- United States

- /

- IT

- /

- NYSE:IBM

IBM (IBM) Is Up 8.8% After Q3 Earnings Beat and Breakthroughs in AI and Quantum Solutions

Reviewed by Sasha Jovanovic

- International Business Machines Corporation recently posted third-quarter 2025 earnings that surpassed expectations, with revenue reaching US$16.33 billion and net income of US$1.74 billion, while also announcing significant advancements across AI, quantum computing, and digital asset solutions.

- High-profile collaborations and product launches in defense AI, enterprise automation, and blockchain platforms have highlighted IBM's growing relevance in emerging technology sectors.

- We'll examine how IBM's stronger-than-expected financial results and expanding footprint in AI-powered offerings may influence its investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

International Business Machines Investment Narrative Recap

To be a shareholder in IBM, you need to believe that the company's pivot toward AI, hybrid cloud, and automation solutions can drive recurring revenue growth and margin expansion, even as the technology sector faces rapid change. The recent earnings report and AI-focused partnerships reinforce the importance of execution in IBM’s software segment, but near-term catalysts are still closely tied to robust client demand for these new offerings and the risk of competitive pressures in virtualization and cloud remains significant. At this time, the recent news does not materially alter the most important short-term catalyst (client adoption of AI/cloud solutions) or the primary risk (competitive and macro-driven revenue volatility).

The expanded collaboration with Alight, Inc., focusing on embedding watsonx AI into employee benefits and enterprise automation, stands out for its potential to exemplify IBM’s AI-driven strategy in action. This partnership underscores how new AI-powered offerings could impact client productivity and strengthen IBM’s recurring revenue base, central to the current investment narrative.

But on the flip side, investors should be aware that IBM’s future could be impacted by...

Read the full narrative on International Business Machines (it's free!)

International Business Machines is forecast to achieve $74.4 billion in revenue and $10.5 billion in earnings by 2028. This outlook is based on anticipated annual revenue growth of 5.1% and an earnings increase of $4.6 billion from current earnings of $5.9 billion.

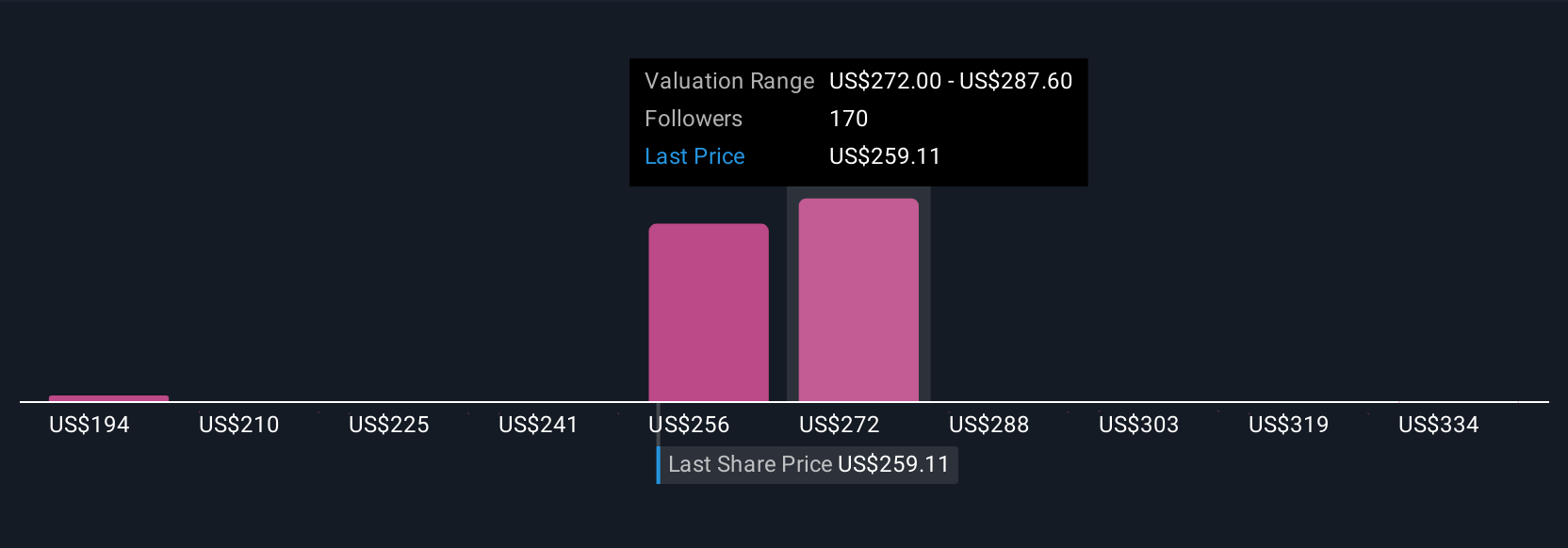

Uncover how International Business Machines' forecasts yield a $287.70 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Consider this: while consensus expects IBM’s revenue to reach US$73.3 billion and earnings of US$8.8 billion by 2028, the most pessimistic analysts argue that competition from cloud giants could erode legacy revenue faster than new AI and automation gains can offset. Your own view on IBM’s path may change as new deals and results emerge, so taking into account both optimistic and cautious opinions is key.

Explore 17 other fair value estimates on International Business Machines - why the stock might be worth 36% less than the current price!

Build Your Own International Business Machines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Business Machines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free International Business Machines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Business Machines' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives