- United States

- /

- Software

- /

- NasdaqGS:ZS

Has Zscaler’s 54% Rally in 2025 Left Shares Priced for Perfection?

Reviewed by Bailey Pemberton

- Wondering if Zscaler is truly worth its current price? This article will help you cut through the noise and see what’s really under the hood.

- Despite a rapid 54.0% rally so far this year, Zscaler’s price has dipped nearly 10% over the past month, showing how quickly investor sentiment can shift.

- Recently, major cybersecurity sector headlines and news about industry partnerships have heightened both optimism and caution, fueling extra interest in players like Zscaler. High-profile breaches and growing enterprise security demand are pushing the entire industry into the spotlight and adding some volatility to Zscaler’s shares.

- Currently, Zscaler scores just 1 out of 6 on our valuation checks, meaning it only passes one test for being undervalued. We’ll dig into standard valuation approaches, but stick around because there is a more powerful way to judge value that you won’t want to miss at the end.

Zscaler scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Zscaler Discounted Cash Flow (DCF) Analysis

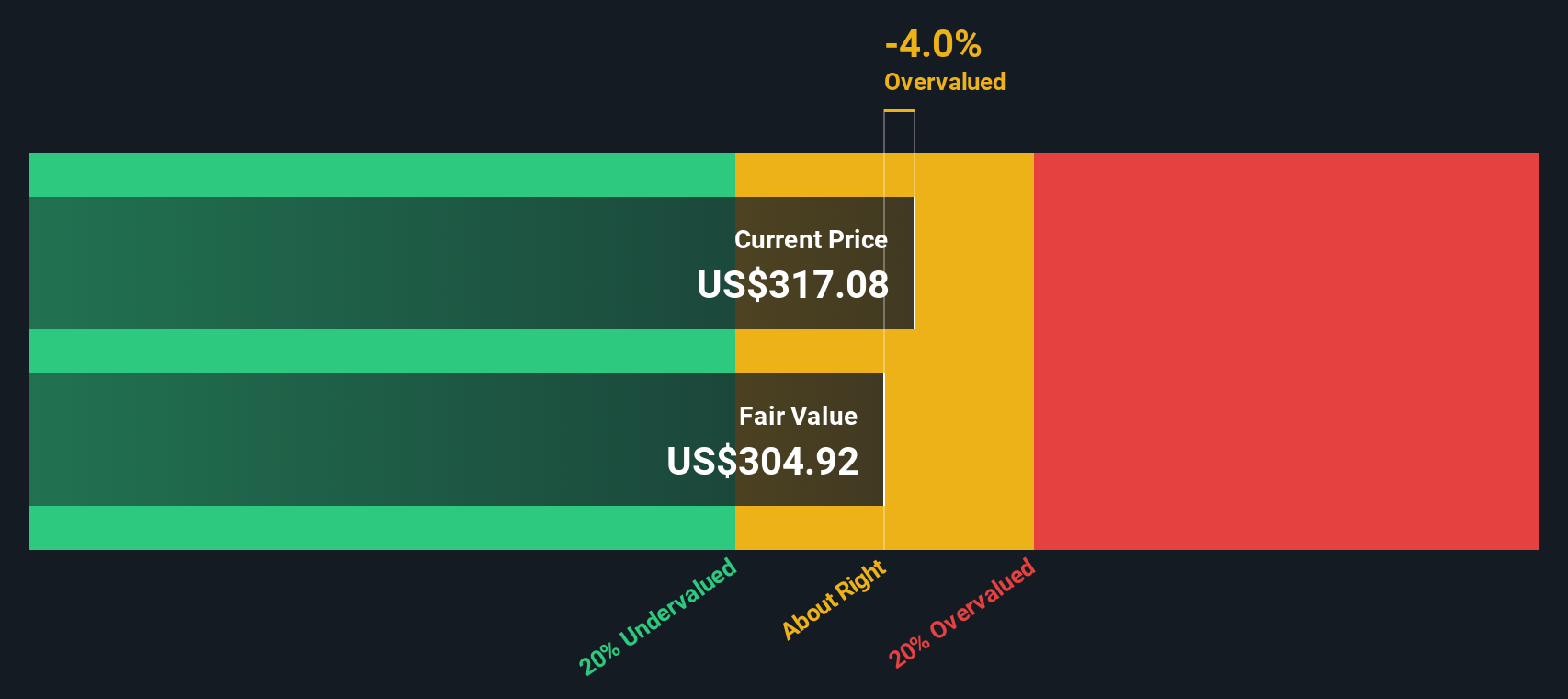

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future free cash flows and discounting them back to today’s value. Essentially, it attempts to answer what all of Zscaler’s potential future profits are worth right now.

Currently, Zscaler is producing free cash flow of $736.8 Million. Analysts expect solid growth ahead, with projected free cash flow increasing to $2.25 Billion by 2030. This reflects robust expectations for the business. These projections are based on analyst estimates for the next five years, with longer-term numbers extrapolated beyond that horizon.

Based on these forecasts and DCF calculations, Zscaler’s intrinsic value is estimated at $285.88 per share. This is about 2.2% higher than the current share price, suggesting the stock is only slightly undervalued at today’s level.

Result: ABOUT RIGHT

Zscaler is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

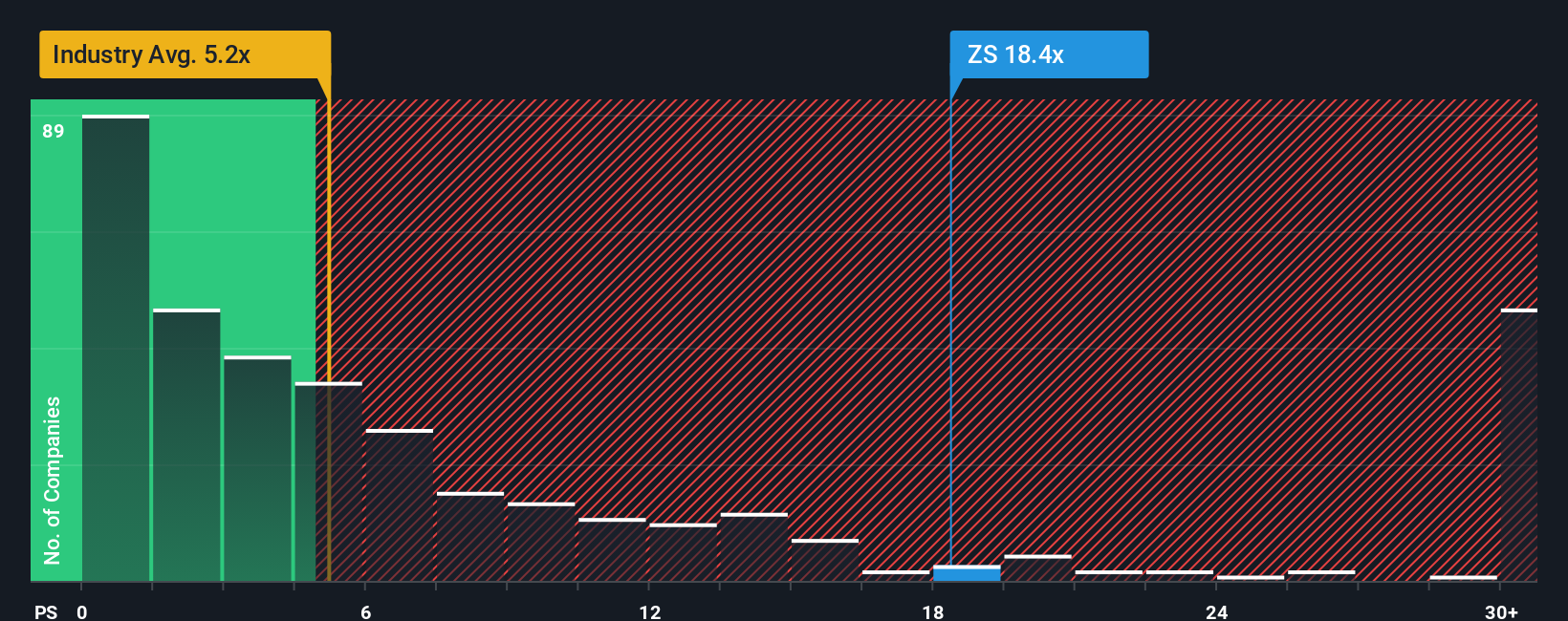

Approach 2: Zscaler Price vs Sales

The Price-to-Sales (P/S) ratio is often the go-to valuation tool for companies like Zscaler that are not yet consistently profitable but are still delivering strong sales growth. This ratio provides a quick sense of how much investors are willing to pay for every dollar of revenue. This is particularly meaningful for high-growth software firms where earnings may be volatile or negative in the short term.

Investors usually assign higher P/S multiples to companies with robust growth prospects and lower perceived risk. Conversely, slower-growing or riskier businesses tend to trade at lower P/S ratios. Therefore, while raw numbers are important, context around growth and risk can dramatically influence what counts as a “fair” multiple for any given software stock.

Right now, Zscaler trades at a P/S ratio of 16.57x. This is notably above the Software industry average of 4.43x and the peer group’s average of 15.61x. However, Simply Wall St’s proprietary “Fair Ratio” calculation, which incorporates Zscaler’s growth outlook, margins, risk profile, and market cap, suggests a fair P/S multiple of 12.68x.

Using the Fair Ratio is more insightful than just comparing with peers or the industry because it factors in company-specific strengths and weaknesses, not just broad averages. It captures whether Zscaler’s growth, profitability, and risks justify a higher or lower P/S multiple.

Comparing Zscaler’s actual P/S of 16.57x to its Fair Ratio of 12.68x, shares appear to be trading above what is justified. This suggests the stock is somewhat overvalued at these levels.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1422 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Zscaler Narrative

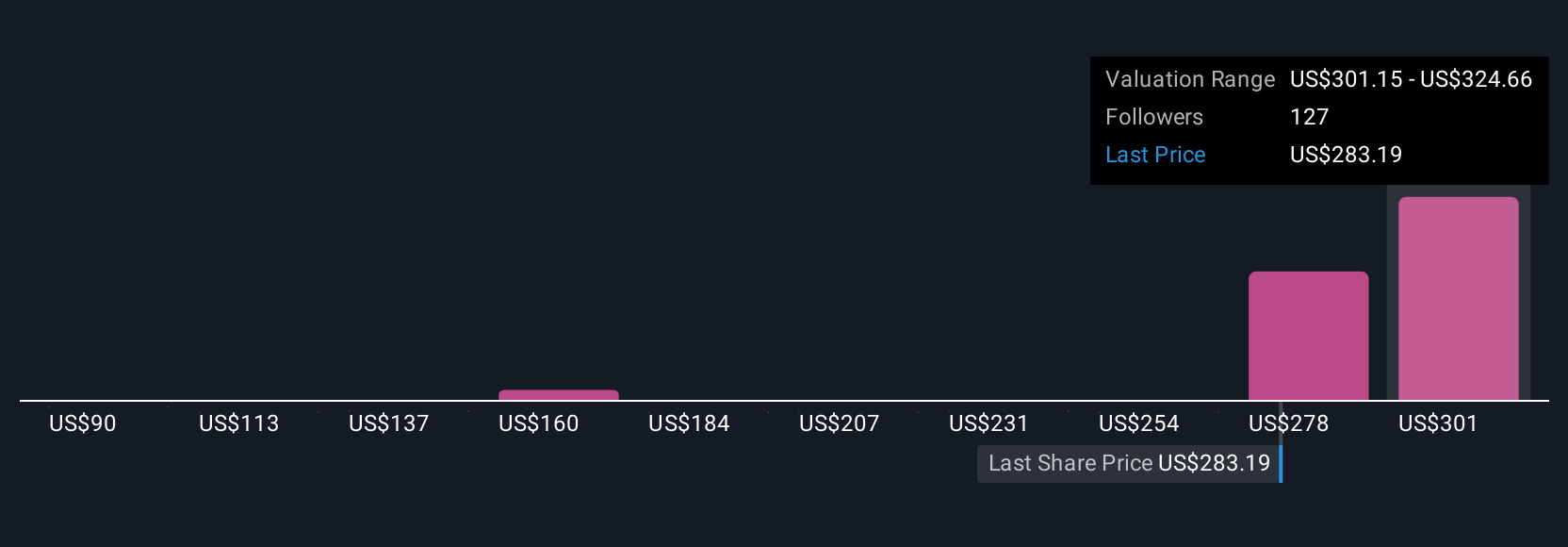

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives offer a powerful and intuitive way to frame your investment decision by connecting Zscaler’s story, your perspective on its future, with numbers such as forecasted revenue, profit margins, and ultimately an estimated fair value for its shares.

Rather than relying solely on ratios or consensus targets, Narratives allow you to articulate your beliefs about what is driving Zscaler’s business, link those assumptions to a specific financial forecast, and instantly see the resulting fair value. This approach is streamlined and accessible to everyone. Millions of investors already use the Narratives feature on Simply Wall St’s Community page to inform their buy and sell decisions.

Narratives make it easy to compare your fair value to Zscaler’s current price and quickly update as new earnings or breaking news comes in, helping you avoid outdated views. For example, one investor might construct a bullish Narrative based on accelerating AI-driven cloud security and forecast strong profit growth, resulting in a fair value as high as $385 per share, while another might see rising competition and margin pressures, leading them to a far more cautious estimate of $251 per share.

Do you think there's more to the story for Zscaler? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives