- United States

- /

- IT

- /

- NasdaqGS:VRSN

VeriSign (NasdaqGS:VRSN) Amends Bylaws To Limit Officer Liability Under Delaware Law

Reviewed by Simply Wall St

VeriSign (NasdaqGS:VRSN) recently amended its Restated Certificate of Incorporation to limit officer liability per Delaware law, a decision possibly influencing its 22% share price increase over the last quarter. This change, detailed in the company's Proxy Statement, coincided with solid Q1 2025 earnings, which showed a rise in both sales and net income. These developments likely bolstered investor confidence amid broader market declines, in which major indexes like the Nasdaq Composite fell over 1%. While the stock outperformed amidst broader market volatility, its protective corporate governance amendments may have added resilience to its recent performance.

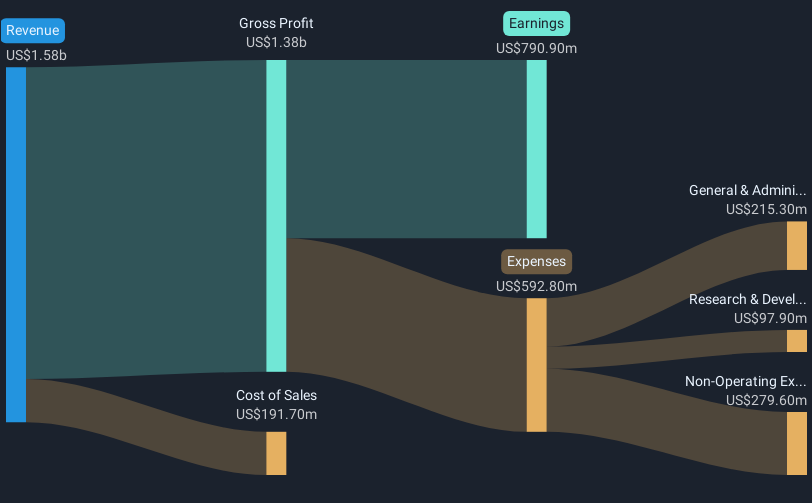

The recent amendment to VeriSign's Restated Certificate of Incorporation may have contributed to bolstering confidence in its corporate governance, potentially enhancing investor sentiment. The adjustment aligns with broader efforts to reduce risks and improve stability, which may indirectly lead to positive market perceptions. While this news coincided with improved Q1 2025 earnings, characterized by an increase in sales and net income, the potential for increased investor confidence could support revenue and earnings forecasts. Analysts foresee a 5.7% annual growth in revenue over the next three years and a slight increase in profit margins, suggesting that stability initiatives are in synergy with financial expectations.

Over the past year, VeriSign achieved a total shareholder return of 64.32%, indicating strong longer-term performance. This surpasses the return of the US IT industry, which was 28.8% over the same period. The company's substantial return highlights its ability to outperform both its industry and the broader US market, which returned 10.5%. This outperformance may reflect successful execution of their market expansion strategies and confidence in financial practices.

Despite the recent share price increase of 22% in the last quarter, the current price of $278.36 remains above the consensus analyst price target of $248.03, suggesting some market optimism beyond analyst expectations. The company's initiatives, such as new marketing strategies and registrar engagement efforts, are expected to influence domain registration growth positively, thereby potentially improving near-term revenue streams. The regulatory process surrounding the .web registry could also impact future performance, should it proceed favorably. Overall, these elements collectively contribute to shaping investor perspectives on VeriSign's valuation and growth potential.

Click to explore a detailed breakdown of our findings in VeriSign's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRSN

VeriSign

Provides internet infrastructure and domain name registry services that enables internet navigation for various recognized domain names worldwide.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives