- United States

- /

- IT

- /

- NYSE:GDDY

What the Recent 7.4% Pullback Means for GoDaddy’s True Value in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with GoDaddy stock? You’re definitely not alone. Over the past few weeks, shares of GoDaddy have shown a bit of volatility that has left many investors pausing to reassess. After a steady climb over the last several years, the stock recently pulled back by 7.4% in the past month but is still up an impressive 85.1% over the last five years. This kind of longer-term performance is hard to ignore.

Some of the recent moves can be traced back to fresh headlines around the company’s expansion into new digital services and its ongoing work to simplify web presence for small businesses. These steps have caught the eye of both analysts and the market, hinting at greater growth potential in the future. Even so, GoDaddy’s year-to-date return is down 34.2%, suggesting that investors are recalibrating their expectations, whether due to sector trends or a shift in perceived risk.

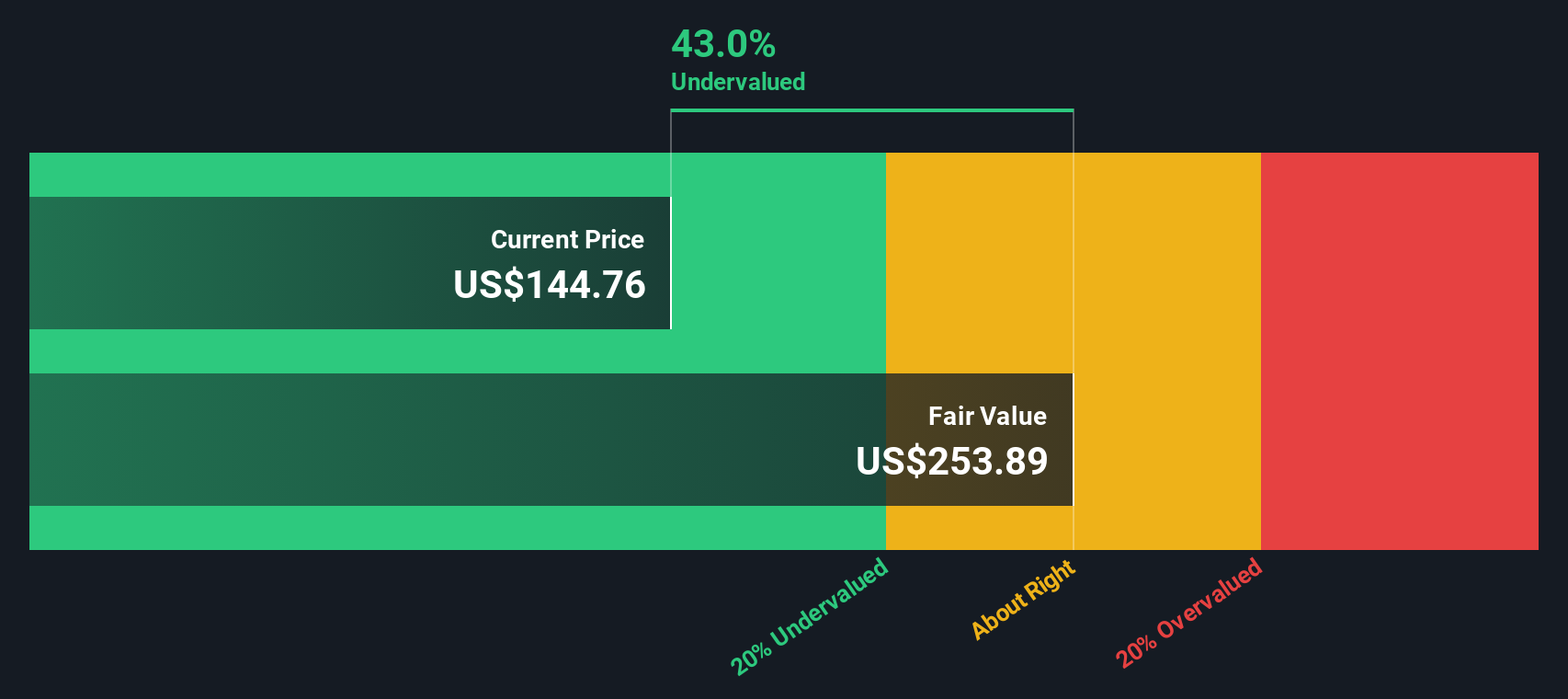

With a value score of 5 out of 6, GoDaddy is currently considered undervalued by most standard checks. But what do those checks really mean, and how do they stack up in practice? Let’s dive into the valuation methods often used by the pros, and later, I’ll share an even better lens for understanding what GoDaddy is really worth.

Why GoDaddy is lagging behind its peers

Approach 1: GoDaddy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This model is widely used by analysts because it allows them to focus on the underlying earning power of a business over time, rather than just relying on short-term metrics.

For GoDaddy, the current Free Cash Flow stands at $1.43 billion. Analysts have projected strong growth, with Free Cash Flow forecasted to reach nearly $2.3 billion by the end of 2029. While detailed analyst estimates typically only go out five years, further cash flow projections have been carefully extrapolated to provide a robust long-term outlook for the company.

Based on this approach, the DCF model calculates an intrinsic value of $250.33 per share for GoDaddy. Since this value is 47.7% higher than the current share price, the model indicates that GoDaddy stock appears significantly undervalued at the moment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GoDaddy is undervalued by 47.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: GoDaddy Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is often the preferred metric for valuing profitable companies like GoDaddy because it directly relates a company’s current share price to its per-share earnings. This makes it a quick gauge for investors to assess how much they’re paying for each dollar of reported profit. Typically, higher growth expectations or lower risk can justify a higher PE ratio, while slower growth or higher risk would drive that ratio lower.

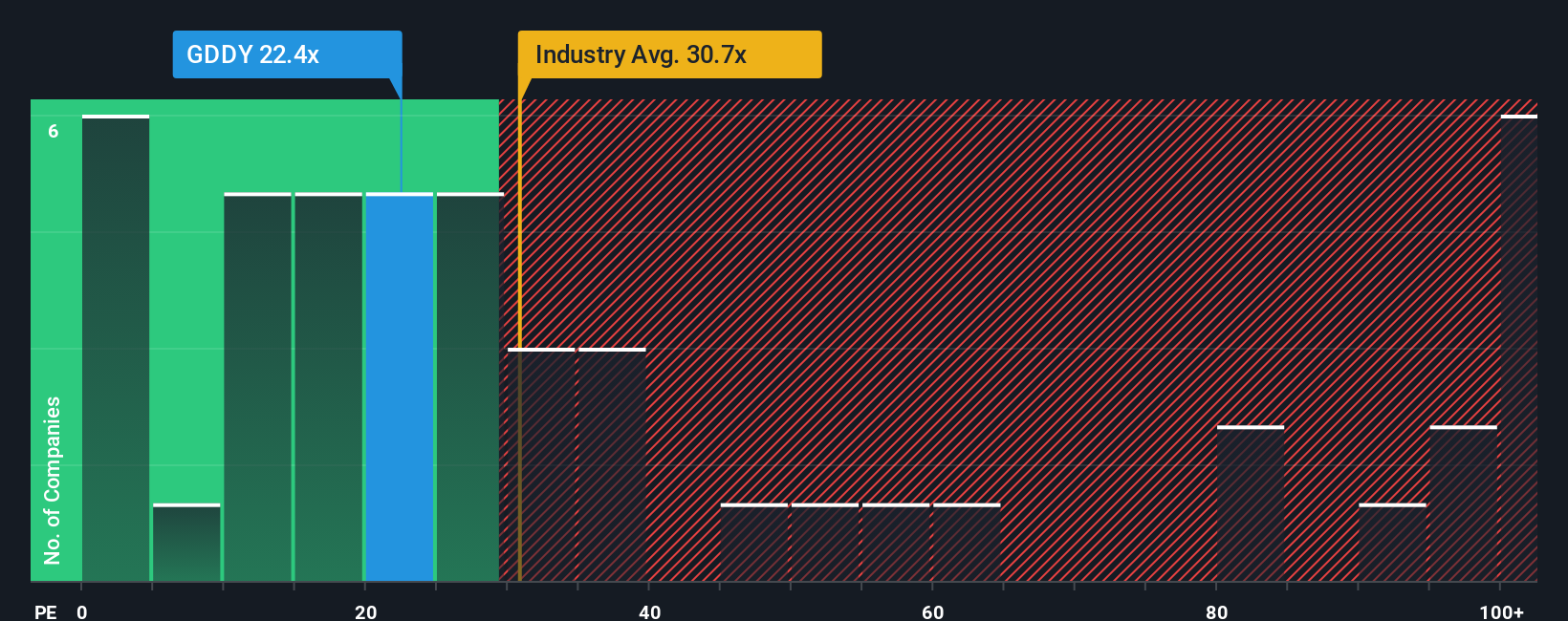

At the moment, GoDaddy trades at a PE ratio of 22.4x. That is notably below the IT industry’s average of 30.7x and far under the peer group average of 81.7x. While these comparisons can be helpful, they do not always capture the nuances of GoDaddy’s earnings quality, growth trajectory, or business risks.

This is where Simply Wall St's “Fair Ratio” comes in. Instead of just relying on broad industry or peer group numbers, the Fair Ratio factors in GoDaddy’s specific growth profile, profit margins, market capitalization, and risk profile to provide a more tailored benchmark. For GoDaddy, the Fair Ratio is calculated at 34.3x, offering a more personalized yardstick for what is reasonable given the company’s outlook.

Comparing GoDaddy’s current 22.4x PE to its Fair Ratio of 34.3x suggests the stock is trading at a significant discount based on its fundamentals and future prospects. This points toward GoDaddy being undervalued on a PE basis as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

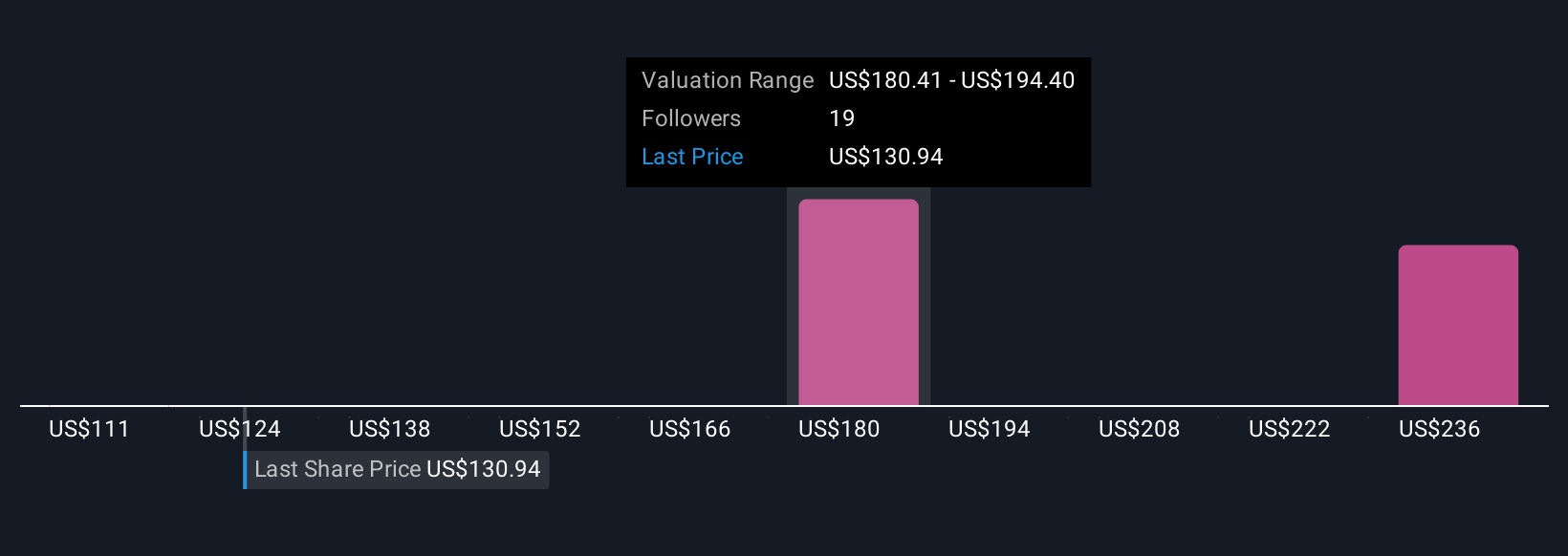

Upgrade Your Decision Making: Choose your GoDaddy Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story behind the numbers: it’s how you connect what you believe about GoDaddy’s future, such as how fast revenue might grow or whether profit margins will rise, to a financial forecast and an estimated fair value. Narratives make investing less about imitating analysts and more about expressing your own viewpoint. This approach links a company’s journey directly to its numbers and gives you a concrete, up-to-date fair value to compare against today’s share price.

On Simply Wall St’s Community page, millions of investors easily create and update their own Narratives, allowing you to test out what happens to GoDaddy’s worth when news breaks or earnings are announced. As new information emerges, Narratives update automatically, helping you make smarter decisions about when to buy or sell based on the difference between your fair value and the current market price.

For example, some investors see accelerated AI adoption and ecosystem expansion boosting GoDaddy’s fair value to $250 per share, while others highlight competitive risks and forecast as low as $150. This shows that no single story fits all. Narratives put you in control, providing a smarter, more dynamic way to invest with confidence.

Do you think there's more to the story for GoDaddy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GDDY

GoDaddy

Engages in the design and development of cloud-based products in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives