- United States

- /

- IT

- /

- NYSE:GDDY

How GoDaddy’s Raised Guidance and Buyback Activity Could Shape the Long-Term Story for GDDY Investors

Reviewed by Sasha Jovanovic

- GoDaddy raised its full-year 2025 revenue guidance to 8% growth and reported higher third quarter earnings and revenue versus a year ago, while also completing a share repurchase of 4.64 million shares for US$767.27 million.

- In a related collaboration, the ASU Student-Athlete Venture Studio spotlighted how GoDaddy Empower and the AI-powered GoDaddy Airo platform are helping student-athletes like Adama Fall build a digital presence beyond their athletic careers.

- Let's explore how GoDaddy's improved revenue outlook and solid quarterly results may influence its long-term investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

GoDaddy Investment Narrative Recap

For investors considering GoDaddy, the main draw is belief in the company’s ability to drive consistent growth in digital tools and services for small businesses, with new AI-powered offerings seen as a possible accelerator. The recent uplift in revenue guidance and share buyback support confidence in short-term growth, while strengthening the investment case. Still, longer-term competition from all-in-one platforms and cloud service providers remains an overarching risk, and this announcement does not materially alter that central issue.

Among the latest updates, GoDaddy’s raised full-year 2025 revenue guidance stands out. The new target of 8% growth suggests strengthening demand for its online presence and commerce platforms. While strong quarterly earnings and the buyback may reinforce immediate momentum, market share pressure as competition intensifies is an ongoing concern for the investment case in this sector.

By contrast, investors should be aware that intense pricing and margin competition from integrated platform rivals could quickly shift the long-term outlook if...

Read the full narrative on GoDaddy (it's free!)

GoDaddy's outlook anticipates $5.9 billion in revenue and $1.3 billion in earnings by 2028. This scenario is based on 7.7% annual revenue growth and a $491.5 million earnings increase from the current $808.5 million.

Uncover how GoDaddy's forecasts yield a $187.75 fair value, a 42% upside to its current price.

Exploring Other Perspectives

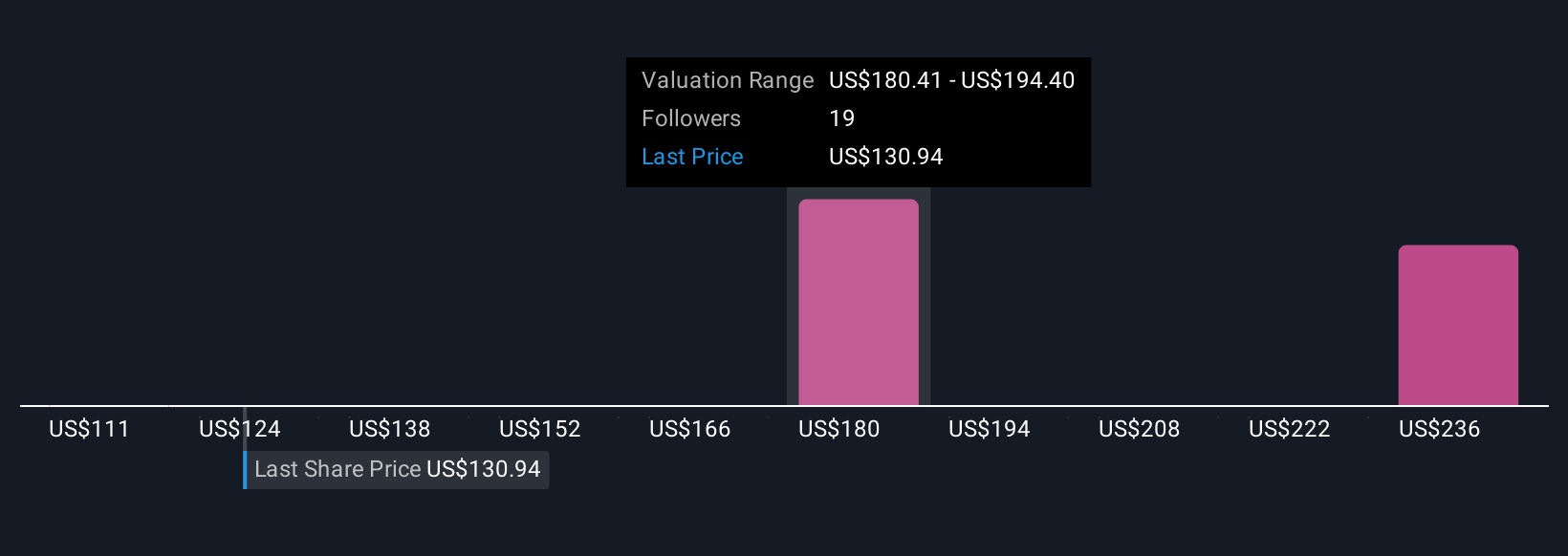

Three Simply Wall St Community fair value estimates for GoDaddy span from US$110.50 to US$256.90 per share. While these valuations reflect wide-ranging outlooks, recurring concerns linger around competitive threats that could weigh on future revenue growth. Explore several viewpoints and see how expectations can differ.

Explore 3 other fair value estimates on GoDaddy - why the stock might be worth 17% less than the current price!

Build Your Own GoDaddy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GoDaddy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free GoDaddy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GoDaddy's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GDDY

GoDaddy

Engages in the design and development of cloud-based products in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives