- United States

- /

- Software

- /

- NYSE:CRM

Is CRM's New AI Partnership a Sign of Deeper Enterprise Momentum or Just Table Stakes?

Reviewed by Sasha Jovanovic

- ASGN Incorporated recently announced a multi-year partnership to integrate Salesforce’s Agentforce platform into its digital engineering practice, aiming to accelerate AI innovation and streamline intelligent automation for clients across commercial and government sectors.

- This collaboration underscores Salesforce's growing adoption among enterprise clients who are leveraging agent-based AI solutions to enhance workflow efficiency and expand offerings across critical technology areas.

- Next, we’ll explore how Salesforce’s enterprise-focused AI partnerships, such as the ASGN alliance, impact its broader investment narrative and market outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Salesforce Investment Narrative Recap

For shareholders, the underlying thesis for Salesforce remains anchored in its ability to drive enterprise digital transformation through AI-powered platforms like Agentforce, aiming for sustained revenue and margin growth from large enterprises. The recent partnership with ASGN spotlights Salesforce’s continued traction among enterprise clients, but is unlikely to materially alter the primary near-term catalyst, adoption and upsells for Agentforce-driven solutions, or address the main risk of rising competition from other tech giants offering bundled AI enterprise tools.

Among recent announcements, ShiftUp’s launch of its AI-powered Revenue Intelligence platform on Salesforce AppExchange stands out, echoing the same theme of embedding automation within core Salesforce workflows. This underscores that accelerating AI-powered workflow adoption is central to Salesforce’s value proposition, reinforcing the critical role of agentic automation as a catalyst for expansion and customer engagement.

Yet, investors should be aware that, by contrast, there remains a risk to Salesforce’s continued differentiation if...

Read the full narrative on Salesforce (it's free!)

Salesforce's narrative projects $51.9 billion revenue and $10.3 billion earnings by 2028. This requires 9.6% yearly revenue growth and a $3.6 billion earnings increase from $6.7 billion.

Uncover how Salesforce's forecasts yield a $330.59 fair value, a 46% upside to its current price.

Exploring Other Perspectives

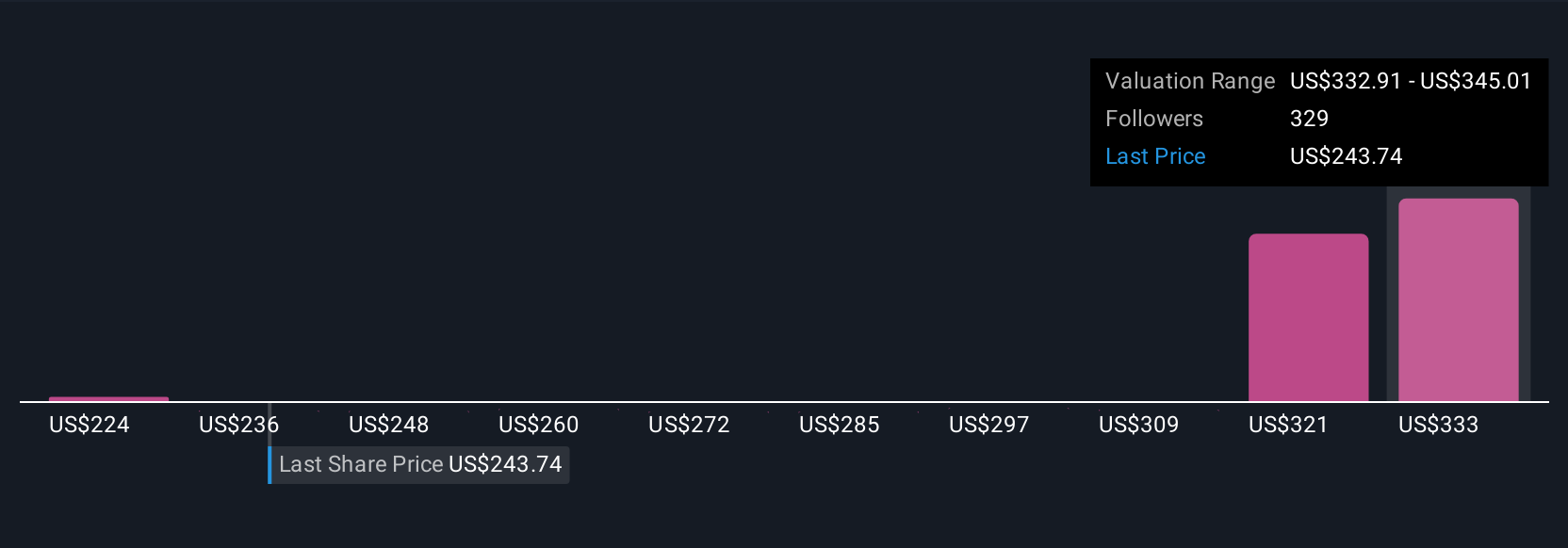

Simply Wall St Community members offer 42 fair value estimates for Salesforce, from US$223.99 to US$373.72 per share. As market participants weigh Agentforce’s rapid adoption against intensifying competition in enterprise software, there are multiple perspectives worth considering.

Explore 42 other fair value estimates on Salesforce - why the stock might be worth as much as 65% more than the current price!

Build Your Own Salesforce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Salesforce research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Salesforce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Salesforce's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives