- United States

- /

- IT

- /

- NYSE:DOCN

Expanded Fal Partnership Could Be a Game Changer for DigitalOcean Holdings (DOCN)

Reviewed by Sasha Jovanovic

- Earlier this week, fal and DigitalOcean announced an expanded partnership to deliver fal’s advanced image and audio generation models through the DigitalOcean Gradient AI Platform, making generative AI more accessible for startups and enterprises.

- This collaboration places hundreds of fal’s high-performance multimodal models on DigitalOcean’s infrastructure, highlighting a growing focus on AI-powered solutions for DigitalOcean’s global developer community.

- We’ll explore how the addition of multimodal AI capabilities from fal impacts DigitalOcean’s long-term growth narrative and competitive position.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

DigitalOcean Holdings Investment Narrative Recap

To be a DigitalOcean shareholder, you need to believe in the company’s ability to drive consistent growth by expanding its AI ecosystem and capturing demand from developers and businesses seeking cost-effective cloud and AI solutions. This week’s fal partnership underscores innovation but is not likely to materially impact the stock’s most significant short-term catalyst, improving customer retention or reinforcing the company’s ability to win durable, large-scale enterprise contracts. The chief risk remains potential margin compression if AI adoption fails to scale or competitive pressures intensify.

Among recent announcements, DigitalOcean’s launch of the AI Partner Program earlier this month is particularly relevant as it strengthens the company’s push to integrate third-party AI solutions like fal’s, supporting its strategy to broaden product reach and usage. This aligns with management’s focus on catalyzing higher incremental revenue and building a stickier ecosystem for startups and digital businesses.

However, against this promising backdrop, investors should also keep in mind the risk of intensifying competition from hyperscale cloud platforms and what that could mean for...

Read the full narrative on DigitalOcean Holdings (it's free!)

DigitalOcean Holdings is forecast to reach $1.3 billion in revenue and $182.0 million in earnings by 2028. This outlook assumes annual revenue growth of 14.6% and an earnings increase of $55.6 million from current earnings of $126.4 million.

Uncover how DigitalOcean Holdings' forecasts yield a $41.60 fair value, a 5% upside to its current price.

Exploring Other Perspectives

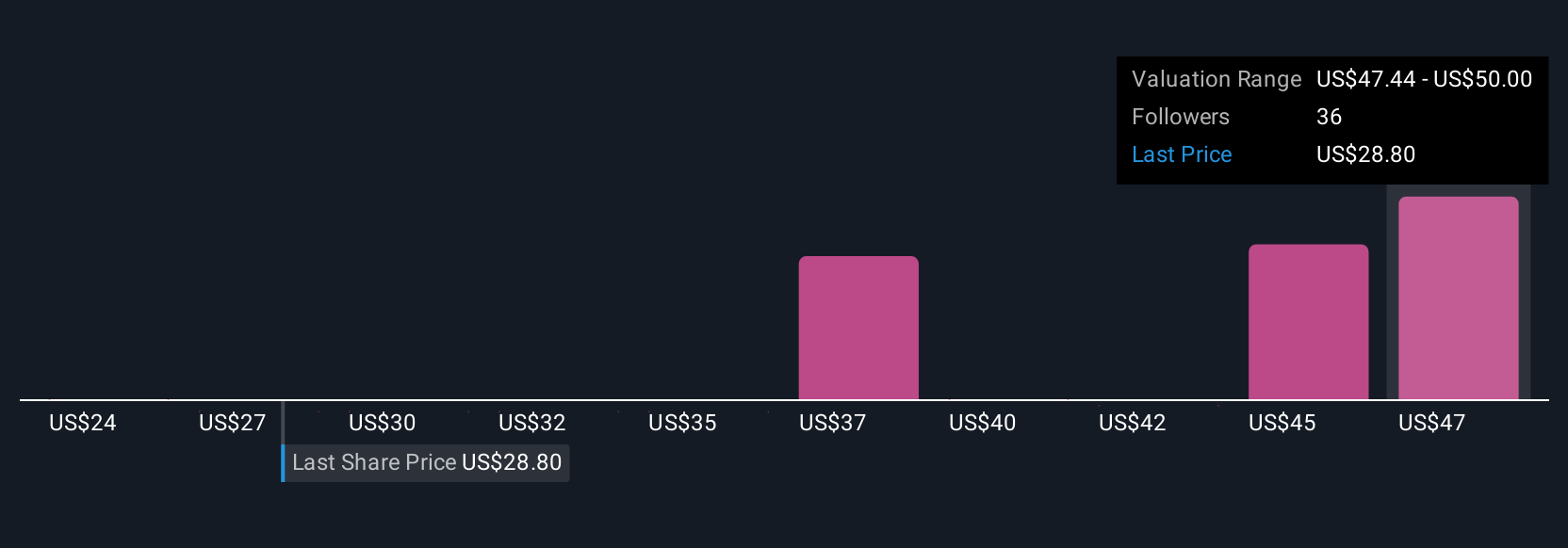

Eleven Simply Wall St Community members shared fair value estimates for DigitalOcean ranging from US$24.42 to US$50. Expansion of AI capabilities is a focus, but competition from larger cloud providers could shape earnings and growth outlooks. Explore several other viewpoints from the community.

Explore 11 other fair value estimates on DigitalOcean Holdings - why the stock might be worth as much as 27% more than the current price!

Build Your Own DigitalOcean Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DigitalOcean Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free DigitalOcean Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DigitalOcean Holdings' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives