- United States

- /

- IT

- /

- NYSE:BBAI

Why BigBear.ai Holdings (BBAI) Is Up 5.8% After Posting Profits Despite Falling Sales and Outlook Uncertainty

Reviewed by Sasha Jovanovic

- BigBear.ai Holdings recently announced its third quarter 2025 earnings, reporting quarterly sales of US$33.14 million, down from US$41.51 million a year earlier, but with net income turning positive at US$2.52 million compared to a loss the previous year.

- This marks a return to quarterly profitability for the company despite ongoing revenue headwinds, while management’s full-year outlook highlights continued pressure on sales and underlying contract uncertainties.

- We’ll explore how the mix of lower sales but improved quarterly profit margins reshapes BigBear.ai’s investment outlook and financial trajectory.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

BigBear.ai Holdings Investment Narrative Recap

For BigBear.ai Holdings, the core investment thesis centers on faith in the company’s ability to convert federal technology contracts and AI-driven product deployments into consistent long-term growth, despite volatility in its financial results. The latest results mark a return to quarterly profitability, but revenue continues to fall, and contract timing remains the most immediate catalyst as well as the biggest near-term risk; this earnings update does not meaningfully change that equation.

Of the recent news, the reaffirmed full-year revenue guidance of US$125 million to US$140 million is most relevant. While this suggests management’s confidence in the sales pipeline, maintaining guidance amidst ongoing sales declines keeps focus squarely on whether existing and new contract awards can stabilize future results.

However, even as profitability returns in one quarter, investors should be aware that unpredictability in government contract funding can still ...

Read the full narrative on BigBear.ai Holdings (it's free!)

BigBear.ai Holdings' narrative projects $162.2 million revenue and $10.3 million earnings by 2028. This requires 2.1% yearly revenue growth and a $454.2 million earnings increase from -$443.9 million today.

Uncover how BigBear.ai Holdings' forecasts yield a $6.33 fair value, a 5% upside to its current price.

Exploring Other Perspectives

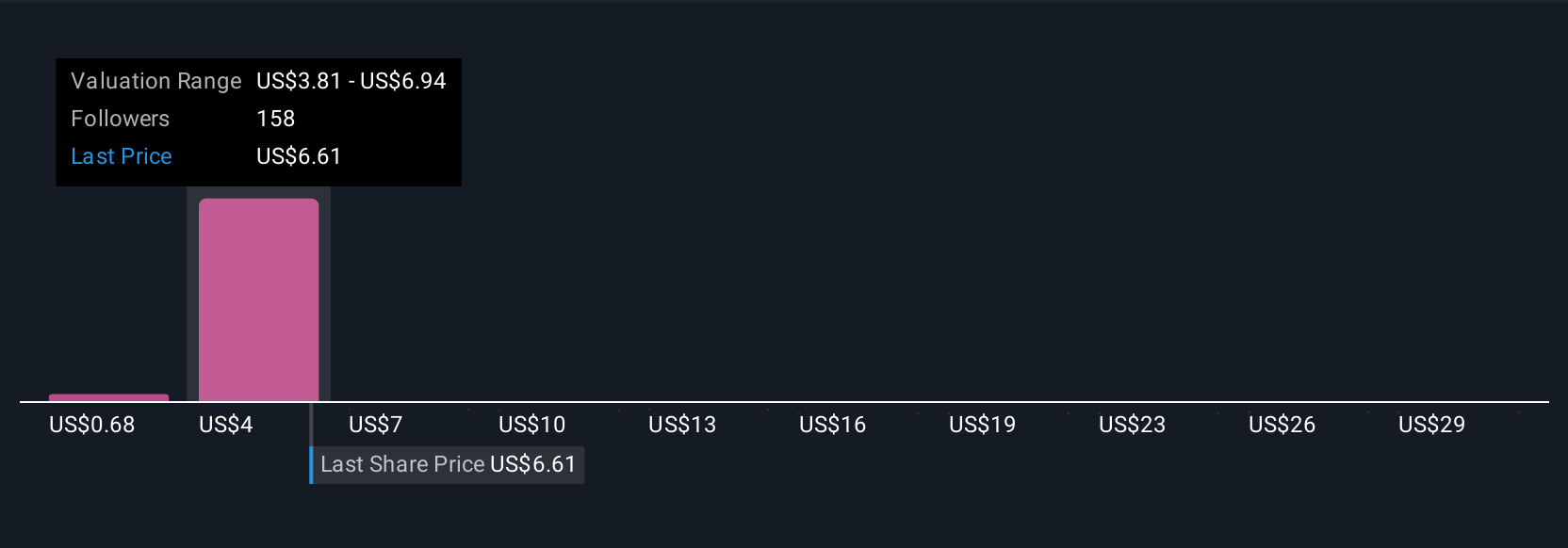

Fair value estimates from 33 Simply Wall St Community members span from US$0.68 to US$15.26, reflecting wide differences in opinion. With revenue still pressured by federal contract delays, expect further debate about BigBear.ai’s path forward.

Explore 33 other fair value estimates on BigBear.ai Holdings - why the stock might be worth less than half the current price!

Build Your Own BigBear.ai Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BigBear.ai Holdings research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free BigBear.ai Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BigBear.ai Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBAI

BigBear.ai Holdings

Provides artificial intelligence-powered decision intelligence solutions.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives