- United States

- /

- IT

- /

- NYSE:DXC

DXC Technology (DXC) Valuation Check After AdvisoryX AI Push and New Digital Leadership

Reviewed by Simply Wall St

DXC Technology (DXC) just launched AdvisoryX, a global advisory group focused on helping enterprises turn AI ambition into execution, backed by a detailed study on how leaders are actually deploying AI today.

See our latest analysis for DXC Technology.

Those moves around AdvisoryX and DXC's new Chief Digital Information Officer seem to have caught investors' attention, with a 30 day share price return of 28.69 percent helping reverse some of the deeper multiyear total shareholder return losses.

If DXC's AI pivot has you watching the space more closely, this could be a good moment to explore other high growth tech and AI stocks that might be building similar momentum.

Yet with revenue still shrinking, earnings under pressure and the stock trading below some intrinsic valuations but slightly above analyst targets, investors now face a tougher call: is DXC a contrarian AI value play or already pricing in a turnaround?

Most Popular Narrative Narrative: 6.4% Overvalued

With DXC Technology closing at $15.43 against a narrative fair value of $14.50, the story points to modest downside from here driven by cautious forecasts.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.4x on those 2028 earnings, up from 6.6x today. This future PE is lower than the current PE for the US IT industry at 29.7x.

Want to see how shrinking revenues, thinner margins and a sharply higher earnings multiple still combine into a higher value than today? The full narrative unpacks that puzzle in detail.

Result: Fair Value of $14.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent revenue declines and competitive pressure in cloud and AI services could stall DXC's turnaround and undermine the current valuation narrative.Find out about the key risks to this DXC Technology narrative.

Another View: Multiples Point to Deep Value

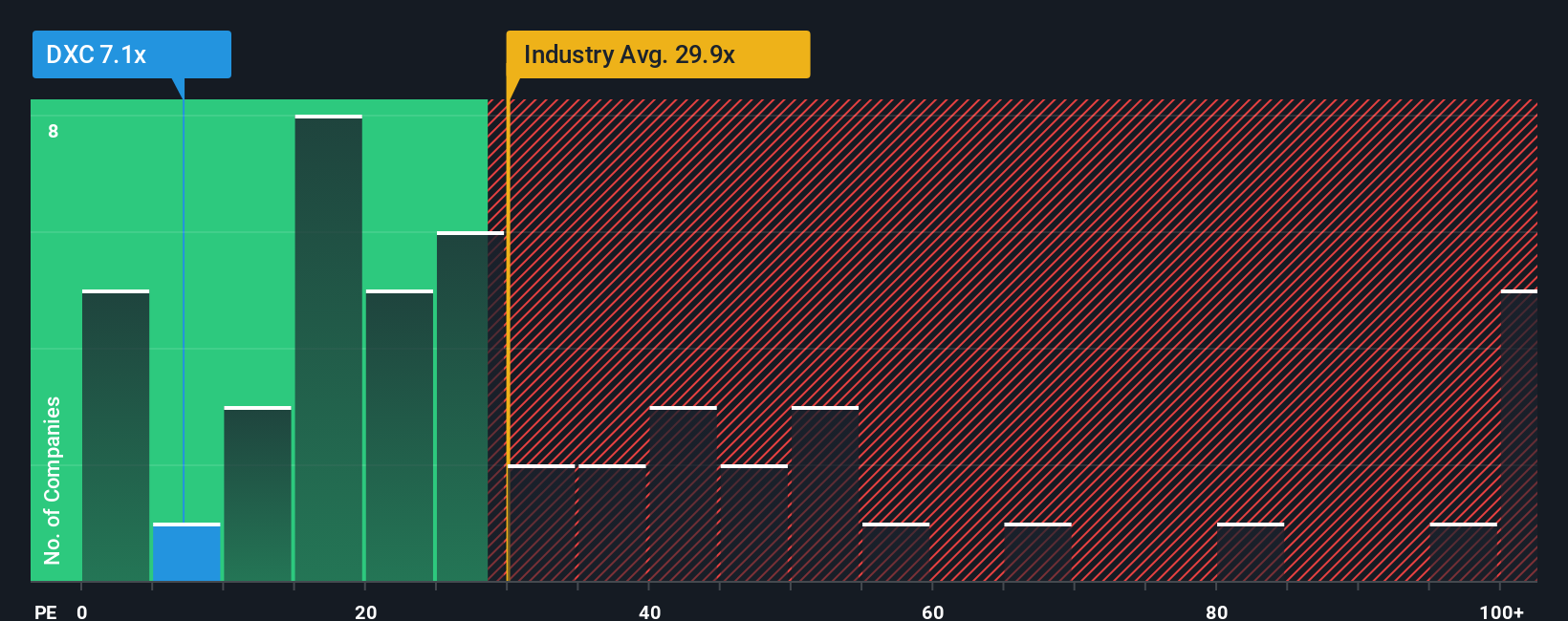

While the narrative fair value suggests DXC is 6.4 percent overvalued, its price to earnings ratio of 7.2 times looks low compared with peers at 19.3 times, the US IT industry at 29.9 times, and a fair ratio of 18.8 times. This points to a potential value gap that investors might be overlooking.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DXC Technology Narrative

If you see the numbers differently or want to dig into the data yourself, you can build a custom DXC view in minutes: Do it your way.

A great starting point for your DXC Technology research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you stop at DXC, put Simply Wall Street's powerful Screener to work on other high potential ideas so you are not leaving compelling opportunities on the table.

- Capitalize on major price misalignments by scanning these 914 undervalued stocks based on cash flows that may offer different prospects than mature, fully priced names like DXC.

- Explore the next wave of innovation by targeting these 25 AI penny stocks that are connected to real world adoption, not just buzz.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that can complement growth-focused AI exposure with regular cash payments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DXC

DXC Technology

Provides information technology services and solutions in the United States, the United Kingdom, the Rest of Europe, Australia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion