- United States

- /

- IT

- /

- NYSE:GLOB

How Investors May Respond To Globant (GLOB) Teaming With YPF on AI-Driven Supply Chain Platform

Reviewed by Sasha Jovanovic

- YPF and Globant recently announced the launch of Digital Suppl.AI, an agentic AI-powered transformation platform aimed at modernizing the supply chain of Argentina's top energy company, with initial developments targeting procurement and inventory management using Globant's AI Pods subscription model.

- This partnership highlights Globant's deep involvement in integrating AI-driven automation and real-time data utilization within critical operations, reflecting its commitment to driving transformative change in enterprise processes.

- We'll now examine how the rollout of this AI-driven supply chain platform could influence Globant's position in high-value digital transformation services.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Globant Investment Narrative Recap

Globant's long-term story hinges on whether enterprises continue to entrust critical digital transformation work, especially AI-driven process optimization, to outside partners, as opposed to investing in their own in-house capabilities. The YPF Digital Suppl.AI launch validates demand for sophisticated AI platforms and could help accelerate adoption of Globant's AI Pods model, but with just 18 clients so far, large-scale uptake remains an open question; the biggest near-term catalyst is successful client conversion, while the chief risk is prolonged sluggishness in new signings, making the net short-term impact limited until broader market traction is visible.

Among recent developments, the September upgrade to Globant’s Enterprise AI (GEAI) platform stands out for its focus on interoperability, aligning closely with the objectives of the YPF collaboration. Successful integration across platforms may become increasingly vital if clients demand seamless solutions that span multiple business systems, further tying platform enhancements to future sales momentum.

However, investors should also keep in mind that rising competition and clients developing similar AI capabilities in house could lead to margin pressure and...

Read the full narrative on Globant (it's free!)

Globant's outlook anticipates $3.0 billion in revenue and $242.1 million in earnings by 2028. This scenario requires 6.1% annual revenue growth and a $131.8 million earnings increase from the current $110.3 million.

Uncover how Globant's forecasts yield a $97.05 fair value, a 63% upside to its current price.

Exploring Other Perspectives

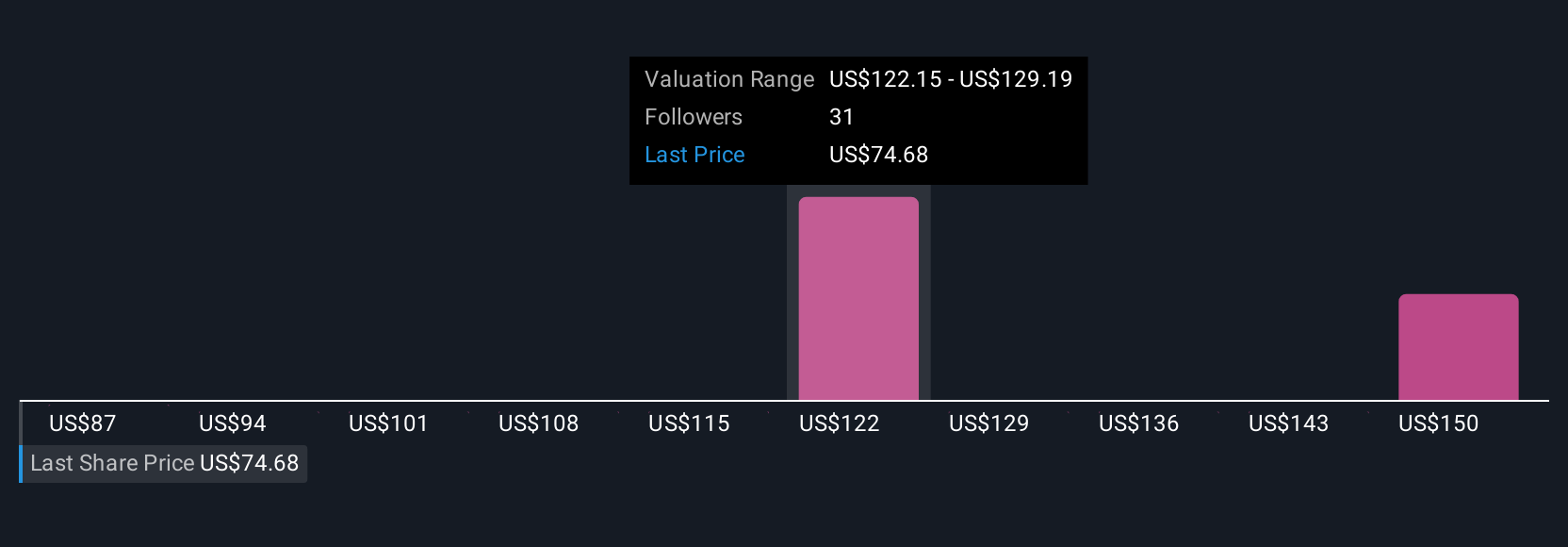

Six members of the Simply Wall St Community have valued Globant between US$61.97 and US$117.55, reflecting wide-ranging outlooks. While some see strong catalysts in AI partnerships and new business models, others point to the risk that persistent demand uncertainty and slow sales cycles could weigh on the company's ability to deliver sustainable growth.

Explore 6 other fair value estimates on Globant - why the stock might be worth as much as 98% more than the current price!

Build Your Own Globant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Globant research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Globant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Globant's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLOB

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives