- United States

- /

- Software

- /

- NasdaqGS:ZS

How Zscaler’s (ZS) SPLX Acquisition and New AI Security Enhancements Could Impact Investors

Reviewed by Sasha Jovanovic

- In late October 2025, Zscaler announced the acquisition of AI security company SPLX and introduced new Zscaler Digital Experience (ZDX) enhancements designed to improve real-time monitoring, AI protection, and response across its Zero Trust Exchange platform.

- The SPLX acquisition brings over 5,000 tailored AI attack simulations and an integrated AI security layer, highlighting Zscaler's commitment to advancing security for the full AI development lifecycle at a time of rapid industry investment in AI.

- We'll explore how Zscaler's expanded AI security capabilities could reshape its future growth outlook and address emerging industry needs.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Zscaler Investment Narrative Recap

To make the case for Zscaler, I believe shareholders need confidence in the company's ability to remain a leader in Zero Trust and AI-driven security, outpacing both cloud giants and legacy security vendors. While the SPLX acquisition and enhanced ZDX platform could further strengthen Zscaler’s appeal with enterprise clients and bolster its platform’s AI capabilities, these moves are unlikely to change the most important short-term catalyst, broad enterprise adoption of AI security, or fully mitigate the biggest risk: intensifying competition and pricing pressure from public cloud providers and bundled security suites.

Among recent announcements, the ZDX platform’s upgrades stand out, addressing a critical pain point, minimizing downtime across global enterprises. These real-time monitoring and remediation capabilities are highly relevant to Zscaler's biggest catalyst: the rapid adoption of unified cloud security as organizations seek seamless performance and reliable SLAs for increasingly remote and distributed workforces. Keeping pace with customer needs in performance, not just security, has direct implications for Zscaler’s future deal flow, account expansion, and recurring revenue momentum.

However, on the other side of rapid product innovation, investors should be aware of the ongoing risk that as public cloud providers expand integrated security offerings...

Read the full narrative on Zscaler (it's free!)

Zscaler's narrative projects $4.7 billion in revenue and $139.8 million in earnings by 2028. This requires 20.5% annual revenue growth and a $181.3 million increase in earnings from the current -$41.5 million.

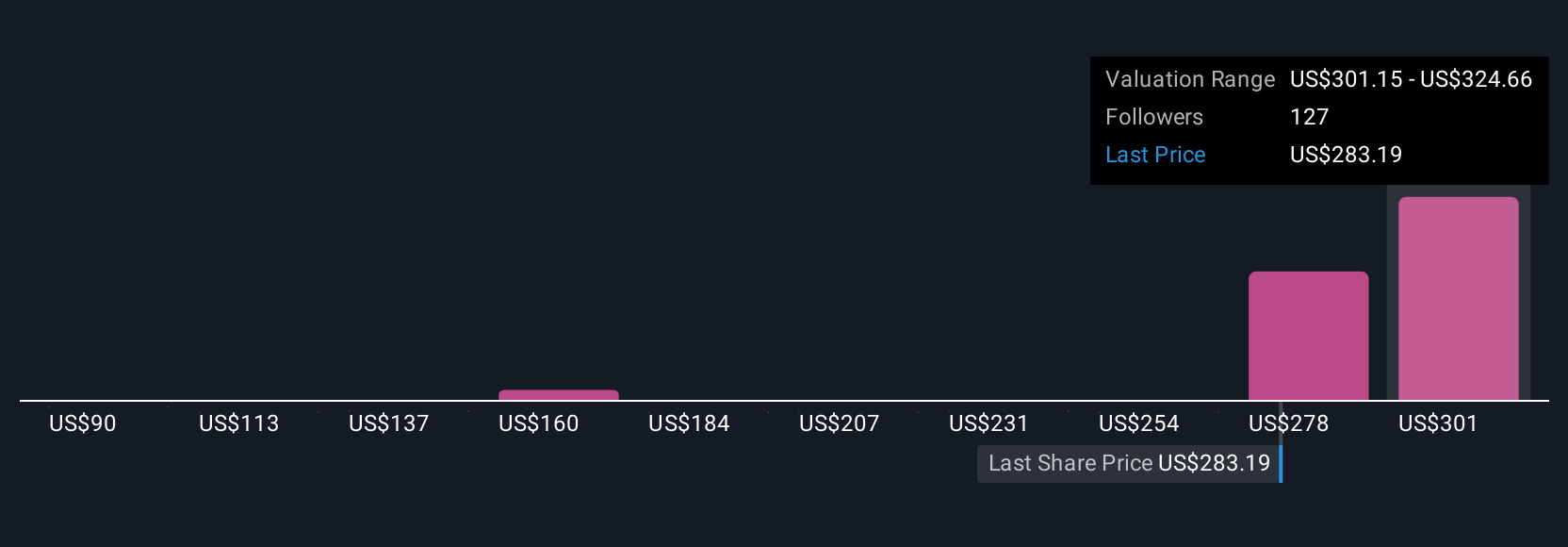

Uncover how Zscaler's forecasts yield a $324.66 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members set Zscaler’s fair value from as low as US$86.42 up to US$324.66, with nine total perspectives represented. These wide-ranging views highlight that as Zscaler leans on AI-driven platform upgrades, opinions across the market differ sharply about the company’s ability to outpace mounting competition and sustain premium growth.

Explore 9 other fair value estimates on Zscaler - why the stock might be worth as much as $324.66!

Build Your Own Zscaler Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zscaler research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zscaler research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zscaler's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives