- United States

- /

- Software

- /

- NYSE:GWRE

Will Guidewire’s (GWRE) Cloud Wins With Major Insurers Redefine Its Long-Term Growth Story?

Reviewed by Sasha Jovanovic

- Guidewire Software recently reported 19 new deals for its Guidewire Cloud platform, including a decade-long partnership with Liberty Mutual and considerable progress internationally, supported by its acquisition of Quantee.

- This momentum underscores rising adoption among major insurers and highlights increased confidence in Guidewire’s long-term subscription-based revenue outlook, aided by new data intelligence offerings.

- We'll explore how Guidewire's cloud deal acceleration and Tier 1 insurer traction influence its long-term growth narrative and earnings expectations.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Guidewire Software Investment Narrative Recap

To be a Guidewire Software shareholder typically means believing in the migration of the insurance sector to cloud-based systems, with subscription revenue growth driving long-term value. The recent announcement of 19 new Guidewire Cloud deals, especially the 10-year contract with Liberty Mutual, reinforces the central investment catalyst of cloud adoption, though it does not materially reduce ongoing risks such as execution on global expansion and potential profit margin pressure from localization costs.

Among the recent developments, the acquisition of Quantee stands out, as it strengthens Guidewire’s analytics capabilities and supports international expansion, key themes for ongoing deal momentum and market competitiveness. This complements recent subscriber wins and growing recurring revenue, providing context for understanding earnings forecasts and future growth constraints.

However, in contrast, investors should also carefully consider the risks posed by foreign exchange fluctuations and how these could surprisingly affect...

Read the full narrative on Guidewire Software (it's free!)

Guidewire Software's narrative projects $1.7 billion revenue and $191.6 million earnings by 2028. This requires 15.1% yearly revenue growth and a $157 million earnings increase from $34.6 million.

Uncover how Guidewire Software's forecasts yield a $268.38 fair value, a 24% upside to its current price.

Exploring Other Perspectives

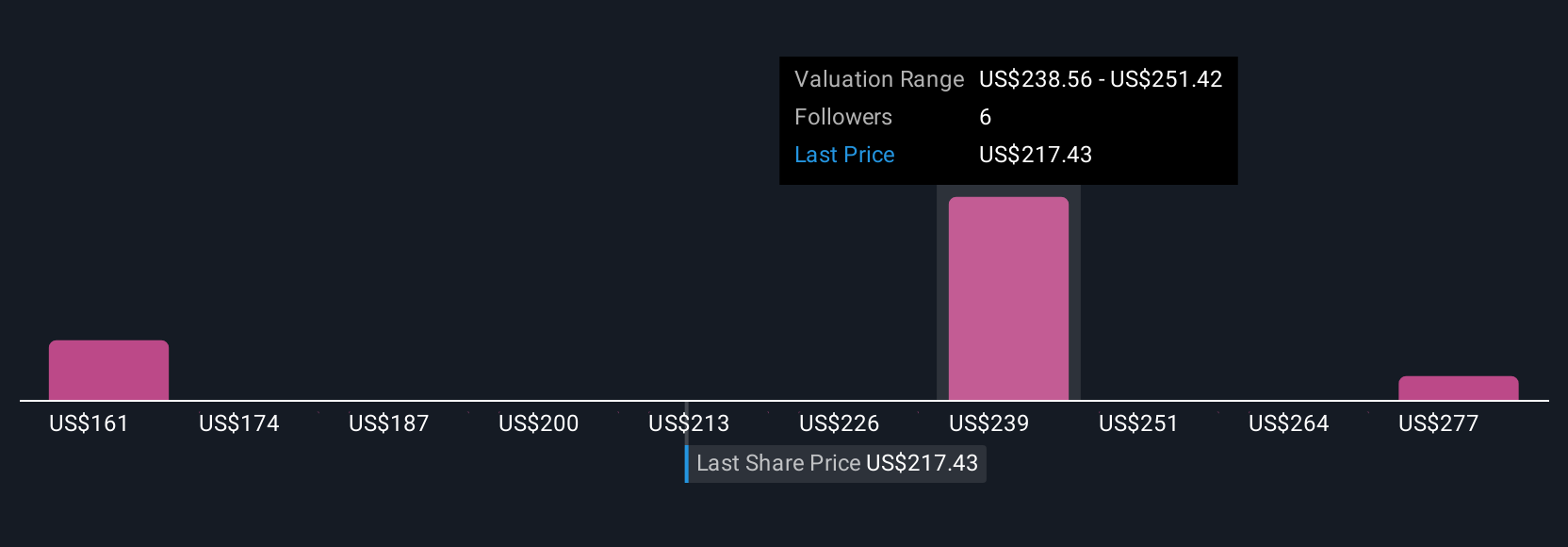

Simply Wall St Community members estimated fair value for Guidewire Software between US$149 and US$305 per share, across 3 crowd-sourced analyses. This wide span of opinions meets the strong cloud deal momentum but highlights how expectations about recurring revenue growth can vary among market participants, explore a range of informed perspectives.

Explore 3 other fair value estimates on Guidewire Software - why the stock might be worth as much as 41% more than the current price!

Build Your Own Guidewire Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Guidewire Software research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Guidewire Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Guidewire Software's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GWRE

Guidewire Software

Provides a platform for property and casualty (P&C) insurers worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives