- United States

- /

- Software

- /

- NYSE:ETWO

E2open Parent Holdings, Inc.'s (NYSE:ETWO) Shares Bounce 27% But Its Business Still Trails The Industry

E2open Parent Holdings, Inc. (NYSE:ETWO) shareholders have had their patience rewarded with a 27% share price jump in the last month. Unfortunately, despite the strong performance over the last month, the full year gain of 9.4% isn't as attractive.

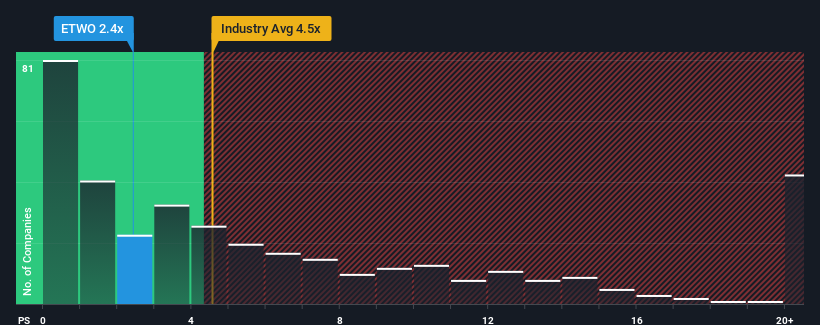

Although its price has surged higher, E2open Parent Holdings' price-to-sales (or "P/S") ratio of 2.4x might still make it look like a buy right now compared to the Software industry in the United States, where around half of the companies have P/S ratios above 4.5x and even P/S above 12x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for E2open Parent Holdings

How Has E2open Parent Holdings Performed Recently?

E2open Parent Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on E2open Parent Holdings.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like E2open Parent Holdings' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.7%. Even so, admirably revenue has lifted 148% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 4.1% per annum over the next three years. That's shaping up to be materially lower than the 15% per year growth forecast for the broader industry.

With this information, we can see why E2open Parent Holdings is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does E2open Parent Holdings' P/S Mean For Investors?

Despite E2open Parent Holdings' share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of E2open Parent Holdings' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you settle on your opinion, we've discovered 1 warning sign for E2open Parent Holdings that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if E2open Parent Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ETWO

E2open Parent Holdings

Provides cloud-based and end-to-end supply chain management and orchestration SaaS platform in the Americas, Europe, and the Asia Pacific.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives