- United States

- /

- Software

- /

- NYSE:HKD

Does AMTD Digital's (HKD) Surging Revenue Mask Underlying Profitability Challenges?

Reviewed by Sasha Jovanovic

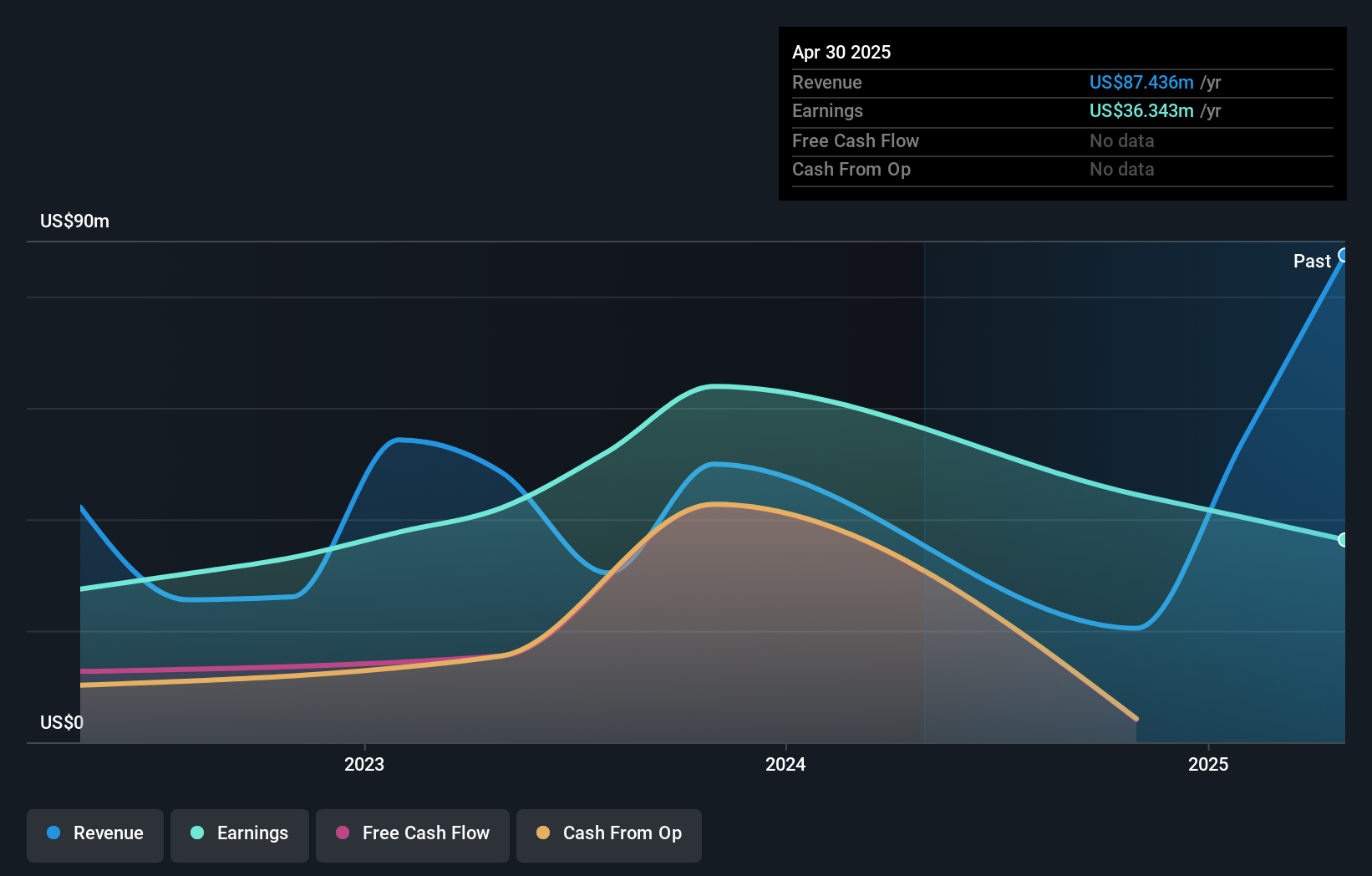

- AMTD Digital Inc. recently announced earnings for the half year ended April 30, 2025, with sales reaching US$25.31 million and revenue growing to US$73.16 million compared to the same period last year.

- While the company achieved very large year-over-year revenue growth, its net income and earnings per share declined from the prior year.

- We'll explore how the combination of surging revenue and lower net income informs AMTD Digital's evolving investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is AMTD Digital's Investment Narrative?

To be an AMTD Digital shareholder, you’d need to believe in the company’s ability to turn rapid revenue gains into consistent, quality profits while managing a turbulently traded stock. The latest half-year results, showing revenue surging to US$73.16 million but with net income and earnings per share falling, spotlight an evolving business model that is still ironing out profitability. In the short term, this news could impact confidence in the company’s near-term profit trajectory, especially as large one-off items continue to feature in their income statement. On the catalyst side, major buyback activity has recently wrapped up and leadership changes have been made, but neither seems likely to outweigh investor concerns about falling profit margins and persistent share price volatility following the recent update. The risks and short-term catalysts now center even more squarely on earnings quality and sustainable growth.

Yet, the ongoing high volatility in the share price is something investors should clearly keep in mind.

Exploring Other Perspectives

Explore 2 other fair value estimates on AMTD Digital - why the stock might be worth as much as $1.53!

Build Your Own AMTD Digital Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AMTD Digital research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free AMTD Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AMTD Digital's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HKD

AMTD Digital

Through its subsidiaries, provides digital solutions; media and entertainment services; and hotel operations, hospitality, and very important person (VIP) services in Europe, the United States, Hong Kong, Singapore, and Asia.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives