- United States

- /

- Software

- /

- NYSE:GWRE

How Do Recent Customer Wins Impact Guidewire Software’s 2025 Valuation?

Reviewed by Bailey Pemberton

- Wondering if Guidewire Software might be undervalued or overheated? If you are on the hunt for value in software stocks, you probably have questions about whether Guidewire is worth a closer look right now.

- The stock has seen a bit of everything recently, climbing an impressive 34.5% year-to-date and 22.9% over the past year, but dropping 9.9% in the last week. That kind of movement often means investors are rethinking what Guidewire could be worth.

- One factor influencing these moves has been a series of strategic customer wins and new product announcements, which has attracted fresh attention from both institutional and retail investors. Positive press around Guidewire's partnerships with major insurers, and its reputation for innovation, have fueled optimism even as shares remain volatile.

- According to our valuation checks, Guidewire Software scores a 0 out of 6 on undervaluation criteria. Next, let's break down how this score is calculated and consider classic and modern approaches to valuing software companies. In addition, at the end of the article, we will reveal the smarter way to look for value beyond just the numbers.

Guidewire Software scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Guidewire Software Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its expected future free cash flows and discounting them back to today’s dollars. This approach is popular for software companies like Guidewire Software because it focuses on core cash generation rather than just earnings or revenue multiples.

Currently, Guidewire Software reports free cash flow of $278.90 million. Analyst estimates forecast steady growth, with projections reaching $539.39 million by 2028. Beyond the five-year analyst window, further growth to nearly $971.95 million in free cash flow by 2035 is extrapolated, reflecting optimism for the company’s ability to scale its cloud and insurance software offerings. All of these figures are in US dollars and remain well below the billion mark, so analysts expect solid but measured expansion.

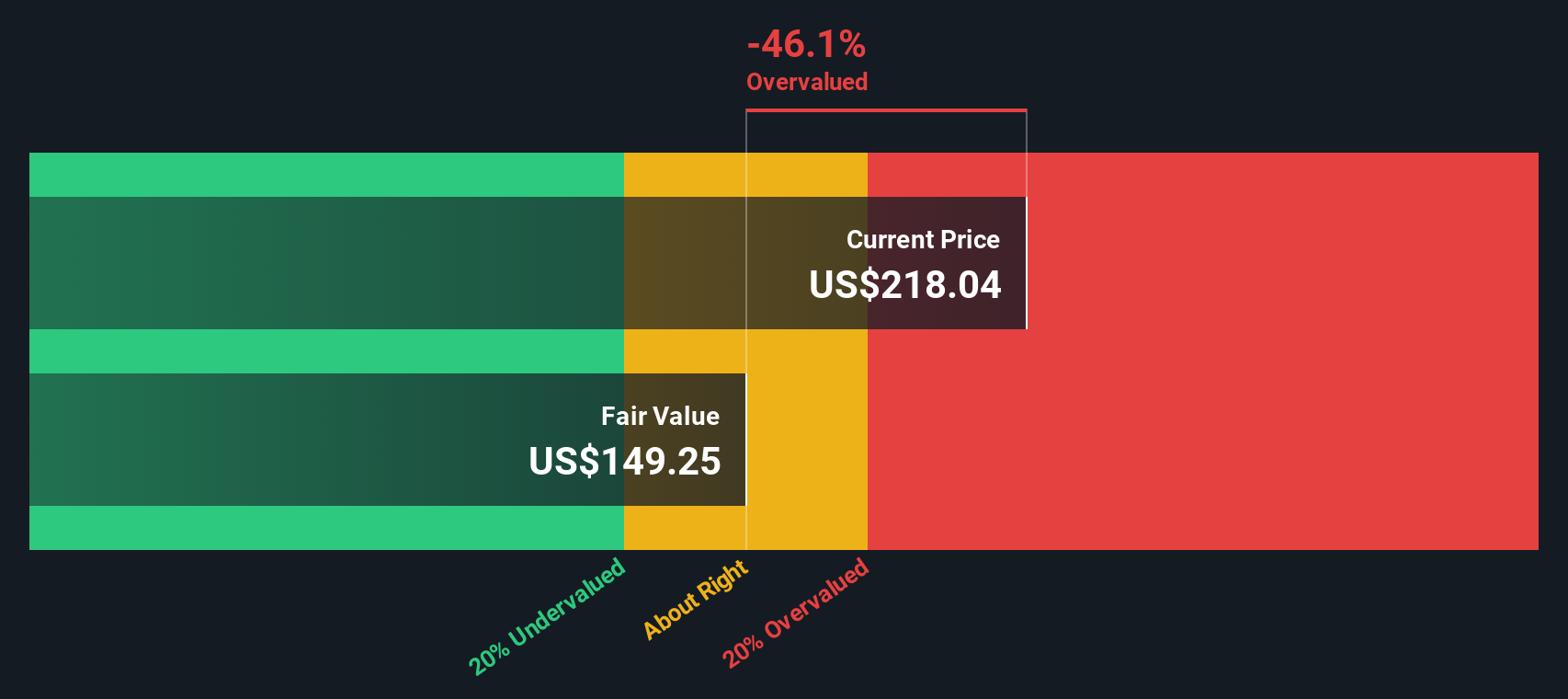

Based on this cash flow trajectory, the DCF analysis calculates an estimated intrinsic value of $145.94 per share. Compared to the current price, the implied intrinsic discount reveals the stock is roughly 56.2% overvalued. This indicates that shares are trading well above what the model suggests as fair value. This large gap signals caution for value-focused investors.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Guidewire Software may be overvalued by 56.2%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Guidewire Software Price vs Sales (P/S) Multiple

The Price-to-Sales (P/S) ratio is a commonly used valuation metric for software companies, especially when profits are modest relative to revenue growth. It helps investors compare how much they are paying for each dollar of the company’s revenue. This is particularly useful for software businesses like Guidewire Software that are investing heavily in growth and may not yet show high profits despite robust sales momentum.

What counts as a "fair" or "normal" P/S ratio depends on growth expectations and business risk. Fast-growing companies in innovative sectors often command higher multiples because investors anticipate stronger future sales, while companies with more risk or slower growth usually see lower ratios.

Currently, Guidewire Software trades at a P/S ratio of 16.12x. This is substantially higher than the industry average of 5.25x and the peer average of 8.68x. However, a single multiple rarely tells the full story. Simply Wall St's proprietary “Fair Ratio” for Guidewire stands at 7.07x. Unlike a basic industry comparison, the Fair Ratio incorporates Guidewire’s unique mix of growth prospects, profit margins, risk, market cap and sector dynamics. This gives a tailor-made benchmark instead of a one-size-fits-all average.

With Guidewire’s actual P/S ratio more than double its Fair Ratio, the stock appears to be notably overvalued using this approach.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

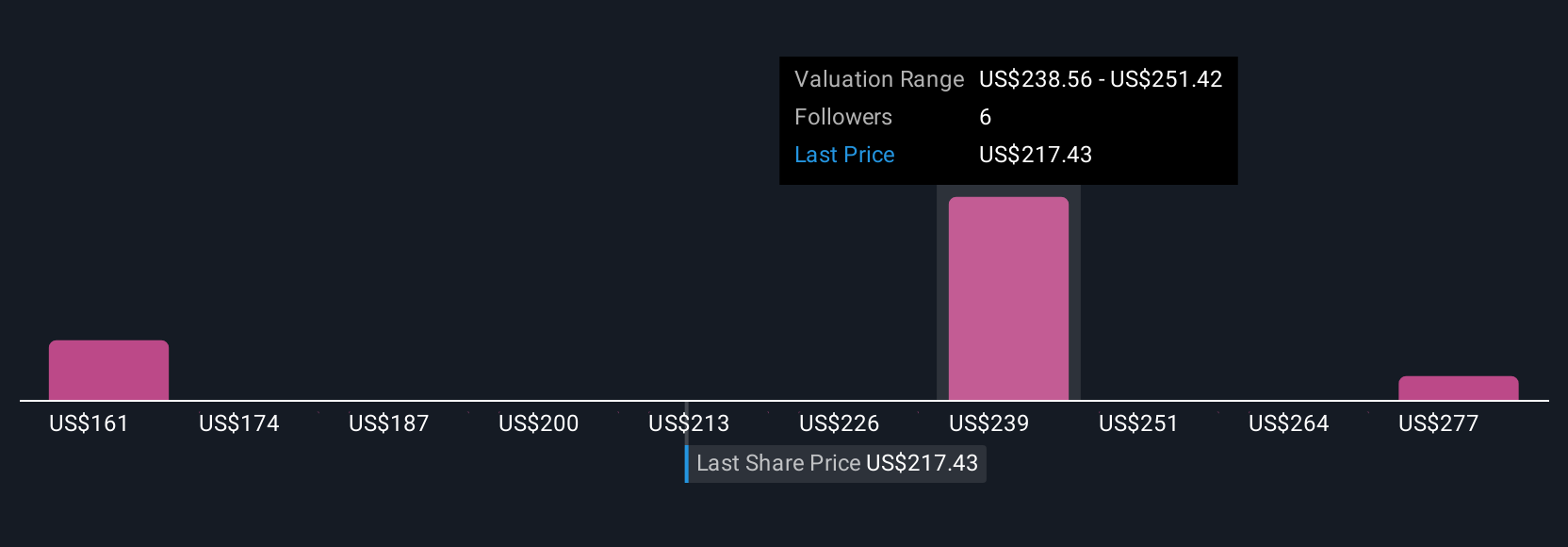

Upgrade Your Decision Making: Choose your Guidewire Software Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or thesis about a company, combining your beliefs about its business trajectory with concrete forecasts like future revenue, earnings, and profit margins. In essence, a Narrative connects the company's big-picture strategy to a detailed financial outlook and results in your own fair value estimate.

Narratives are easy and accessible on Simply Wall St's platform, where millions of investors share and refine their perspectives in the Community page. With Narratives, you can evaluate whether Guidewire Software is a buy or sell by comparing your calculated Fair Value with the current market price, all in just a few clicks. Narratives are also dynamic, updating automatically when new information such as earnings releases or major news emerges, so your investment case never becomes outdated.

For instance, one bullish investor might craft a Narrative around rapid cloud adoption and soaring analytics demand, leading to a fair value estimate like $290 per share. A more cautious investor might highlight margin pressures or global execution risks, supporting a much lower fair value closer to $155. Narratives make it easy to see these different viewpoints and quickly test which story matches your conviction and the latest data.

Do you think there's more to the story for Guidewire Software? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GWRE

Guidewire Software

Provides a platform for property and casualty (P&C) insurers worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives