- United States

- /

- IT

- /

- NYSE:ACN

How Accenture's (ACN) AI Safety Platform Collaboration Could Shape Its Factory Modernization Story

Reviewed by Sasha Jovanovic

- In October 2025, Belden Inc. announced a collaboration with Accenture and NVIDIA to deploy AI-powered worker safety systems in manufacturing and warehouse environments, demonstrating their solution at NVIDIA GTC Washington, D.C., and piloting it with an automotive manufacturer.

- This partnership leverages Accenture's new "Physical AI Orchestrator" platform, enabling manufacturers to use digital twins and advanced AI for real-time safety, efficiency, and operational modernization across their facilities.

- We'll explore how expanding digital twin adoption and AI-enhanced factory modernization could influence Accenture's broader investment narrative and growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Accenture Investment Narrative Recap

To be a shareholder in Accenture today, you need to believe in the company's ability to drive revenue growth by harnessing AI-powered transformation, particularly as industries modernize their operations using digital twins and AI solutions. While the recent partnership with Belden and NVIDIA validates Accenture's leadership in industrial AI, the event does not materially alter the company's most critical short-term catalyst, continued large-scale AI and cloud transformation bookings, or alleviate the key risk around federal revenue uncertainty and margin pressures.

Among the recent announcements, Accenture’s launch of the “Physical AI Orchestrator” stands out. This product directly supports the latest alliance with Belden and NVIDIA, further expanding Accenture’s relevance as manufacturers and warehouse operators seek to modernize and streamline their operations, contributing to the company’s positioning in high-impact digital transformation projects.

But despite the promise of digital twins and physical AI, investors should be aware that ongoing federal revenue slowdowns remain a risk if...

Read the full narrative on Accenture (it's free!)

Accenture's narrative projects $81.5 billion revenue and $10.0 billion earnings by 2028. This requires 6.0% yearly revenue growth and a $2.1 billion earnings increase from $7.9 billion today.

Uncover how Accenture's forecasts yield a $277.60 fair value, a 12% upside to its current price.

Exploring Other Perspectives

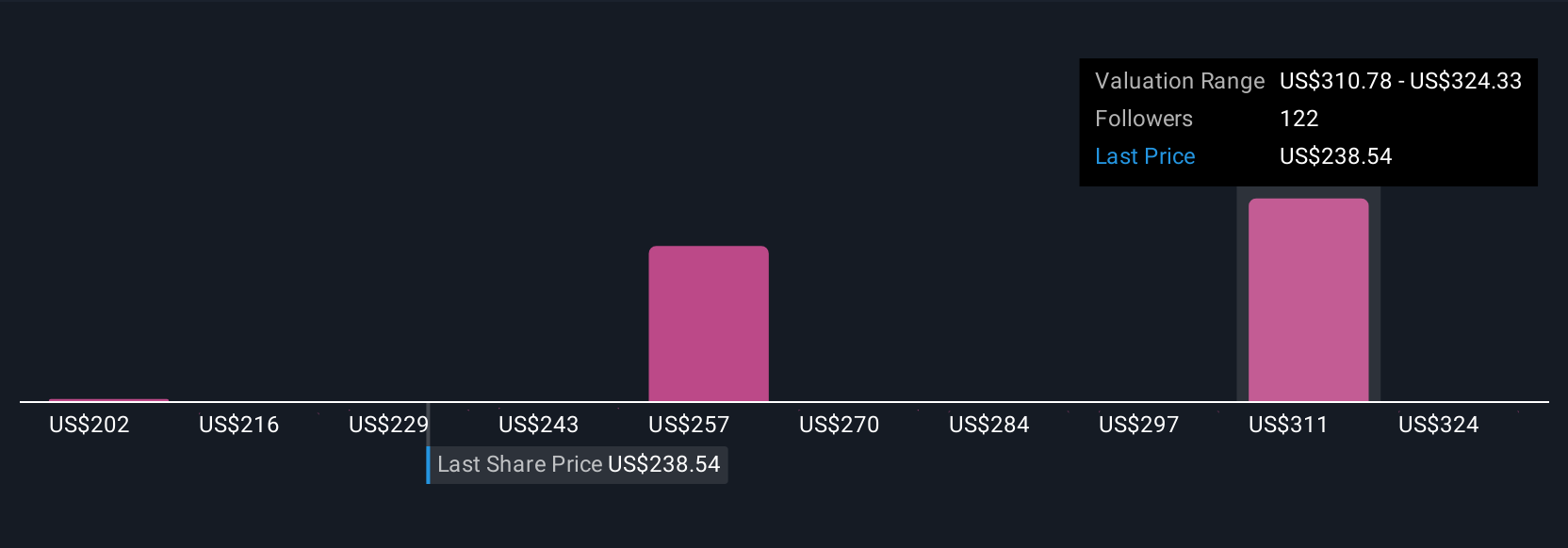

Thirteen fair value estimates from the Simply Wall St Community range from US$202.38 to US$277.60 per share, reflecting broad divergence among individual investors. As opinions differ, it is important to weigh ongoing margin pressures and federal contract uncertainties when evaluating Accenture’s performance and outlook.

Explore 13 other fair value estimates on Accenture - why the stock might be worth as much as 12% more than the current price!

Build Your Own Accenture Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Accenture research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Accenture research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Accenture's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives