- United States

- /

- Software

- /

- NYSE:DT

How Investors May Respond To Dynatrace (DT) Launching Real-Time AI Observability with AWS AgentCore Integration

Reviewed by Sasha Jovanovic

- On November 18, 2025, Dynatrace announced its integration with Amazon Bedrock AgentCore, now generally available to AWS customers, offering real-time observability into autonomous agents and their interactions across AWS services.

- This collaboration establishes Dynatrace as one of the first observability providers with full support for AgentCore, enhancing developer capabilities to monitor, analyze, and audit AI-driven workflows in real time.

- We’ll explore how being an early supporter of AWS’s new AgentCore could reshape Dynatrace’s investment narrative and its position in AI observability.

Find companies with promising cash flow potential yet trading below their fair value.

Dynatrace Investment Narrative Recap

Owning Dynatrace stock means believing in the company’s ability to lead AI-driven observability as demand for cloud automation and advanced monitoring continues to rise. The recent Amazon Bedrock AgentCore integration directly supports Dynatrace’s push into AI observability, reinforcing a key short-term catalyst: differentiation through innovation, though it may not fully offset competitive pressures from large hyperscalers and open-source alternatives that remain the biggest risk for now.

Among recent product announcements, the expanded partnership with AWS stands out as particularly relevant, as it deepens Dynatrace’s integration across leading cloud environments. Together with AgentCore support, these moves may help Dynatrace reinforce its reputation among enterprise buyers looking to unlock more value from AI-powered cloud workloads.

On the other hand, investors should be aware of the risk that intensifying competition from both hyperscalers and specialty observability players could...

Read the full narrative on Dynatrace (it's free!)

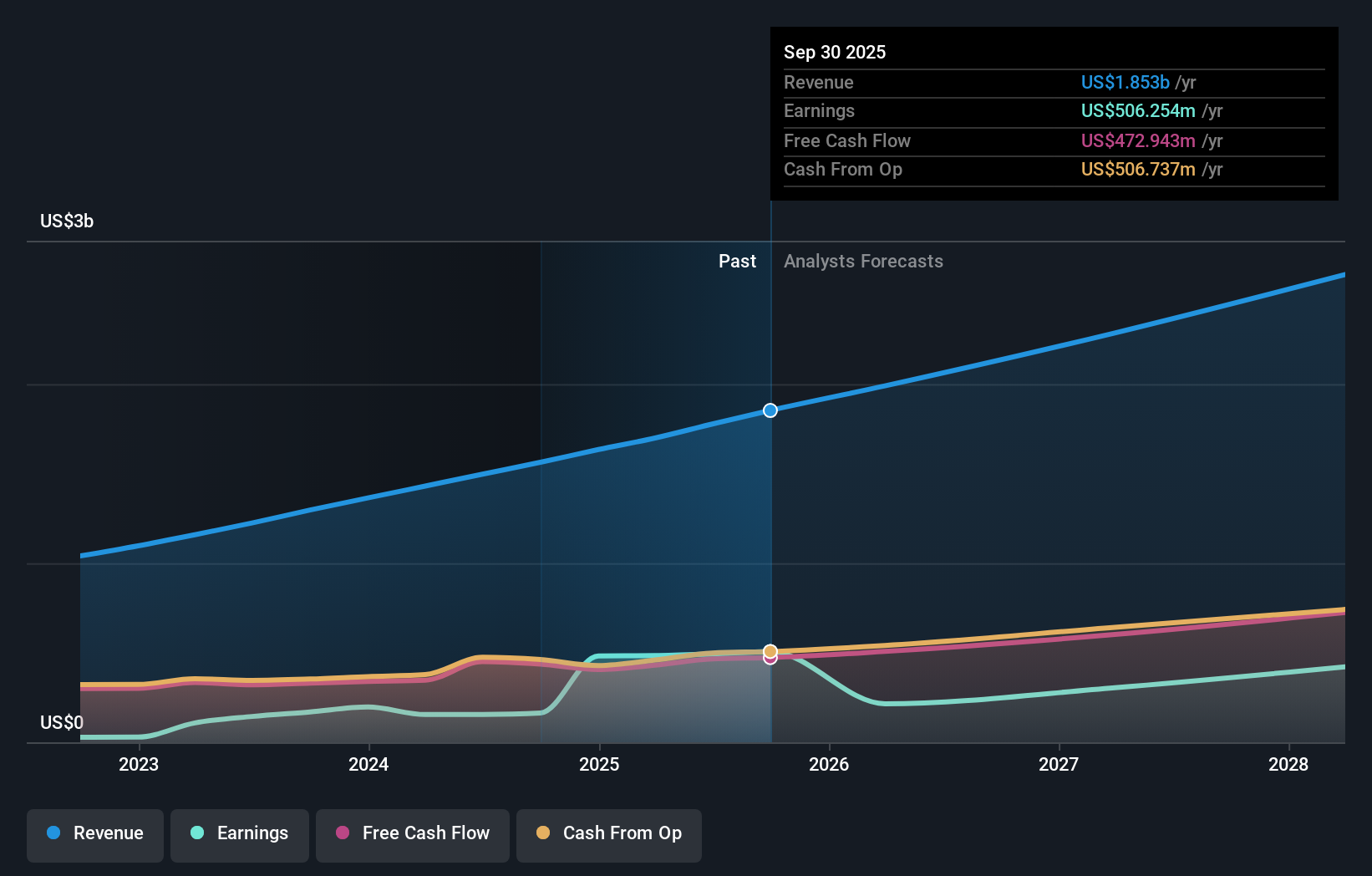

Dynatrace is projected to reach $2.7 billion in revenue and $521.4 million in earnings by 2028. This outlook is based on a 15.2% annual revenue growth rate and a $28.4 million increase in earnings from the current $493.0 million.

Uncover how Dynatrace's forecasts yield a $61.24 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Five individual investor valuations from the Simply Wall St Community range from US$50.62 up to US$72.77 per share. Amid this broad uncertainty, many are watching how Dynatrace’s innovation in AI observability could influence its ability to maintain pricing power and market share.

Explore 5 other fair value estimates on Dynatrace - why the stock might be worth as much as 63% more than the current price!

Build Your Own Dynatrace Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dynatrace research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Dynatrace research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dynatrace's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DT

Dynatrace

Engages in the advancement of observability for digital businesses, which transforms the complexity of modern digital ecosystems in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026