- United States

- /

- IT

- /

- NYSE:IBM

IBM's DARPA Quantum Milestone Might Change the Case for Investing in International Business Machines (IBM)

Reviewed by Sasha Jovanovic

- IBM was recently selected for Stage B of the U.S. Defense Advanced Research Projects Agency’s Quantum Benchmarking Initiative, highlighting external recognition of its quantum computing advancements and ongoing collaboration with SEEQC to explore novel scaling approaches.

- This announcement reinforces IBM’s position as one of only two companies with operational quantum computing technology, amplifying confidence in its competitive edge within this emerging field.

- We'll examine how IBM's progress in quantum computing, validated by DARPA, could influence the company’s overall investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

International Business Machines Investment Narrative Recap

IBM shareholders generally need to believe that the company’s multi-decade focus on enterprise technology puts it in a good position as digital transformation ramps up across industries. The recent DARPA quantum selection highlights IBM’s technical credibility but does not meaningfully shift the most important short-term catalyst, which continues to be the pace of hybrid cloud and AI adoption. The biggest risk remains the company’s exposure to discretionary consulting and software spending in a shifting macro environment; this DARPA milestone does not offset that near-term sensitivity.

One recent announcement that stands out is IBM Fusion’s partnership with the University of Southwestern Medical Center to deploy NVIDIA’s AI Data Platform. While not directly related to the quantum initiative, it showcases IBM’s efforts to deepen its role in AI, which is increasingly relevant to its hybrid cloud catalyst. Both announcements reinforce the theme that IBM is seeking to solidify its technology leadership amid intensifying competition and rapid changes in enterprise IT priorities.

However, what really stands out is...the potential disconnect between recurring software momentum and IBM's ability to offset weakness in legacy services, which investors should be aware of.

Read the full narrative on International Business Machines (it's free!)

International Business Machines is projected to reach $74.4 billion in revenue and $10.5 billion in earnings by 2028. Achieving this will require annual revenue growth of 5.1% and an increase in earnings of $4.6 billion from current earnings of $5.9 billion.

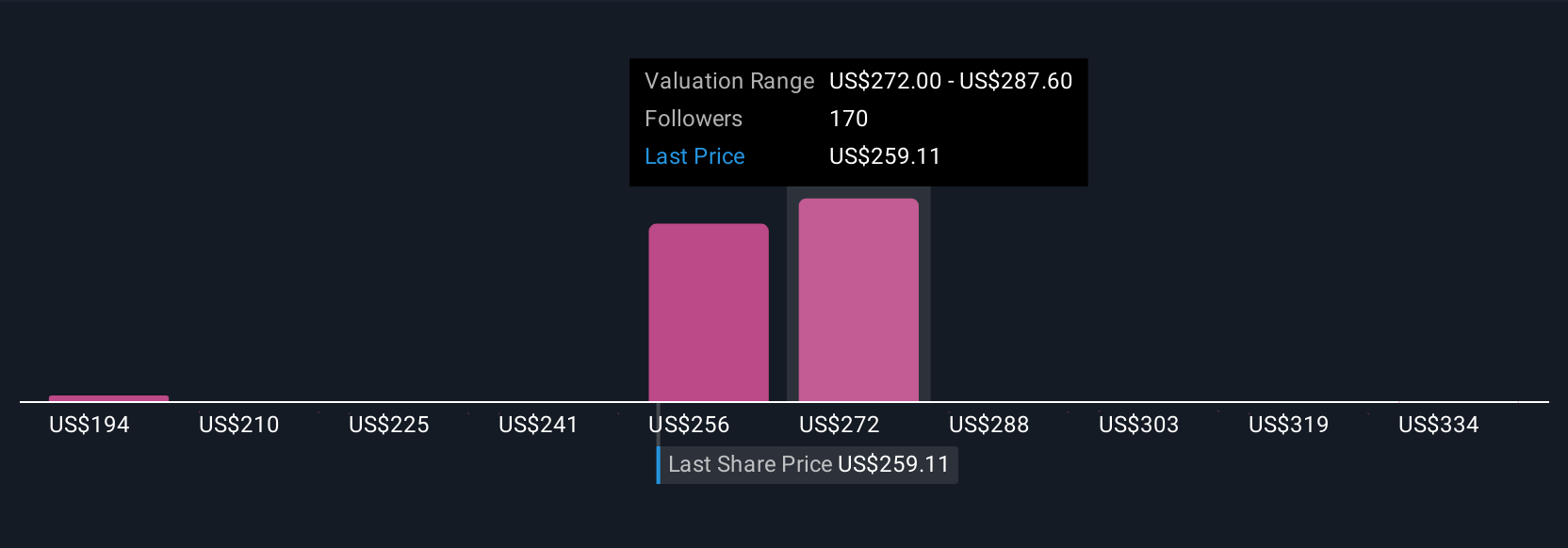

Uncover how International Business Machines' forecasts yield a $287.09 fair value, a 6% downside to its current price.

Exploring Other Perspectives

While consensus analysts expect IBM’s revenue to grow 4.7 percent yearly, the most optimistic outlook going into this news saw potential for US$76.6 billion in revenue and US$12.1 billion in earnings by 2028. These bullish analysts believed that quantum and AI could structurally lift growth for years, but risks like declining legacy revenues loom large. Depending on how you see events like the DARPA selection, it might be worth comparing these bold projections to your own expectations.

Explore 17 other fair value estimates on International Business Machines - why the stock might be worth 35% less than the current price!

Build Your Own International Business Machines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Business Machines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free International Business Machines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Business Machines' overall financial health at a glance.

No Opportunity In International Business Machines?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives