- United States

- /

- IT

- /

- NYSE:GDDY

GoDaddy (NYSE:GDDY) Shareholders Approve Charter Amendments to Limit Officer Liability

Reviewed by Simply Wall St

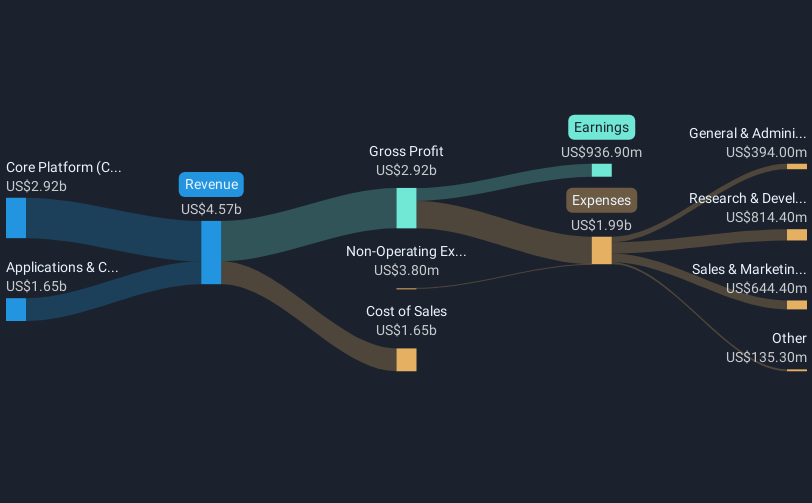

GoDaddy (NYSE:GDDY) recently approved amendments to its charter that limit officer liability, a move that could influence its governance structure. Over the past quarter, the company's stock increased by 2.34%, aligning with broad market trends influenced by positive inflation data and easing trade tensions between the U.S. and China. Also during this period, GoDaddy reported mixed earnings results with rising revenue but declining net income and EPS, and continued its share buyback program. These actions added weight to the company's slight upward trajectory, complementing wider economic optimism.

We've identified 3 weaknesses for GoDaddy that you should be aware of.

The recent amendments GoDaddy made to its charter to limit officer liability could have implications beyond governance. Such changes may influence investor confidence and potentially stabilize the company's governance practices, a critical aspect for its long-term growth narrative. Over the past three years, GoDaddy provided a total shareholder return of 168.88%, reflecting strong performance beyond short-term market fluctuations. This is a significant figure when viewed against a single year's performance, where GoDaddy underperformed the US IT industry. Still, its longer-term gains indicate robust strategic initiatives paying off.

The stock's 2.34% gain this past quarter aligns with broader market trends but contrasts its more muted performance over the last year compared to the IT sector's stronger returns. If the recent corporate governance adjustments foster improved operational management, this could further enhance revenue and earnings forecasts. Analysts currently anticipate GoDaddy's revenue and earnings to grow, with a potential increase in earnings to US$1.3 billion, contingent on execution risk and market conditions.

With GoDaddy trading at US$182.54, slightly below the consensus analyst price target of US$210.75, the potential for a price adjustment could hinge on the company sustaining its revenue initiatives and managing high debt levels effectively. Such factors will be crucial for determining if the stock can realize its projected valuation, suggesting careful monitoring of both internal and external developments remains essential for investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GDDY

GoDaddy

Engages in the design and development of cloud-based products in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives