- United States

- /

- IT

- /

- NYSE:DXC

AI Partnerships and Leadership Recognition Might Change the Case For Investing In DXC Technology (DXC)

Reviewed by Simply Wall St

- Earlier in August 2025, DXC Technology announced executive appointments in Canada and entered a strategic partnership with Boomi to enhance AI-driven enterprise modernization.

- DXC’s recognition as a Leader in Everest Group’s PEAK Matrix® Assessment 2025 highlights the company’s accelerated application development and commitment to AI-powered, secure software solutions across its global client base.

- We'll explore how DXC's focus on intelligent automation and AI partnerships impacts its broader investment narrative and future prospects.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

DXC Technology Investment Narrative Recap

To believe in DXC Technology as a shareholder right now, you need confidence that its investments in intelligent automation, AI capabilities, and partnerships will successfully transform the business and stabilize organic revenue declines. The recent Canadian executive appointments and the Boomi partnership underline DXC's commitment to client innovation and market positioning, but do not materially shift the main short-term catalyst, conversion of strong bookings into realized revenue, nor do they resolve the core risk of persistent GIS segment declines and overall revenue contraction. Of the latest announcements, DXC’s partnership with Boomi stands out as most relevant, reflecting ongoing efforts to modernize client technology stacks and accelerate adoption of AI-driven solutions. This approach may support future enterprise wins and gradual improvement in deal conversion but does not eliminate execution risks tied to legacy business declines and competition from hyperscalers. By contrast, investors should also be aware that the GIS segment’s mid-single-digit declines remain unresolved...

Read the full narrative on DXC Technology (it's free!)

DXC Technology's narrative projects $12.1 billion revenue and $208.6 million earnings by 2028. This requires a 1.7% annual revenue decline and a $170.4 million decrease in earnings from the current $379.0 million.

Uncover how DXC Technology's forecasts yield a $15.62 fair value, a 10% upside to its current price.

Exploring Other Perspectives

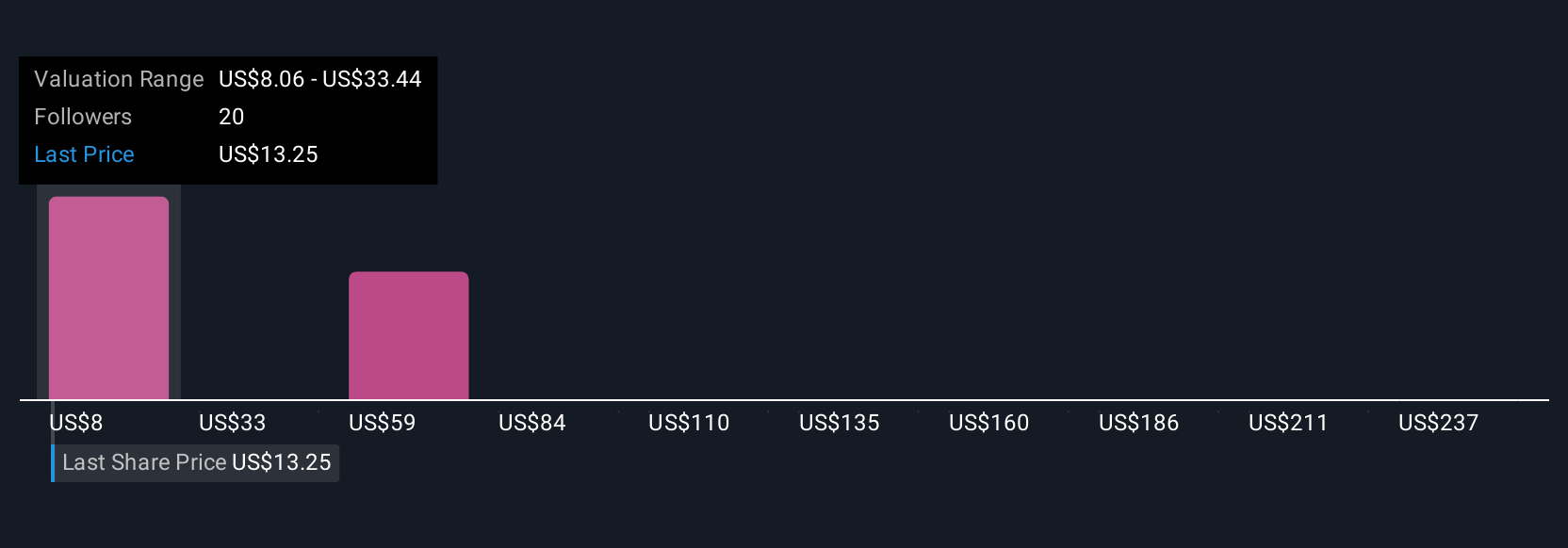

Fair value estimates from the Simply Wall St Community span US$8.06 to US$261.89 across six independent analyses. These wide-ranging valuations coincide with ongoing challenges in revenue stabilization, reminding you to consider multiple viewpoints before making decisions.

Explore 6 other fair value estimates on DXC Technology - why the stock might be worth 43% less than the current price!

Build Your Own DXC Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DXC Technology research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free DXC Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DXC Technology's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DXC

DXC Technology

Provides information technology services and solutions in the United States, the United Kingdom, the rest of Europe, Australia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives