- United States

- /

- IT

- /

- NYSE:EPAM

Why EPAM Systems (EPAM) Is Up 10.3% After Launching AI/Run.Transform and $1 Billion Buyback

Reviewed by Sasha Jovanovic

- Earlier this week, EPAM Systems announced the launch of its AI/Run.Transform Playbook, a next-generation AI-native consulting platform, and authorized a US$1 billion share repurchase program to be executed over 24 months.

- This dual move signals EPAM’s emphasis on accelerating enterprise AI transformation while demonstrating management’s confidence in the company’s ongoing growth and financial stability.

- We'll explore how the introduction of AI/Run.Transform and the substantial buyback initiative may reshape EPAM’s investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

EPAM Systems Investment Narrative Recap

To be an EPAM Systems shareholder, you need conviction in the company's ability to outpace shifting trends in enterprise AI adoption, while managing competitive and margin pressures from automation and industry heavyweights. The recent launch of AI/Run.Transform enhances EPAM's positioning as an AI-native solutions provider, but it does not materially change the immediate catalyst: execution on large AI-driven transformation deals, nor does it alleviate the critical risk of clients moving toward automated or prebuilt solutions. Among recent announcements, the US$1 billion share buyback program stands out, highlighting EPAM’s intent to return value to shareholders as it transitions to more complex, high-value service offerings, the very evolution investors see as key to offsetting margin pressure from commoditization and larger rivals. Conversely, with the growing adoption of automated tools and pre-packaged solutions, investors should be mindful that...

Read the full narrative on EPAM Systems (it's free!)

EPAM Systems' outlook anticipates $6.5 billion in revenue and $582.4 million in earnings by 2028. This scenario is based on an 8.8% annual revenue growth rate and a $181.2 million increase in earnings from the current level of $401.2 million.

Uncover how EPAM Systems' forecasts yield a $206.80 fair value, a 30% upside to its current price.

Exploring Other Perspectives

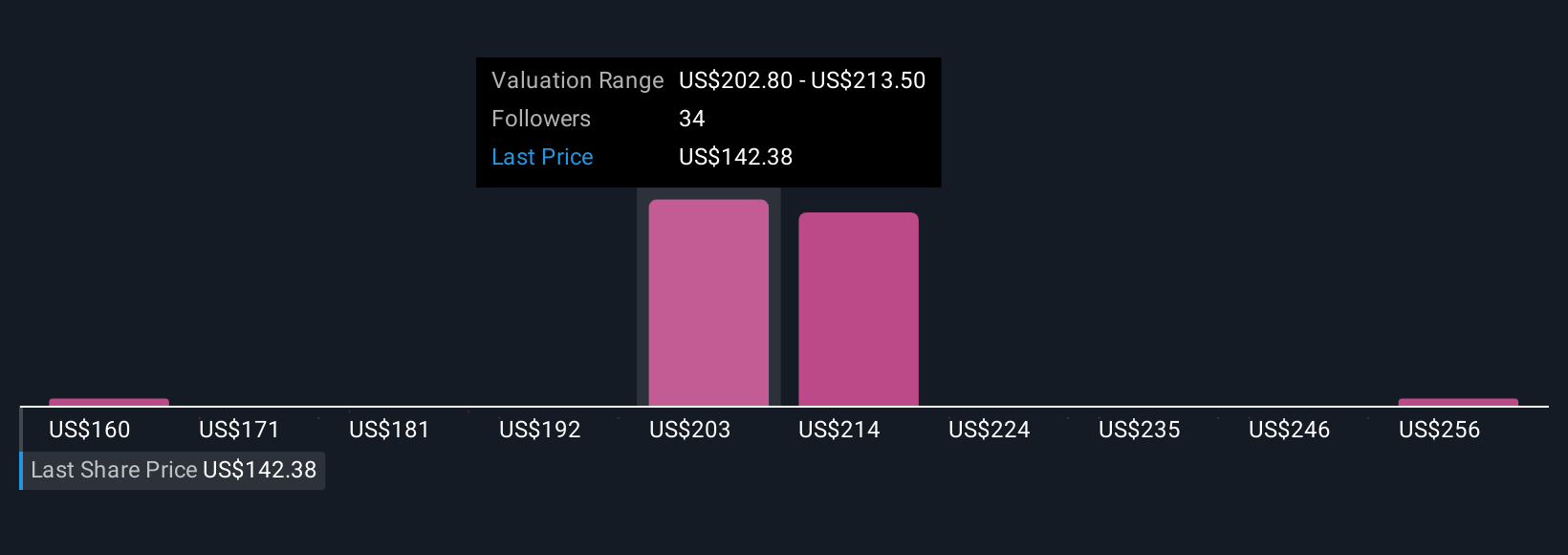

Members of the Simply Wall St Community recently estimated EPAM's fair value between US$160 and US$267, with nine distinct opinions submitted. In light of the heightened industry risk from generative AI adoption, exploring such a wide set of viewpoints can equip you to consider both opportunities and vulnerabilities in EPAM’s outlook.

Explore 9 other fair value estimates on EPAM Systems - why the stock might be worth just $160.00!

Build Your Own EPAM Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EPAM Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EPAM Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EPAM Systems' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EPAM Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPAM

EPAM Systems

Provides digital platform engineering and software development services worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives