- United States

- /

- IT

- /

- NYSE:ASGN

How Investors May Respond To ASGN (ASGN) Securing DoD Awardable Status for Blue Dawn Cloud Solution

Reviewed by Simply Wall St

- ECS announced that its Blue Dawn cloud-based mission partner environment has been designated "awardable" on the Department of Defense's Tradewinds Solutions Marketplace, making the solution contract-ready and accessible to government customers seeking secure, AI-enabled infrastructure.

- This designation opens up expanded federal contracting opportunities for ASGN in high-security and AI-focused environments, which could enhance its government segment at a time of commercial margin pressure.

- We'll examine how Blue Dawn's contract-ready status in the DoD marketplace could shift ASGN's investment narrative toward federal sector growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ASGN Investment Narrative Recap

At the core, an ASGN investment hinges on confidence in its ability to offset commercial margin pressures with growth in higher-value federal and AI-driven contracts. The recent "awardable" designation for ECS's Blue Dawn platform on the Department of Defense Tradewinds Solutions Marketplace supports this view, presenting a potential catalyst for its federal segment, but it does not immediately reduce the near-term risk of further margin compression as contract mix and pricing remain uncertain.

Among recent announcements, ECS securing a place as prime contractor on the FBI's US$8 billion ITSSS-2 contract stands out. This complements the Blue Dawn news, reinforcing ASGN's access to resilient government IT spending as a meaningful offset to softer commercial demand and industry headwinds.

However, it's important to contrast these federal growth opportunities with the investor risk that persistently low commercial staffing revenues and compressed gross margins could still impact...

Read the full narrative on ASGN (it's free!)

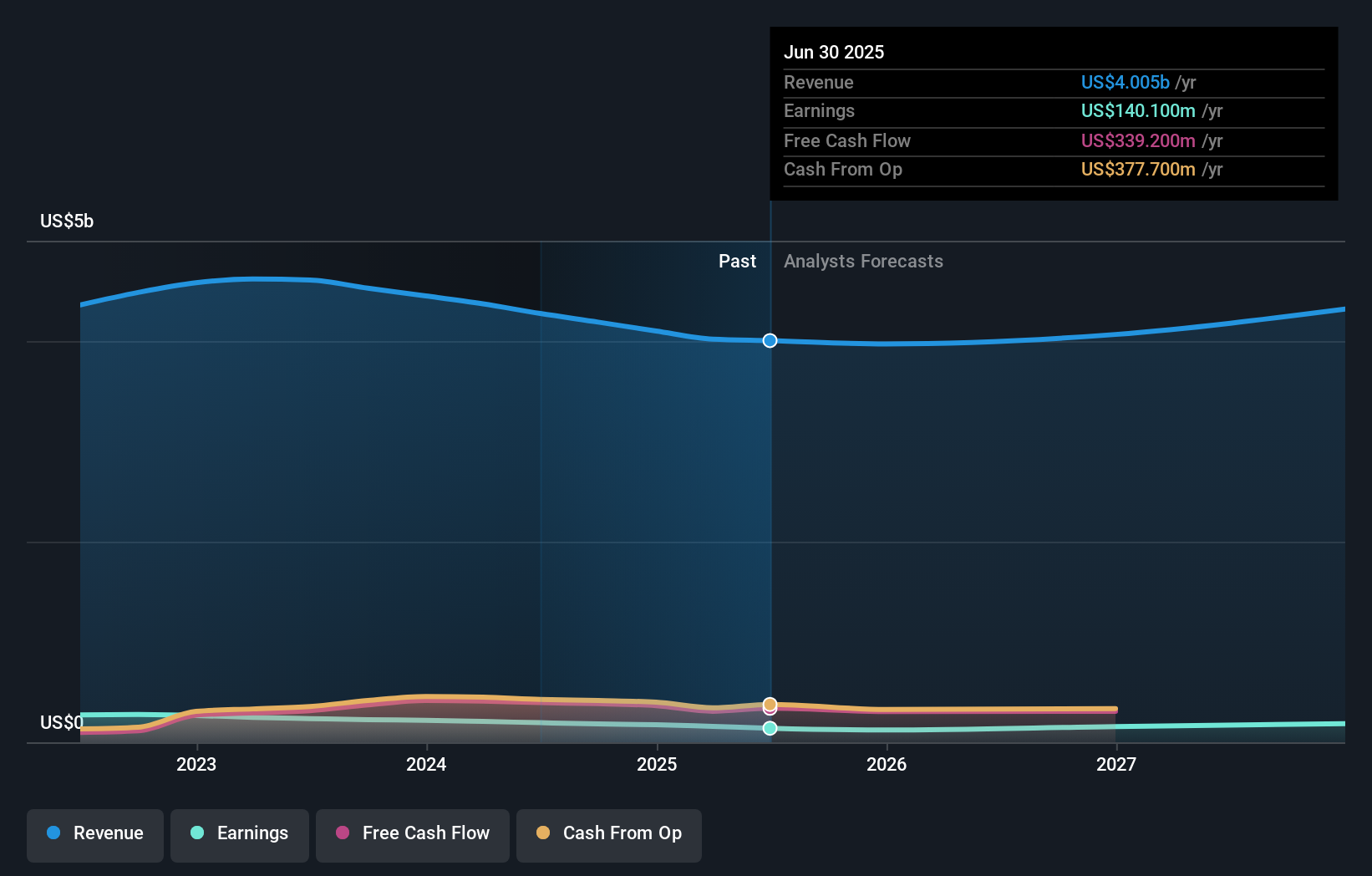

ASGN's narrative projects $4.3 billion revenue and $193.8 million earnings by 2028. This requires 2.5% yearly revenue growth and a $53.7 million earnings increase from $140.1 million today.

Uncover how ASGN's forecasts yield a $57.50 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided three fair value estimates for ASGN, ranging widely from US$30.33 to US$79.17. While some see substantial upside, others caution that soft commercial segment earnings and margin risks could weigh on performance, explore these differing viewpoints to form your own outlook.

Explore 3 other fair value estimates on ASGN - why the stock might be worth as much as 52% more than the current price!

Build Your Own ASGN Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ASGN research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ASGN research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ASGN's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASGN

ASGN

Engages in the provision of information technology (IT) services and solutions in the technology, digital, and creative fields for commercial and government sectors in the United States, Canada, and Europe.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives