- United States

- /

- Software

- /

- NasdaqGS:ZS

Exploring Zscaler (ZS) Valuation After Recent Gains and Strong Revenue Growth

Reviewed by Simply Wall St

See our latest analysis for Zscaler.

Zscaler has ridden a wave of sector momentum, with its share price returning nearly 8% in the last three months and a solid 69.5% year-to-date. This continues a strong run, highlighted by a 70% total shareholder return over the past year and more than doubling investors’ money over three and five years. Recent gains suggest optimism about the company’s long-term growth prospects is building, as investors respond to ongoing revenue growth and improved profitability.

If you’re watching trends in digital security, it makes sense to see which other fast-growing tech and AI companies are capturing investor attention. See the full list for free.

With shares near all-time highs and strong performance metrics, investors may wonder if Zscaler is undervalued and primed for future gains or if the market has already priced in much of its growth potential.

Most Popular Narrative: 5.2% Undervalued

Compared to the latest closing price of $307.92, the most widely followed narrative estimates Zscaler's fair value at $324.66. This suggests the stock could still gain ground if the key growth drivers play out as projected in the narrative.

Strategic platform innovation and programs like Z-Flex are driving broader product adoption within existing accounts and enabling larger, multi-year deals. This is increasing total contract value and supporting higher future operating margins through scale.

What’s behind this upbeat fair value? The story centers on expanding margins, aggressive platform adoption, and blockbuster multi-year growth. There is a bold set of fundamental forecasts running the show. If you want to see exactly how these expectations add up, the full narrative breaks it down in detail.

Result: Fair Value of $324.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increasing competition from established cybersecurity giants and ongoing cloud provider integration could put pressure on Zscaler’s growth trajectory and margins moving forward.

Find out about the key risks to this Zscaler narrative.

Another View: Market Multiples Raise Caution

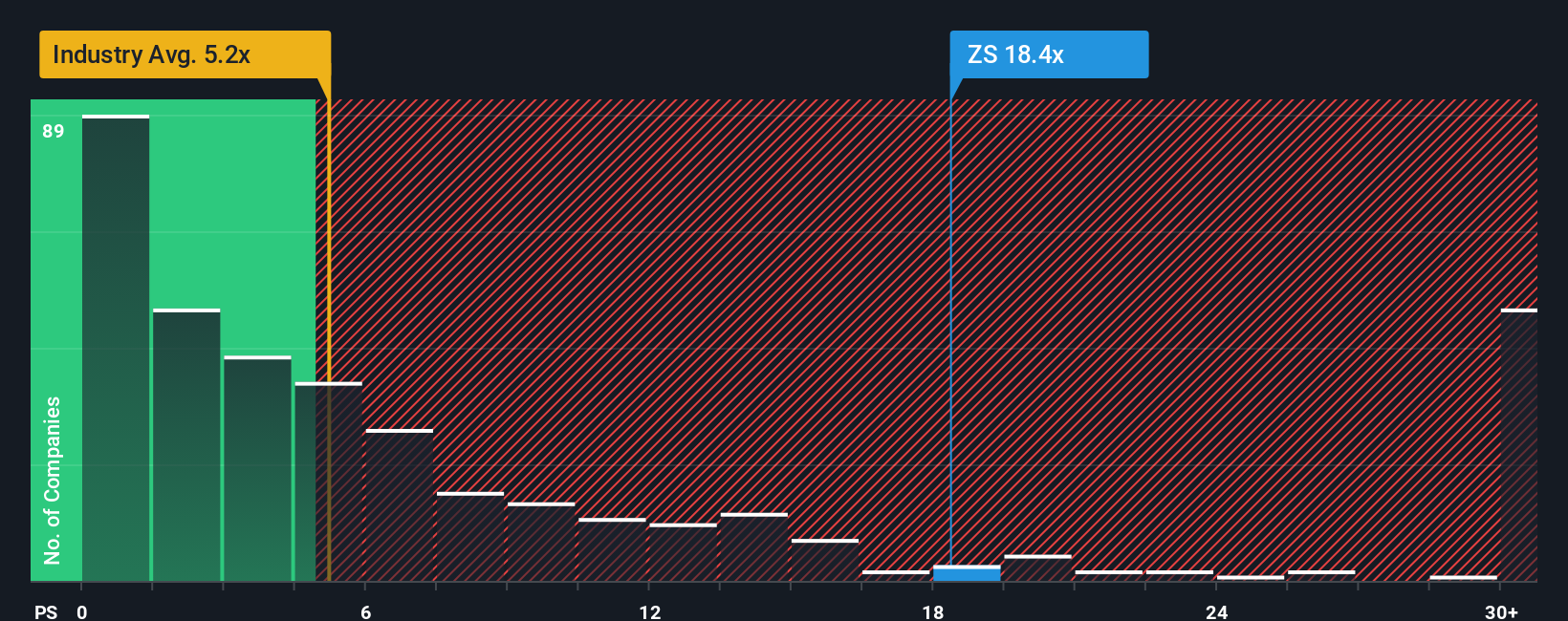

Looking at how Zscaler’s price compares to sales, the stock currently trades at 18.2 times sales versus an industry average of just 5.2, and even peers average 19. This is also above the fair ratio of 13.1. Such a wide gap means investors are paying a significant premium. The market has already priced in a lot of growth, which adds some risk if things do not go perfectly. Are investors too optimistic, or will Zscaler keep justifying this lofty valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zscaler Narrative

If you have a different perspective or want to dive deeper into the financials, you can quickly build your own narrative using our tools. Do it your way

A great starting point for your Zscaler research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock even more opportunities beyond Zscaler by targeting stocks with promising growth, unique value, or sector leadership. Don’t let your next smart investment slip by. These handpicked strategies are just a click away.

- Power up your portfolio with high-yield options by checking out these 17 dividend stocks with yields > 3% that consistently deliver attractive returns above 3%.

- Spot emerging trends early when you review these 26 AI penny stocks offering exposure to cutting-edge artificial intelligence innovations at accessible prices.

- Take advantage of mispriced gems by seizing these 874 undervalued stocks based on cash flows that stand out thanks to strong fundamentals and attractive valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives