- United States

- /

- IT

- /

- NasdaqGS:WIX

Wix.com (WIX): Evaluating Valuation Potential After Strong Q2 Growth in New Customer Bookings

Most Popular Narrative: 31.5% Undervalued

According to the most widely followed narrative, Wix.com is trading well below its projected fair value, offering an apparent discount from market consensus on its long-term growth prospects.

Accelerating adoption of AI-powered tools and onboarding funnels is driving a significant increase in new user cohorts and higher conversion to paid subscriptions. This supports expectations for revenue growth in both the near and long term.

What is fueling this valuation surge, and why are so many analysts convinced Wix.com is primed for much bigger gains? The underlying forecast hinges on key future trends, ambitious growth targets, and premium financial assumptions that set the bar high for earnings. Want to know the logic and projections that could make or break this bold narrative? The real story behind the numbers might surprise even seasoned investors.

Result: Fair Value of $206.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, growing AI-powered competition and rising regulatory costs could affect Wix.com’s margins and make it more difficult to maintain premium growth rates.

Find out about the key risks to this Wix.com narrative.Another View: Market Metrics Suggest a Premium

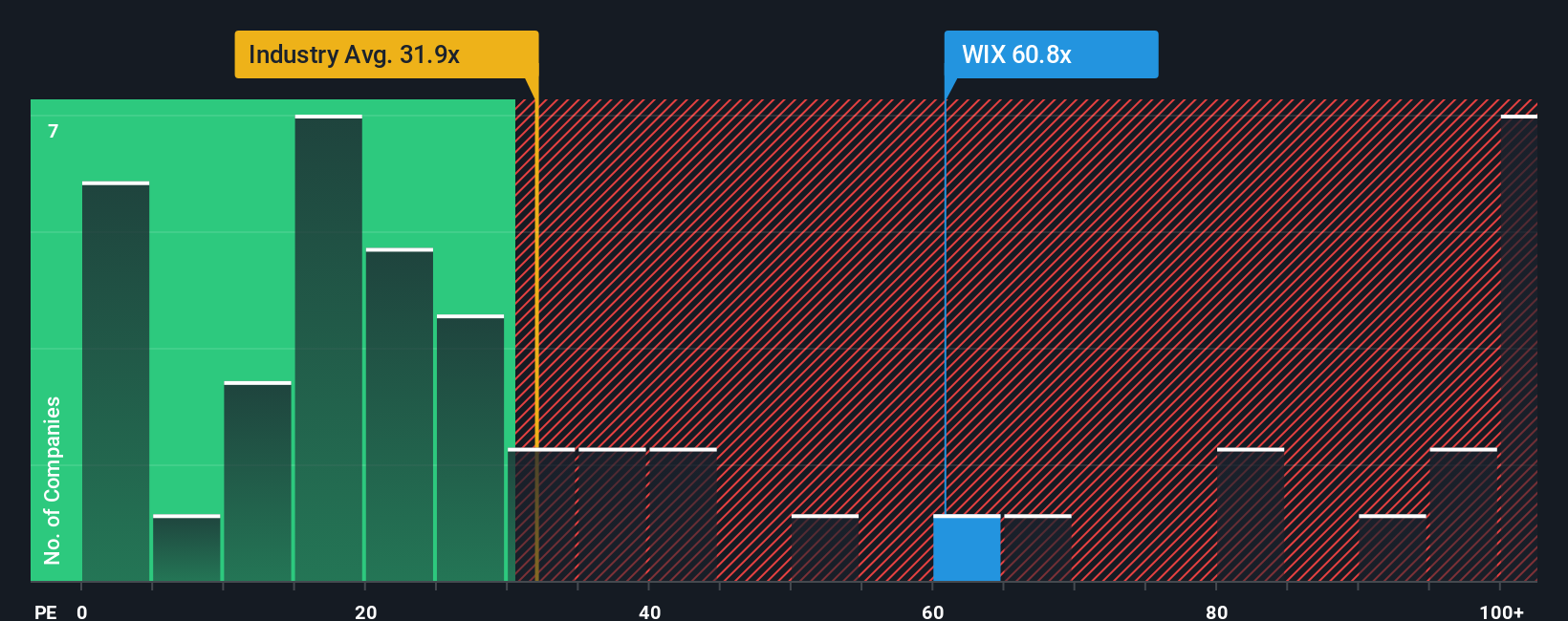

While some see Wix.com as undervalued, a different lens using a price-to-earnings comparison places Wix.com well above the technology sector average. Could the market already be pricing in the company’s growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Wix.com to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Wix.com Narrative

If these perspectives do not fully align with your outlook, or you prefer hands-on analysis, you can easily craft your own narrative in just a few minutes: Do it your way.

A great starting point for your Wix.com research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your horizons and take control of your strategy with hand-picked lists matched to your interests. Find trends and opportunities before others catch on. Your next winning idea could be a click away.

- Supercharge your income strategy by uncovering new dividend stocks with yields > 3% that consistently deliver yields above 3%, putting more cash in your pocket each quarter.

- Ride the next technological revolution by tapping into game-changing quantum computing stocks making quantum leaps in computing and shaping tomorrow’s digital landscape.

- Spot opportunities trading at a fraction of their value and act fast with our tailored list of undervalued stocks based on cash flows with strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wix.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:WIX

Wix.com

Operates a cloud-based web development platform for registered users and creators worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

SoFi Technologies will ride a 33% revenue growth wave in the next 5 years

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.