- United States

- /

- Software

- /

- NasdaqGS:WDAY

Workday (WDAY) Net Margin Drops to 7%—Margin Pressures Challenge Growth Narrative

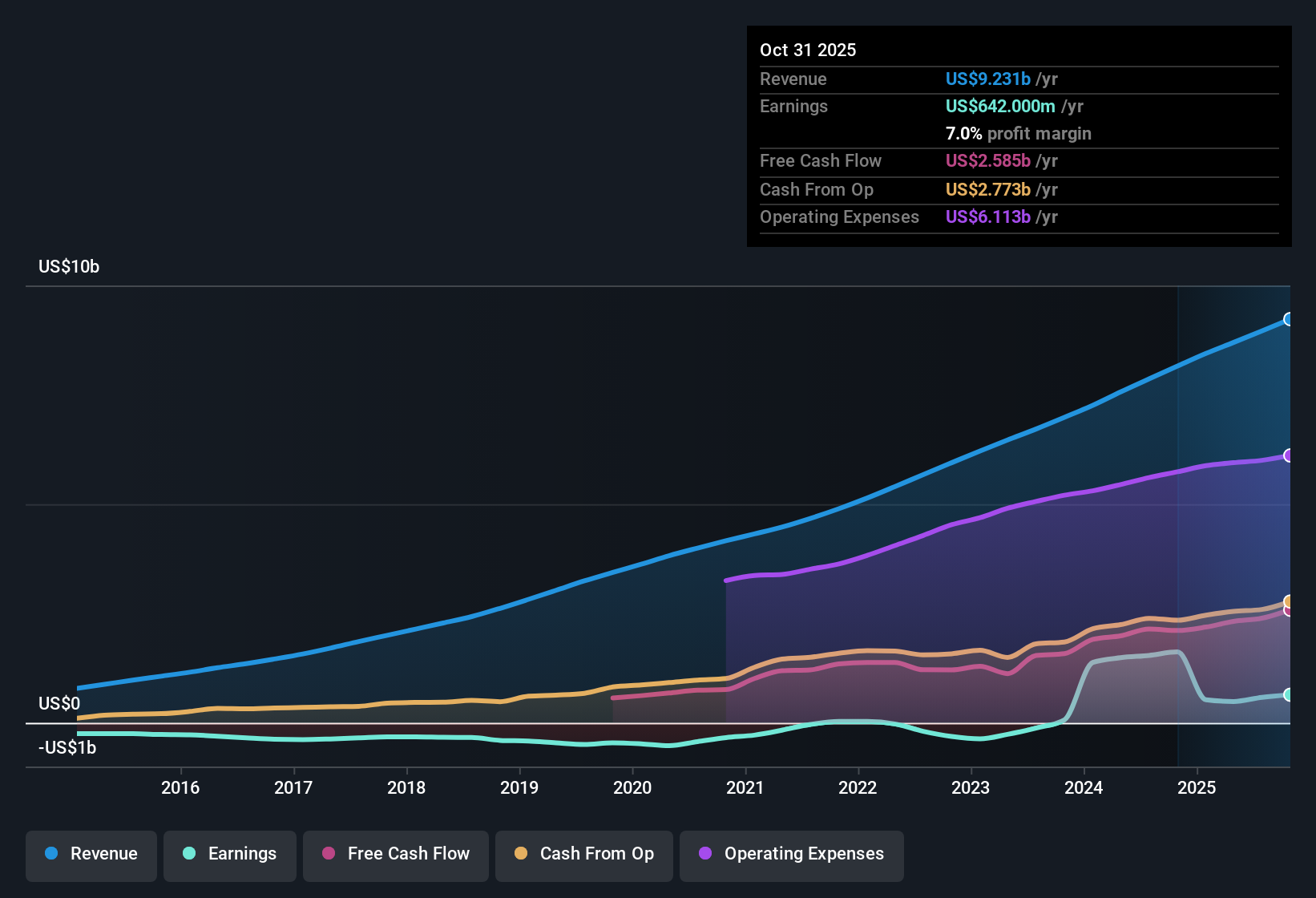

Workday (WDAY) just released its Q3 2026 results, booking revenue of $2.4 billion and basic EPS of $0.95, with net income (excluding extra items) of $252 million for the quarter. The company has seen total revenue climb steadily from $2.1 billion in Q2 2025 to $2.4 billion in Q3 2026, while quarterly EPS has moved from $0.50 to $0.95 over the same stretch. Margins contracted over the trailing twelve months, setting the stage for investors to weigh near-term pressures against longer-term growth forecasts.

See our full analysis for Workday.Next, let’s see how these new results stack up against the widely followed narratives, both in support of and at odds with the market’s expectations.

See what the community is saying about Workday

Net Margins Fall to 7% Despite Rising Profitability

- Workday’s net profit margin stood at 7% over the last twelve months, down sharply from 19.9% the previous year, even though net income (excluding extra items) jumped from $487 million to $642 million in the latest period.

- In the analysts' consensus view, the margin compression is a key concern, but it is being weighed against other positives:

- Analysts see margin recovery on the horizon, with profit margins projected to climb from 6.5% to 14.3% over the next three years. This reflects confidence in longer-term improvements.

- Even with lower recent margins, Workday’s annual earnings have grown 57.8% per year for five years, which helps support a positive outlook for continued profit momentum.

- Strong consensus on margin rebound and earnings growth stands at the heart of this report. See how the full analyst breakdown frames these forecasts. 📊 Read the full Workday Consensus Narrative.

Valuation: Shares 39% Below DCF Fair Value

- As of the latest close, Workday shares traded at $215.63, a price that is 39% below the DCF fair value estimate of $353.44. This offers potential upside based on modeled fundamentals.

- According to the consensus narrative, these valuation levels have drawn notice from analysts for several reasons:

- Price targets cluster near $277.28 (analyst consensus), about 28.6% above the current share price. There is meaningful debate, however, since the company’s P/E is a steep 88.3x, which is well above the software industry’s 36.2x.

- Analysts highlight the tension between robust forecasted earnings growth of 32.6% annualized and the need for continued outperformance to justify such a large valuation premium over peers.

AI and Global Expansion Drive Revenue Growth

- Trailing-twelve-month revenue reached $9.2 billion, up from $7.9 billion a year ago. This increase was underpinned by growing demand for AI-powered solutions and expansion across new international markets.

- The prevailing market view emphasizes how these growth engines are pivotal to the thesis:

- The consensus narrative notes that over 70% of clients now use Workday’s AI products, and recent acquisitions have boosted cross-selling. These factors have helped push annual revenue growth forecasts to 11.3%, outpacing the US market average.

- Expansion into the UK, Germany, Japan, and India is diversifying revenue streams. This is also seen as key to stabilizing results and unlocking new long-term growth opportunities.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Workday on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from another angle? Share your insights and shape your own story. Get started in under three minutes. Do it your way

A great starting point for your Workday research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Workday’s steep valuation premium and compressed profit margins raise concerns about whether its growth can sufficiently justify the current share price.

If you want to zero in on companies trading below intrinsic value with greater margin for safety, discover these 921 undervalued stocks based on cash flows that may offer more attractive entry points right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

SoFi Technologies will ride a 33% revenue growth wave in the next 5 years

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.