- United States

- /

- Software

- /

- NYSE:CRCL

Can Circle (CRCL) Turn Enhanced USDC Custody Into a Competitive Advantage With Institutions?

Reviewed by Sasha Jovanovic

- Safe announced a partnership with Circle Internet Group to enhance USDC self-custody solutions, aiming to support secure digital asset storage for institutional clients.

- This collaboration underscores increasing industry focus on advancing custody infrastructure as institutional adoption of digital assets continues to expand.

- We'll examine how Circle's push for improved institutional storage reflects on its broader investment narrative amid shifting digital asset security demands.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Circle Internet Group's Investment Narrative?

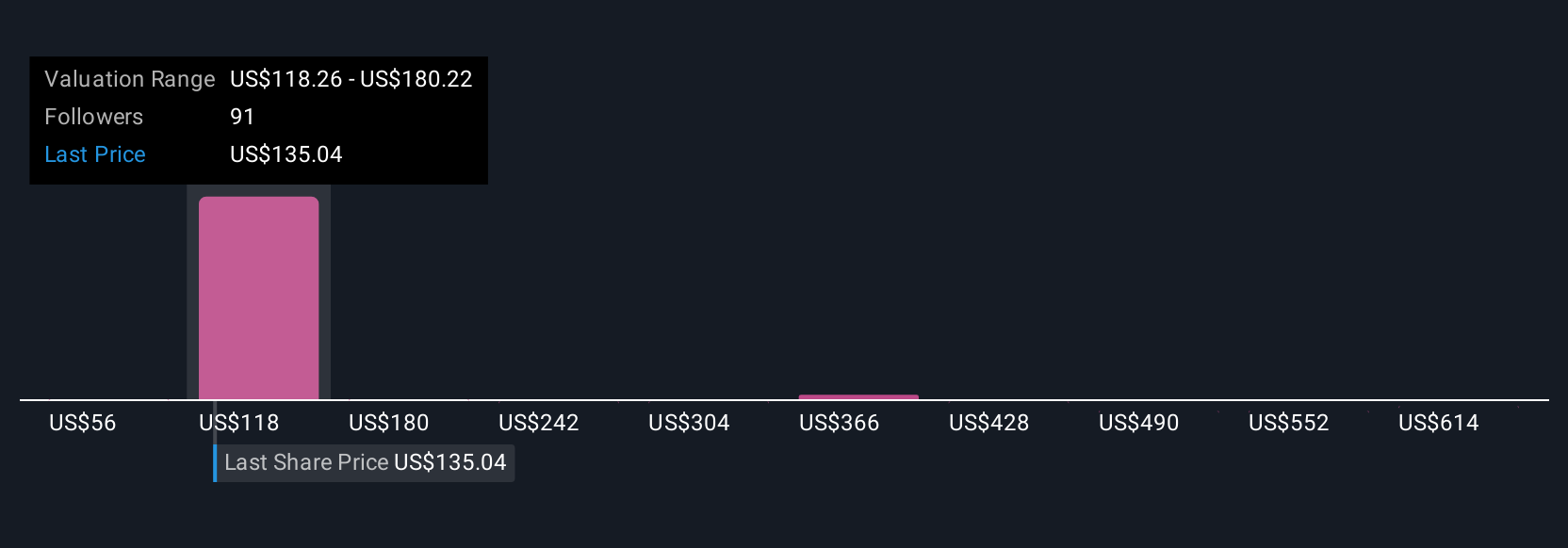

For someone considering Circle Internet Group, the big picture centers on widespread adoption of stablecoin infrastructure and converting a significant share of money supply (M2) onto blockchain rails, an ambitious aim highlighted by recent analyst coverage. The new partnership with Safe, enhancing USDC self-custody for institutions, could boost commercial credibility and help address urgent security and reputational risks that have weighed on digital asset companies. In the near term, this focus on custody may reinforce confidence ahead of Circle’s upcoming earnings, especially with market sensitivity to security concerns and recent share price volatility. However, the company remains unprofitable and is trading below consensus fair value, so progress on adoption and path to profitability are still key short-term catalysts. Whether this partnership fully shifts risk or sentiment will be watched ahead of earnings season.

On the flip side, recent insider selling remains an important concern for investors to track. Despite retreating, Circle Internet Group's shares might still be trading 30% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 39 other fair value estimates on Circle Internet Group - why the stock might be worth over 6x more than the current price!

Build Your Own Circle Internet Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Circle Internet Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Circle Internet Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Circle Internet Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRCL

Circle Internet Group

Operates as a platform, network, and market infrastructure for stablecoin and blockchain applications.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives