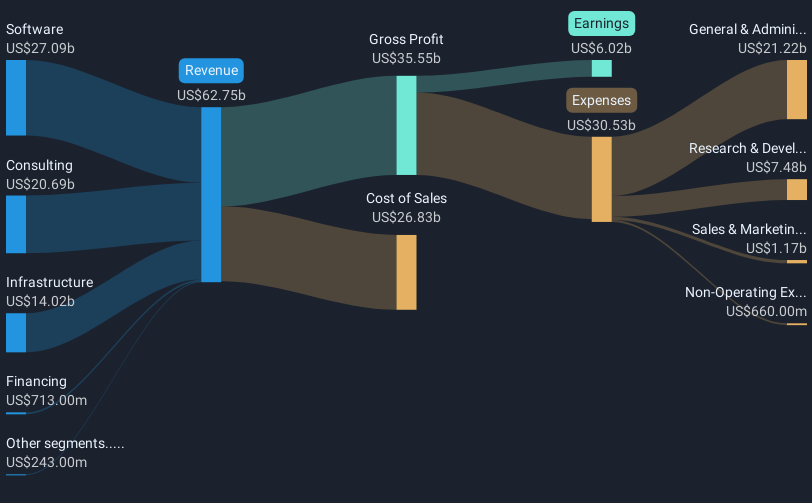

International Business Machines (NYSE:IBM) recently announced a significant OEM partnership with DBmaestro, integrating advanced database DevSecOps and observability tools into its solutions. Despite this development, which promises to enhance IBM's proposition in hybrid and multi-cloud environments, the company's share price rose by 16% over the last quarter, aligning it somewhat with broader market trends. Additionally, IBM's increased quarterly dividend and initiatives in quantum computing and AI integration are likely to have bolstered investor confidence, contributing to this price movement amidst a market environment where indices like the S&P 500 and Nasdaq experienced gains.

Be aware that International Business Machines is showing 4 weaknesses in our investment analysis.

The recent partnership announcement between IBM and DBmaestro represents a significant uplift in IBM’s capabilities in the hybrid and multi-cloud domain. This collaboration could enhance IBM's software offerings and potentially accelerate revenue growth, particularly in sectors integrating advanced database DevSecOps tools. Such advancements align well with IBM's strategic push in cloud and AI, aiding the company in maintaining competitive positioning.

On a longer-term horizon, IBM's total shareholder return, which includes both share price appreciation and dividends, has reached 223.79% over five years. In contrast to the past year, where IBM outperformed the US Market return of 13.9% and the US IT industry return of 36.2%, the five-year performance paints a picture of robust historical gains, possibly driven by strategic investments in innovative technologies.

The recent news could positively impact IBM's revenue and earnings forecasts by bolstering its technology portfolio. However, considering the current share price of US$253.37 and the bearish analyst price target of US$183.83, there appears to be significant disparity between market expectations and some analyst valuations. Continued innovation and strategic partnerships like the one with DBmaestro will be crucial in addressing these valuation gaps and meeting growth expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives