- United States

- /

- IT

- /

- NYSE:DOCN

DigitalOcean (DOCN) Net Margin Rises to 15.2%, Reinforcing Profitability Narrative

Reviewed by Simply Wall St

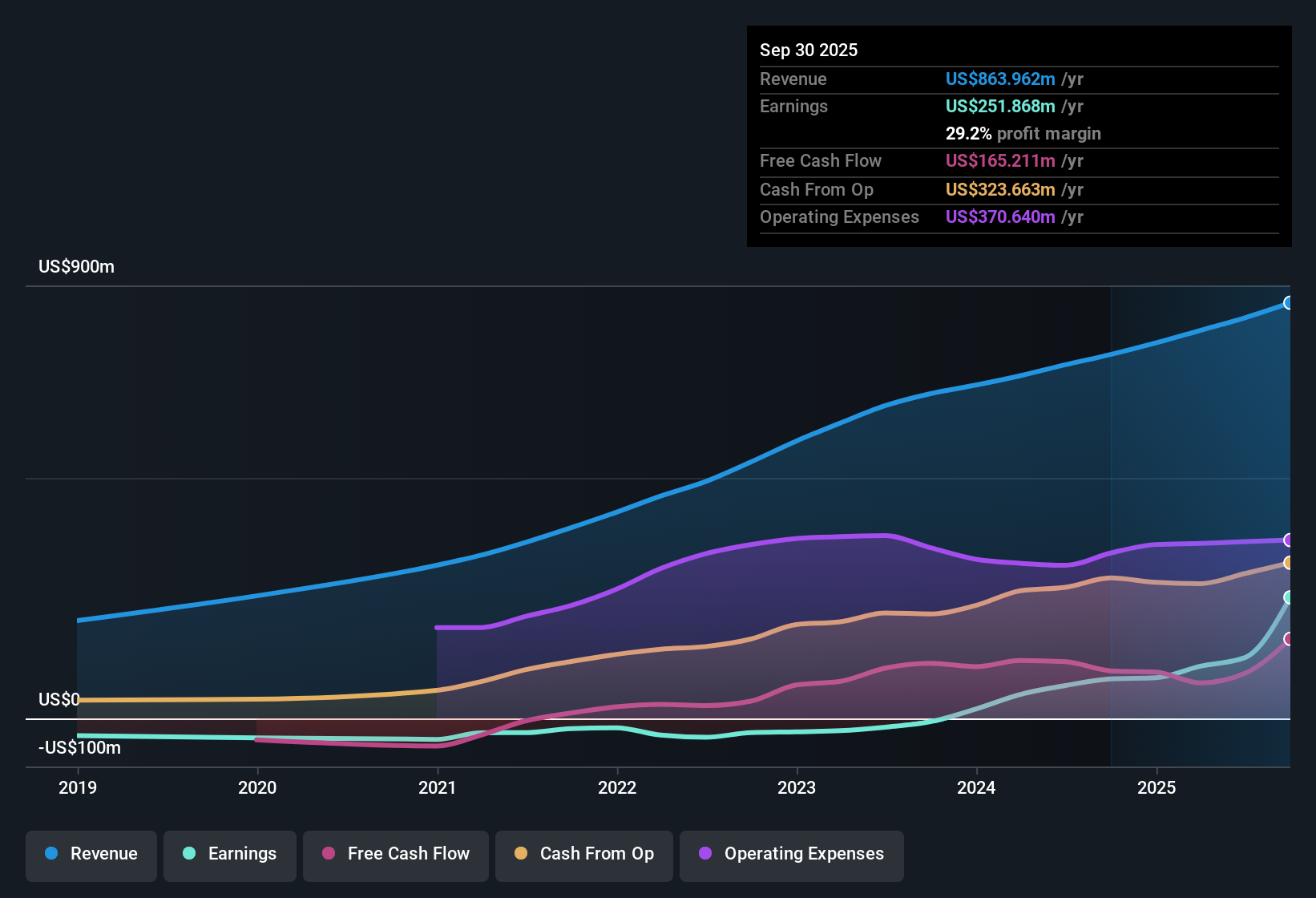

DigitalOcean Holdings (DOCN) came in with a forecast of 15.5% annual revenue growth, topping the broader US market forecast of 10.5%. The company’s earnings are expected to climb 22.2% per year, outpacing the national average of 16%, and net profit margins have increased to 15.2% from last year's 9.3%. After a standout year of 84.9% earnings growth and five-year annualized growth of 78.1%, DigitalOcean is establishing itself as a consistently profitable player.

See our full analysis for DigitalOcean Holdings.Next, we will see how these headline results fit the bigger story by comparing the reported numbers with the prevailing narratives that drive sentiment on DigitalOcean.

See what the community is saying about DigitalOcean Holdings

Net Margins Climb to 15.2%

- Net profit margins stand at 15.2%, up from last year's 9.3%. This highlights a notable improvement in profitability beyond headline growth numbers.

- Analysts' consensus view connects these stronger margins to momentum from expanding AI and product offerings.

- Consensus narrative highlights that new product launches and AI/ML integration have contributed to high gross margins and expanded customer cohorts, directly supporting stronger net margins.

- Analysts note that this profitability trend is supported by operational leverage as high-margin services form a larger share of revenue. This makes margin durability a critical bull case.

- Consensus perspective is reinforced as improved margins reflect both operational efficiency and a positive impact from recent product innovations. If you’re weighing these fundamentals, the full view from all sides is valuable. 📊 Read the full DigitalOcean Holdings Consensus Narrative.

PE Ratio of 33x Sits Below Peers

- DigitalOcean trades at a price-to-earnings ratio (PE) of 33x, which is significantly below its peer group average of 84.7x but above the US IT industry average of 28.9x.

- Analysts' consensus narrative views this discount as reflecting DigitalOcean’s solid earnings quality compared with both high-growth peers and sector norms.

- While the company’s multiple is above the broader industry, consensus notes that long-term profit durability and top-line growth prospects provide a counterweight to valuation concerns.

- This valuation gap highlights DigitalOcean’s stronger profitability and suggests investors may be pricing in the risk-reward mix more favorably than for peers commanding higher premiums.

Financial Risks: Negative Equity Noted

- The company’s two flagged risks center on its financial position and instances of negative equity, even as profits and revenue continue to grow.

- According to the analysts' consensus narrative, these risks temper enthusiasm about rapid AI-driven expansion.

- Consensus highlights that although operational improvements and strong revenue growth are driving positive sentiment, unresolved balance sheet risks could affect future valuation and cash flow predictability.

- The presence of negative equity serves as a reminder that scaling up brings financial complexity. This means investors must watch for changes in net dollar retention and working capital trends.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for DigitalOcean Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you spot something others might have missed? Share your perspective and build your narrative in just a few minutes: Do it your way

A great starting point for your DigitalOcean Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite DigitalOcean’s improving margins and robust growth, the presence of negative equity and financial risks may challenge its ability to deliver sustainable returns.

Uncomfortable with these financial red flags? Find companies with healthier balance sheets and stronger fundamentals using our solid balance sheet and fundamentals stocks screener (1979 results) for greater peace of mind.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Proven track record with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion