- United States

- /

- Software

- /

- NYSE:CRM

Is Salesforce a Bargain After its AI Partnership Shakes Up Valuation in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Salesforce is truly worth its current price? You're not alone. Many investors are searching for answers about whether the stock is a bargain or fully valued right now.

- Salesforce shares have seen a mix of swings lately, gaining 2.2% this week and 8.3% over the past month, though they are still down 21.2% for the year.

- Recent headlines have highlighted Salesforce's ongoing push into AI-powered cloud tools and a major partnership with a leading enterprise tech firm, fueling both optimism and debate in the market. This news has put the spotlight on how the company's strategic bets could impact its future growth and risk profile.

- With a valuation score of 4 out of 6, there is plenty to consider as we break down what the numbers and different valuation methods say about Salesforce. Stick around to the end for a deeper perspective that might just change how you think about valuation altogether.

Find out why Salesforce's -11.1% return over the last year is lagging behind its peers.

Approach 1: Salesforce Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today's value. This method captures what those flows are worth in present terms. For Salesforce, analysts estimate Free Cash Flow (FCF) this year at $12.4 billion, with projections showing consistent growth over the coming decade.

Looking ahead, the model expects Salesforce's FCF to reach around $19.5 billion by 2030. Analyst forecasts drive the near-term estimates for the next five years, while additional years are extrapolated using reasonable growth assumptions. This provides a comprehensive snapshot of the company’s long-term potential through a cash generation lens.

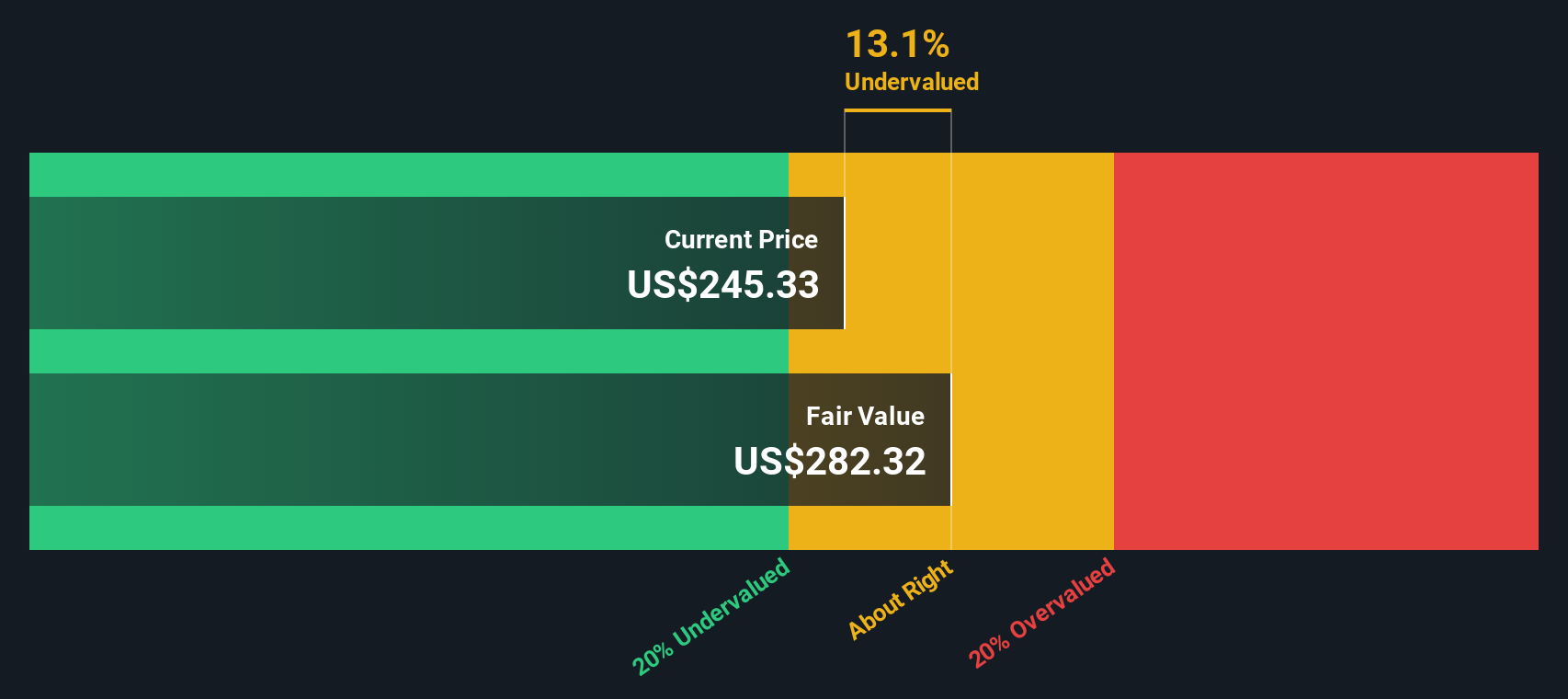

Based on these projections and the DCF calculation, Salesforce’s estimated intrinsic value is $345.60 per share. Compared to the share’s current trading price, this suggests the stock is undervalued by 24.7%. In other words, the DCF points to meaningful upside for investors at today’s price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Salesforce is undervalued by 24.7%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Salesforce Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation tool for profitable companies like Salesforce because it captures what investors are willing to pay for each dollar of the company's current earnings. For mature or consistently profitable businesses, it provides a useful lens into expectations of future growth and perceived risk.

The "right" PE ratio is often shaped by factors such as how quickly a company’s earnings are expected to grow, the stability of those earnings, and any risks on the horizon. A higher ratio can signal strong confidence in continued growth, while a lower one may reflect uncertainty or lackluster prospects.

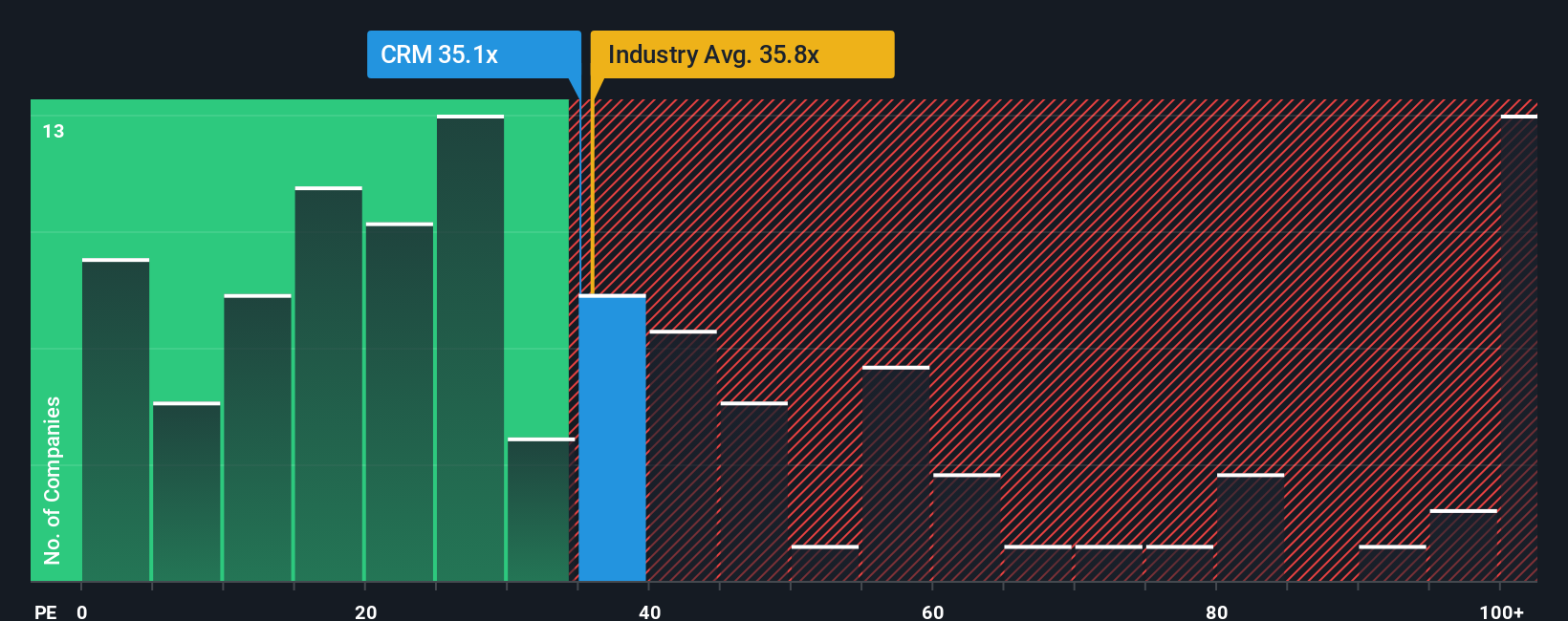

Salesforce’s current PE ratio stands at 37.2x. Comparing this to benchmarks, the industry average for software companies is about 34.9x, while peers on average trade at a notably higher 60.3x. On the surface, Salesforce looks more attractively valued than many of its peers, but somewhat richer than the broader industry average.

To get a more tailored sense of value, Simply Wall St’s proprietary “Fair Ratio” factors in nuanced elements including Salesforce’s earnings growth, industry standing, profit margins, company size, and risk profile. This approach adjusts for context rather than relying solely on broad averages. For Salesforce, the Fair Ratio comes out to 44.4x, which is well above its actual PE of 37.2x. That suggests Salesforce shares are trading below what might be considered a balanced multiple, given all the moving parts.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1415 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Salesforce Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your story about a company: it is where you spell out your own fair value estimate, explain the assumptions behind your forecasts, and provide the reasoning that connects Salesforce’s data with your expectations. Narratives link the company’s business journey, such as new product launches or margin improvements, directly to financial forecasts and ultimately to what you believe is a fair price.

With Narratives, you can easily record your investment thesis right on Simply Wall St's Community page, alongside millions of other investors. This powerful tool helps you decide if Salesforce is a buy or a sell by comparing your calculated Fair Value with the current market Price. In addition, your Narrative dynamically updates whenever new company data, news, or earnings are released, so your investment thesis stays relevant as circumstances change.

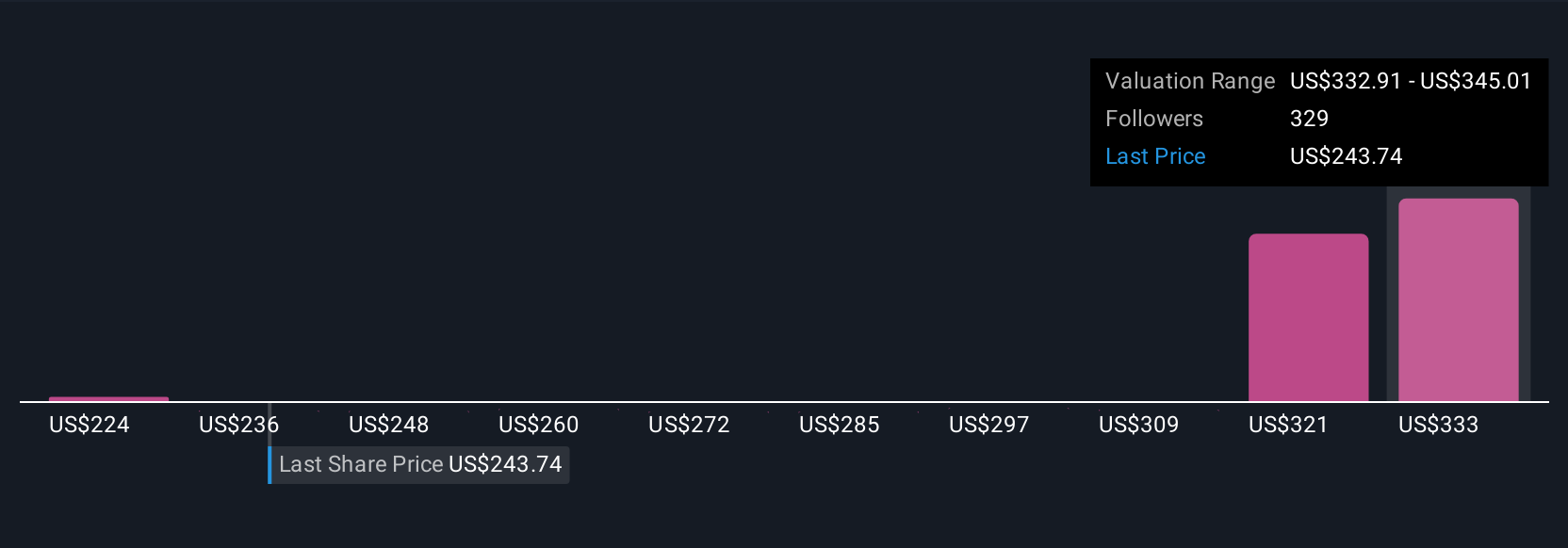

For example, some investors currently think Salesforce is worth as much as $430 per share, banking on AI driving superior growth and margins. Others see fair value closer to $221, suggesting market expectations are overblown. Narratives help you compare and justify these very different viewpoints so you can make confident, informed decisions that match your own outlook.

For Salesforce, we’ll make it really easy for you with previews of two leading Salesforce Narratives:

Fair Value: $334.68

Undervalued by 22.2%

Expected Annual Revenue Growth: 9.6%

- AI-driven automation and integration of workflow tools are increasing customer adoption, which supports long-term revenue and margin potential.

- Success in mid-market and SMB segments, along with strong operating discipline and capital returns, broadens Salesforce’s customer base and scalability.

- Risks include rising competition, regulatory headwinds, and execution challenges from acquisitions. However, analysts see a clear path to continued growth if targets are met.

Fair Value: $223.99

Overvalued by 16.2%

Expected Annual Revenue Growth: 13%

- Salesforce dominates enterprise CRM, but market growth and margin expectations are high, with limited opportunities for new efficiency gains.

- Heavy reliance on a concentrated customer base and large enterprises increases business risks, leading to significant revenue volatility if Salesforce fails to diversify.

- The market may be pricing in overly optimistic free cash flow and AI-driven gains. Persistent acquisitions and competition could add pressure to long-term profitability.

Do you think there's more to the story for Salesforce? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives