- United States

- /

- Software

- /

- NYSE:DLB

Did Super Bowl Partnership and Capital Return Moves Just Shift Dolby Laboratories' (DLB) Investment Narrative?

Reviewed by Sasha Jovanovic

- Dolby Laboratories recently announced its full-year earnings results, updated investors on guidance for fiscal 2026, declared a US$0.36 per share dividend, and provided an update on its ongoing share repurchase program, while the Bay Area Host Committee named Dolby as an Official Signature Partner for Super Bowl LX week in the Bay Area in February 2026.

- This collaboration highlights Dolby’s push to showcase its technologies in live entertainment, reinforcing its position at the intersection of technology, community, and immersive experiences.

- We'll explore how Dolby’s earnings guidance and shareholder initiatives may influence its long-term investment narrative and growth outlook.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dolby Laboratories Investment Narrative Recap

To invest in Dolby Laboratories, one must believe in the ongoing relevance of premium audio and video technologies and Dolby’s ability to expand beyond its traditional hardware-driven licensing model. The recent Super Bowl partnership showcases Dolby’s brand power but does not materially shift immediate catalysts, which remain focused on new vertical adoption of Atmos and Vision, and the core risk of declining device shipments in consumer electronics.

Out of the recent announcements, Dolby’s fresh guidance for fiscal 2026 is most pertinent, with the company projecting revenue between US$1.39 billion and US$1.44 billion and non-GAAP EPS ranging from US$4.19 to US$4.34, setting clear benchmarks for near-term performance against the backdrop of increasing licensing pressures and competition.

By contrast, investors should also be aware of a key risk around the potential commoditization of consumer devices as...

Read the full narrative on Dolby Laboratories (it's free!)

Dolby Laboratories is projected to achieve $1.5 billion in revenue and $334.6 million in earnings by 2028. This outlook is based on a forecasted annual revenue growth rate of 4.0% and an earnings increase of $70.3 million from the current $264.3 million.

Uncover how Dolby Laboratories' forecasts yield a $90.50 fair value, a 34% upside to its current price.

Exploring Other Perspectives

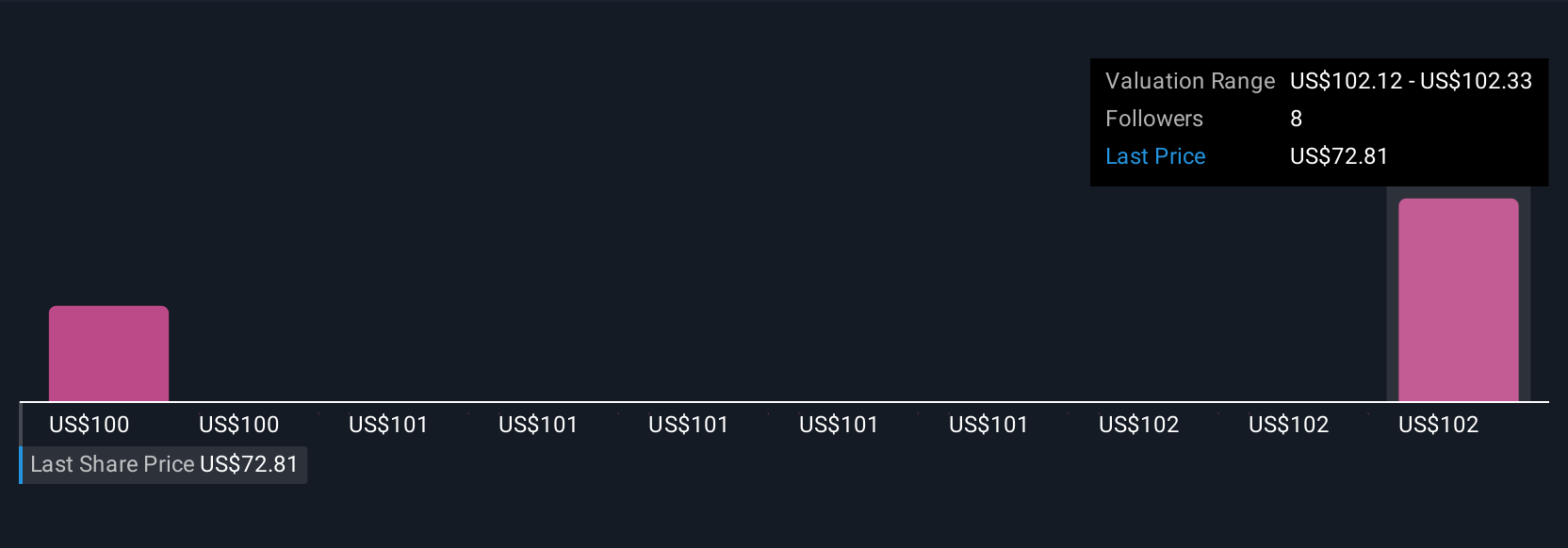

Fair value estimates from five members of the Simply Wall St Community range widely from US$47.36 to US$232.74 per share. While many look to Dolby’s deeper efforts in immersive technology as a driver, remember that sustained growth will likely depend on broader consumer and OEM support for premium solutions.

Explore 5 other fair value estimates on Dolby Laboratories - why the stock might be worth over 3x more than the current price!

Build Your Own Dolby Laboratories Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dolby Laboratories research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dolby Laboratories research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dolby Laboratories' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLB

Dolby Laboratories

Engages in the design and manufacture of audio, imaging, accessibility, and other hardware and software solutions for television, broadcast, and live entertainment industries in the United States and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success