- United States

- /

- IT

- /

- NYSE:ACN

Is Now the Right Time to Revisit Accenture After Its 30% Slide in 2025?

Reviewed by Bailey Pemberton

- Curious whether Accenture's recent price slide means it is now a bargain, or if more market turbulence may be ahead? You're not alone. This question is on many investors' minds.

- After a drop of 4.1% in the last week and a decline of more than 30% since the year began, Accenture's stock is attracting attention for both its challenging stretch and its longer-term resilience.

- Recent headlines point to major IT sector contract wins and new AI-powered consulting services, fueling debate over how quickly the company will regain momentum. Shifting industry dynamics and tech innovation narratives remain central, with investors closely watching how Accenture responds to increased global competition.

- On our 6-point valuation checklist, Accenture scores 4 out of 6, signaling potential value. However, understanding what that really means takes more than just scoring the basics. Let’s dig into the methods behind these numbers, and later, we’ll share the angle that makes the biggest difference in the valuation conversation.

Find out why Accenture's -28.2% return over the last year is lagging behind its peers.

Approach 1: Accenture Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is worth today by forecasting its future cash flows and discounting them back to their present value. This helps investors gauge whether a stock price is justified by underlying financial performance.

For Accenture, analysts estimate that the company generated Free Cash Flow (FCF) of $10.90 Billion over the last twelve months. Projections from analysts reach out to 2029, with FCF expected to grow to $12.37 Billion by then. Beyond these analyst-supplied numbers, further increases in FCF are extrapolated, with estimates reaching up to $14.66 Billion in 2035.

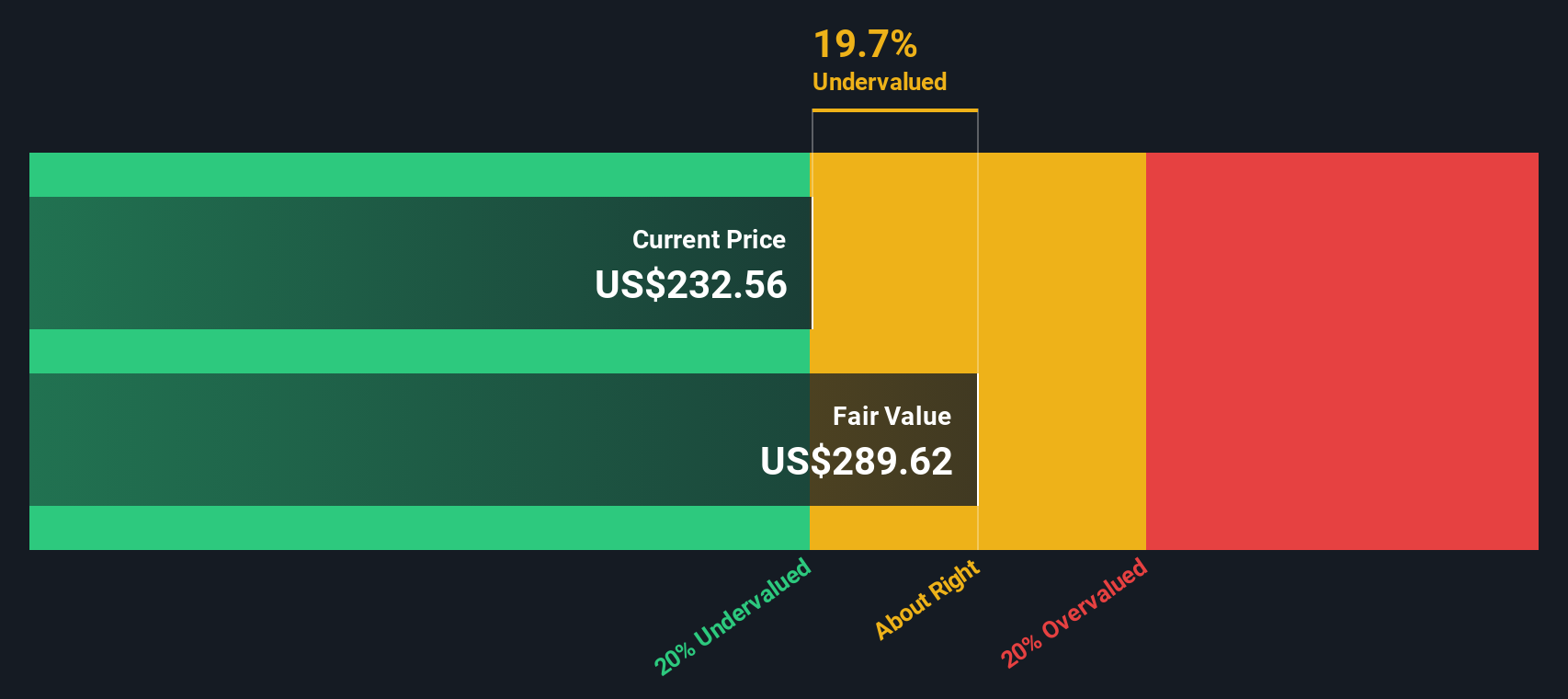

The DCF analysis for Accenture uses a 2 Stage Free Cash Flow to Equity model. This approach incorporates both high-confidence analyst projections and methodical, gradual growth for longer-term forecasts. When these cash flows are discounted to present value, the estimated intrinsic value for Accenture shares is $272.81.

This calculation implies the stock is currently trading at an 11.0% discount to its intrinsic value. According to this method, the shares are considered undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Accenture is undervalued by 11.0%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: Accenture Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation metric for profitable companies like Accenture, as it compares a company’s current share price to its per-share earnings. This makes it especially valuable for understanding how the market values ongoing profitability and growth.

What is considered a “normal” or “fair” PE ratio can vary, depending on factors like expected earnings growth and risk. Higher growth prospects or lower perceived risk usually justify a higher PE multiple, while slower growth or greater risk might push it lower.

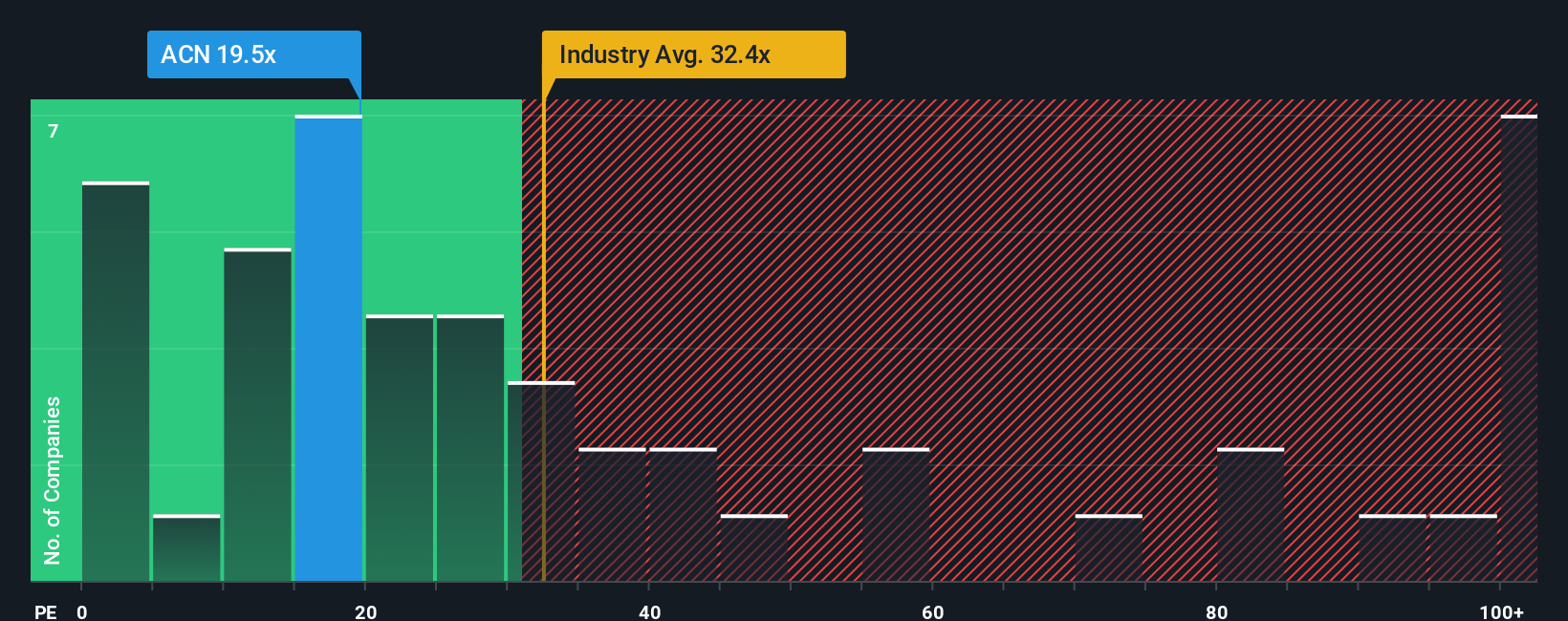

Accenture currently trades on a PE ratio of 19.6x. For context, the average PE among Accenture’s IT industry peers is 26.6x, while the broader industry’s average is an even higher 28.9x. At first glance, this suggests Accenture might be trading at a discount to its sector.

However, Simply Wall St’s proprietary “Fair Ratio” takes this further by estimating the PE multiple that truly suits Accenture’s unique fundamentals. This Fair Ratio considers growth prospects, profit margins, market cap, industry conditions, and risk factors, offering a tailored benchmark rather than a simple comparison to peers or the industry. For Accenture, the Fair Ratio comes in at 38.3x. This is markedly higher than both the current PE and its comparables.

Given that Accenture’s actual PE is 19.6x, well below its Fair Ratio of 38.3x, the stock currently appears undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Accenture Narrative

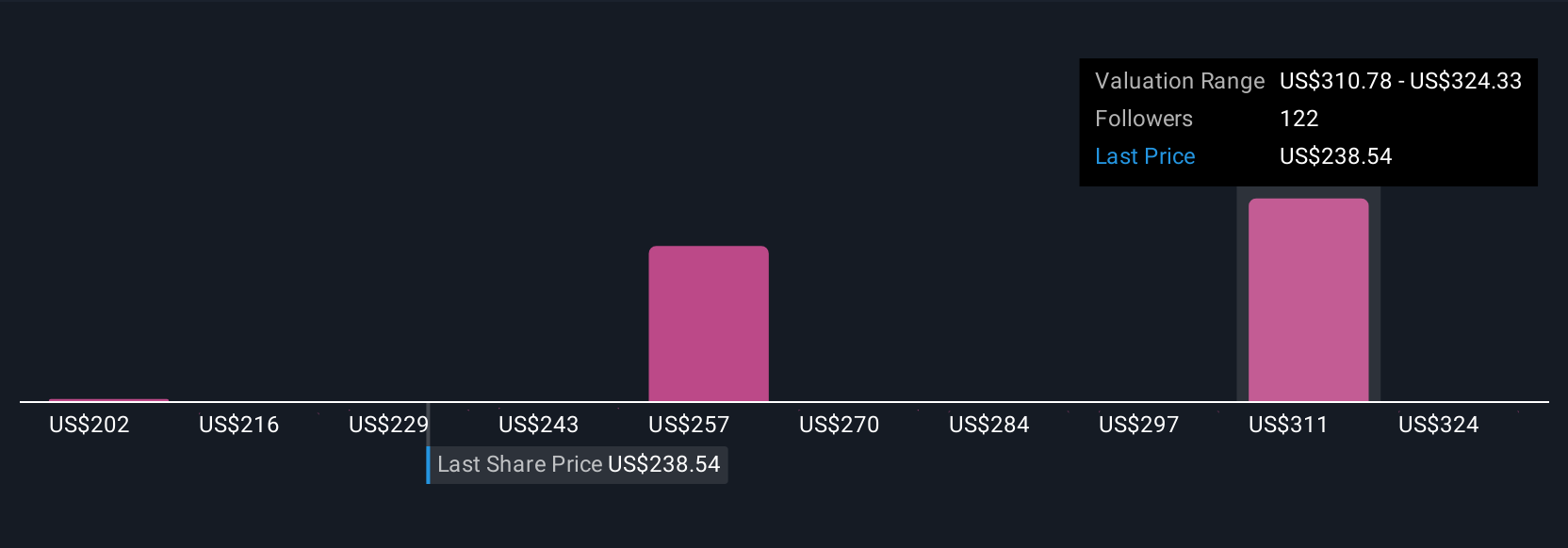

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative connects your personal perspective about Accenture, the story you believe about its future strengths, risks, and trends, with actual financial forecasts and a calculated fair value. Rather than relying solely on numbers or analyst consensus, Narratives let you set your own assumptions for key drivers like revenue growth, profit margins, or valuation multiples, linking company stories directly to how much you think the stock is really worth.

Available within the Simply Wall St Community, Narratives are straightforward tools used by millions of investors to sense-check fair value against the market price before deciding to buy or sell. When news breaks or earnings change, Narratives update automatically, helping you stay up to date and ensure your investment thesis reflects the latest information.

For example, one Accenture Narrative might expect robust Gen AI-led growth, projecting profit margins above 12% and a fair value near $372. Another could take a more cautious view around industry headwinds and margin pressure, resulting in a fair value closer to $202. This shows how different outlooks on the same company can result in very different investing decisions.

For Accenture, we will make it easy for you with previews of two leading Accenture Narratives:

Fair Value: $277.60

Current Price Discount: 12.5% undervalued

Forecast Revenue Growth: 5.7%

- Strategic investment in Gen AI and high-growth acquisitions position Accenture for robust long-term revenue gains as digital transformation picks up pace across industries.

- Continued expansion of cloud and security offerings, in addition to a strong share repurchase program, supports ongoing profit margin and EPS growth.

- Key risks include pressures from slowing federal revenue, global economic uncertainties, persistent margin challenges, and currency fluctuations that may affect future results.

Fair Value: $202.38

Current Price Premium: 20.0% overvalued

Forecast Revenue Growth: 5.4%

- Core financial metrics such as P/E and EV/EBITDA multiples have reset near historic averages, but Accenture still boasts superior profitability and returns for the sector.

- Growth and margin expansion remain visible, and AI momentum is building, but bookings have declined year-over-year and near-term performance is sensitive to macro volatility.

- Despite stable capital returns including dividends and buybacks and a strong balance sheet, execution will hinge on converting AI wins into scaled recurring revenue amid cautious client spending.

Do you think there's more to the story for Accenture? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives