- United States

- /

- IT

- /

- NYSE:DXC

Will AI Partnerships and Buybacks Shift DXC Technology’s (DXC) Modernization Narrative?

Reviewed by Sasha Jovanovic

- In recent weeks, DXC Technology posted mixed second-quarter earnings, continued its share buyback program, and Splitit announced a new strategic collaboration with DXC to enable banks to offer personalized installment plans through DXC’s core banking platform.

- This combination of AI-driven partnerships, operational cost discipline, and ongoing capital returns marks a sharper transition, as leadership and business strategy pivot towards modernization despite continued revenue pressures.

- We’ll now examine how these strategic partnerships and share repurchases are influencing DXC’s future investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

DXC Technology Investment Narrative Recap

To own DXC Technology shares, investors need to believe in the company’s ability to convert operational discipline and AI-focused partnerships into real top-line stabilization, despite ongoing organic revenue declines and segment weaknesses. While the recent buyback program completion highlights management’s ongoing commitment to capital return, it does not meaningfully address the central short-term catalyst, which remains the company’s ability to halt or reverse revenue declines, nor does it materially reduce persistent revenue risk over the next few quarters.

The most relevant recent announcement is DXC’s strategic collaboration with Splitit, which enables banks to integrate flexible installment payment solutions using DXC’s core banking platform. This type of partnership may support DXC’s modernization strategy and help strengthen its value proposition for clients, but its scale and impact will be tested against the broader challenge of stabilizing the GIS segment and overall revenue trends.

However, investors should also be aware of a contrasting risk: despite renewed innovation and share repurchases, the GIS segment’s continued revenue decline remains a key consideration for future returns...

Read the full narrative on DXC Technology (it's free!)

DXC Technology's narrative projects $12.1 billion revenue and $208.6 million earnings by 2028. This requires a 1.7% annual revenue decline and a decrease in earnings of $170.4 million from the current $379.0 million.

Uncover how DXC Technology's forecasts yield a $14.50 fair value, a 7% upside to its current price.

Exploring Other Perspectives

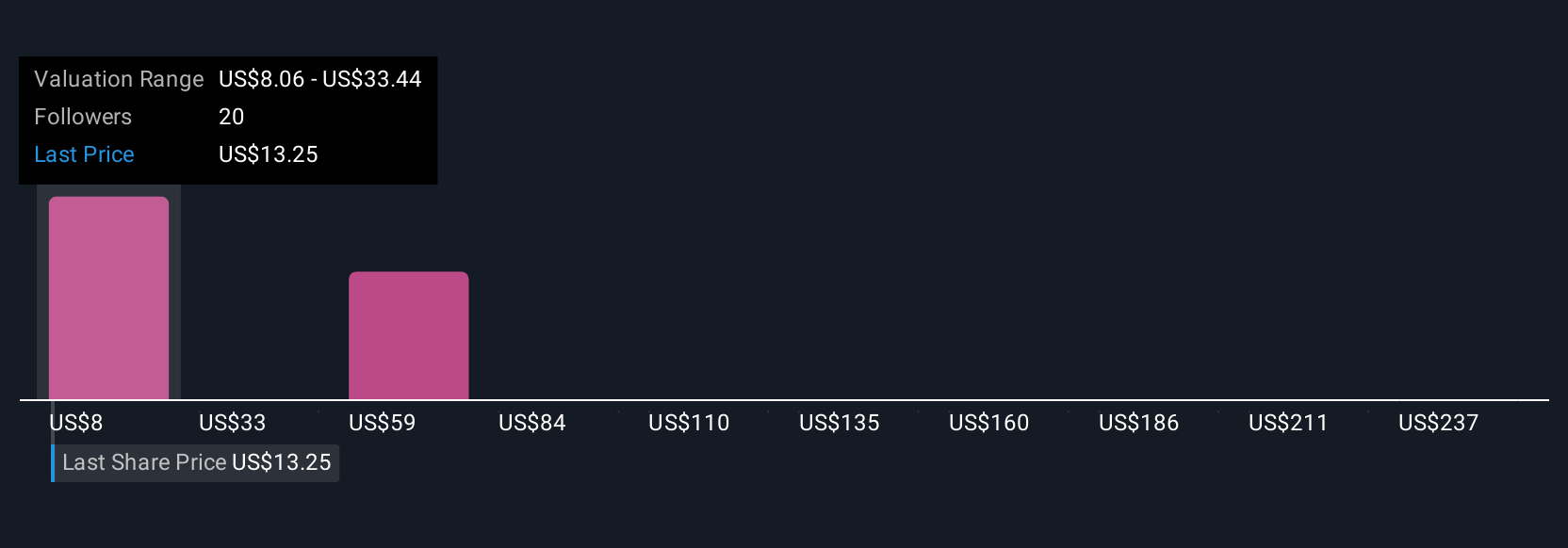

Six members of the Simply Wall St Community value DXC between US$8.06 and US$261.89 per share, showing wide disagreement on fair value. Ongoing revenue declines and execution risk continue to shape how the company is viewed in the market.

Explore 6 other fair value estimates on DXC Technology - why the stock might be a potential multi-bagger!

Build Your Own DXC Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DXC Technology research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DXC Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DXC Technology's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DXC

DXC Technology

Provides information technology services and solutions in the United States, the United Kingdom, the rest of Europe, Australia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives