- United States

- /

- IT

- /

- NYSE:FSLY

Fastly (FSLY): Assessing Valuation After Recent Share Price Uptick

Reviewed by Simply Wall St

Fastly (FSLY) shares have inched up about 1% over the past day, despite lacking any major news or apparent catalyst. Investors might find it useful to explore the valuation context behind this recent price movement.

See our latest analysis for Fastly.

Fastly’s share price ticked up slightly to $8.07, but that comes after a stretch of volatility. While the stock delivered a 90-day share price return of 8.2%, the year-to-date share price return remains in negative territory, and the 1-year total shareholder return stands at -1.1%. In short, momentum has been inconsistent in recent months, reflecting mixed investor sentiment about Fastly’s growth prospects and risks.

If today’s move has you considering fresh opportunities, now’s a great time to see what’s out there and discover fast growing stocks with high insider ownership

But with shares treading water and growth still debated, is Fastly stock trading below its true worth, or has the market already accounted for everything ahead, leaving little space for upside?

Most Popular Narrative: 5% Overvalued

Fastly’s widely followed narrative sets a fair value of $7.57 per share, which is slightly below the last close at $8.07. This highlights current market optimism even as the fundamental outlook remains fiercely debated.

The acceleration of cloud migration and edge computing, combined with Fastly's increased product velocity (especially in Compute and adaptive observability analytics at the edge), expands the company's addressable market and underpins durable multi-year revenue growth.

Curious what powers Fastly’s lofty valuation? The hottest part of this story lies in bold projections for edge innovation and next-level customer growth. Want to see the key financial levers and future earnings scenarios that justify this price target? Don’t miss the numbers hiding behind this headline narrative.

Result: Fair Value of $7.57 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as intensifying competition from larger players and revenue concentration among top customers could quickly change Fastly’s growth story.

Find out about the key risks to this Fastly narrative.

Another View: What Do the Ratios Say?

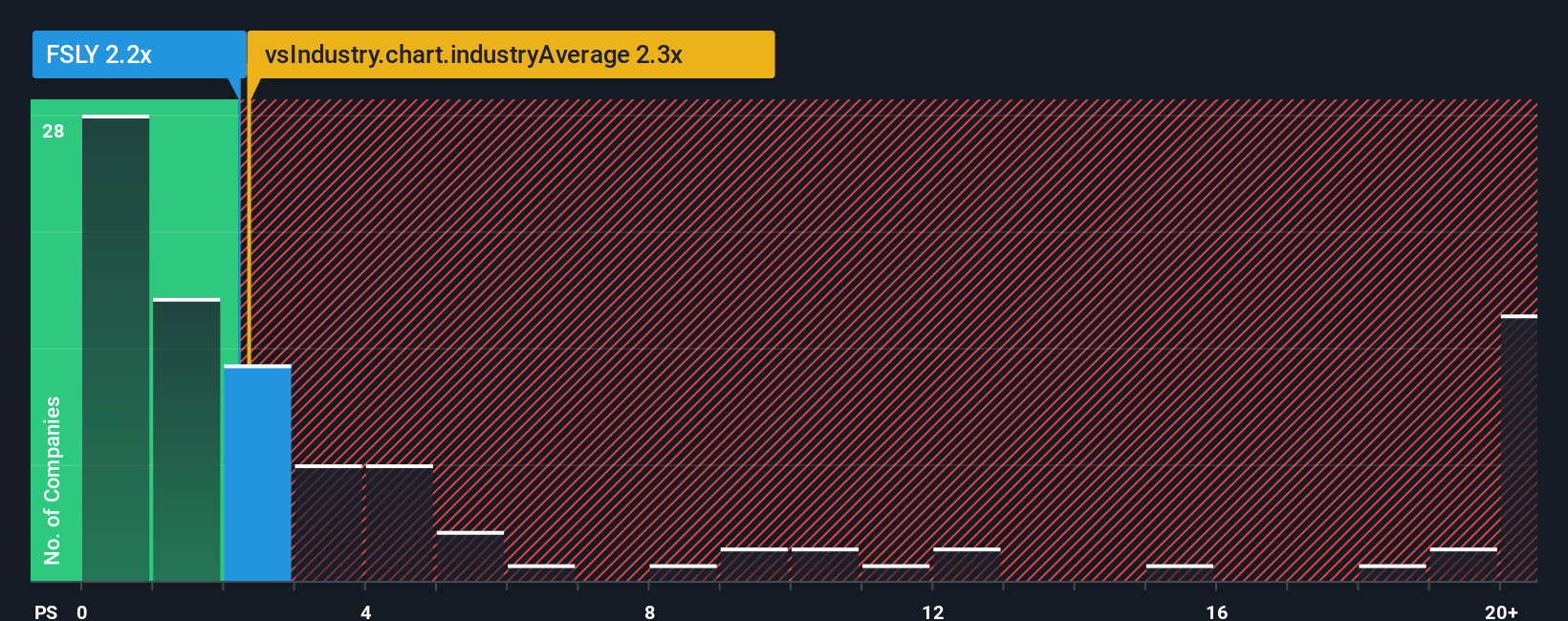

Beyond analyst price targets, looking at Fastly’s price-to-sales ratio provides a different angle. At 2.1x, it is not only below the US IT industry average of 2.5x, but also the fair ratio of 2.5x. This suggests less valuation risk than peers. Is the market underrating potential upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fastly Narrative

If you see the story differently or want to dig deeper into the numbers yourself, you can craft your own viewpoint in just a few minutes. Do it your way

A great starting point for your Fastly research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize your edge by checking out these expertly curated lists. The next opportunity could be waiting where you least expect it; smart investors never limit their search.

- Capitalize on untapped potential and see how you can get ahead with these 849 undervalued stocks based on cash flows driven by strong cash flows right now.

- Unlock income streams that stand out from the crowd and start your journey with these 20 dividend stocks with yields > 3% offering market-beating yields over 3%.

- Speed up your portfolio’s innovation factor with these 26 AI penny stocks that are transforming industries with artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FSLY

Fastly

Operates an edge cloud platform for processing, serving, and securing its customer’s applications in the United States, the Asia Pacific, Europe, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives