- United States

- /

- Software

- /

- NYSE:BOX

Box (BOX): Assessing Valuation Following Launch of New AI-Powered Automation and Security Products

Reviewed by Kshitija Bhandaru

Box (BOX) just rolled out a major suite of AI-powered products, including Box Automate for workflow orchestration and Box Shield Pro for next-level content security. If you are wondering whether these innovations really move the needle for investors, you are not alone. The company is showcasing all of this at BoxWorks, aiming to highlight how agentic AI can drive real changes for business customers, especially those that need secure, efficient content management and automation.

These latest updates come at an interesting time. Over the past year, Box’s stock has drifted slightly lower, down just 0.3%, but momentum has picked up with a 3% gain for the year-to-date and an 8% return over five years. Recent product pushes like Extract and Automate land alongside persistent questions about growth versus profitability, especially as annual revenue has grown steadily but net income slipped a bit. The market seems to be watching for clear signals that these AI bets can translate into real business gains, whether in customer expansion, stickier usage, or margin improvement.

So with all these AI announcements now in the spotlight, does Box offer a genuine buying opportunity at current levels, or is the market already factoring in all the future upside?

Most Popular Narrative: 13.6% Undervalued

The most widely followed narrative suggests Box is currently undervalued, with its fair value estimated to be meaningfully higher than the recent share price.

Ongoing investments in AI-powered metadata extraction, no-code workflow automation, and integration with leading AI model providers (OpenAI, Anthropic, xAI) and enterprise software ecosystems (Microsoft, Google, Salesforce) are deepening Box's value proposition. These initiatives are supporting premium pricing, reducing churn, and contributing to margin expansion over time.

Curious how Box’s bold move into AI and new integrations could shape its value story? The consensus narrative leans into growth levers beyond just headline numbers. Wondering what key financial drivers and ambitious margin expectations might launch Box to the next level? Discover how this valuation really stacks up on future potential versus current sentiment.

Result: Fair Value of $37.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, escalating competition from major cloud providers and tightening data privacy regulations could quickly challenge Box's growth narrative and pricing power.

Find out about the key risks to this Box narrative.Another View: Discounted Cash Flow Perspective

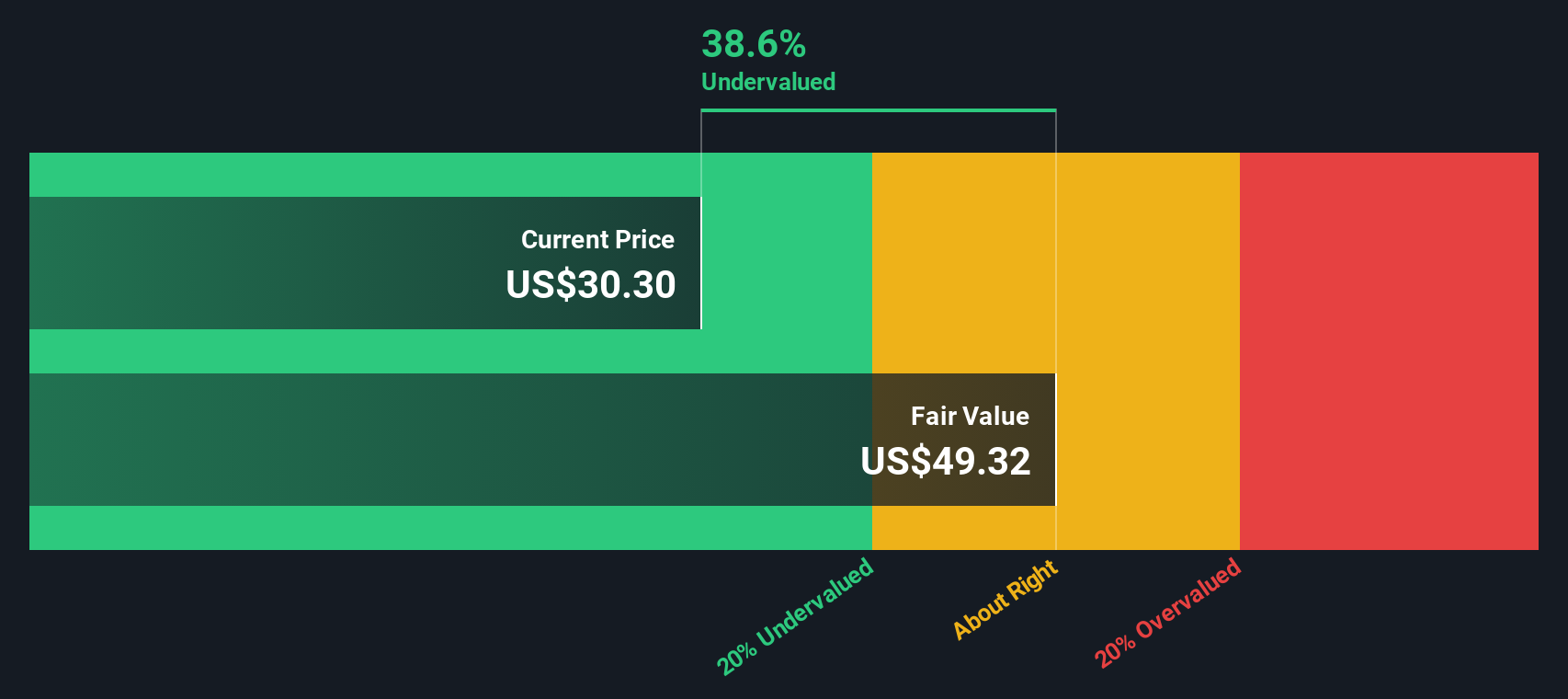

While analysts see upside based on future growth assumptions, our DCF model offers a different perspective by estimating Box's fair value using projected cash flows. This approach currently suggests the stock is undervalued. Which narrative do you find more convincing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Box Narrative

If you see the story differently or prefer to explore the numbers and trends on your own, you can piece together your own view in just minutes. Do it your way

A great starting point for your Box research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Smart Next Steps?

Don’t sit on the sidelines while others spot the next breakout opportunity. It’s your move. See what can happen when you look beyond the obvious and uncover stocks built for the future.

- Kickstart your search for outsized returns in emerging markets with penny stocks with strong financials, shaping big financial upside from a modest price point.

- Tap into the explosive momentum of artificial intelligence by selecting AI penny stocks, fueling tomorrow’s breakthroughs in automation, analytics, and global business transformation.

- Power up your portfolio with strong, reliable income. Lock in opportunities for generous payouts through dividend stocks with yields > 3%, featuring standout, high-yielding companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Box might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOX

Box

Provides a cloud content management platform that enables organizations of various sizes to manage and share their content from anywhere on any device in the United States and Japan.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives