- United States

- /

- IT

- /

- NasdaqGS:VRSN

A Fresh Look at VeriSign’s (VRSN) Valuation After Strong Q2 Results and Analyst Optimism

Reviewed by Simply Wall St

Most Popular Narrative: 11.5% Undervalued

According to community narrative, VeriSign is considered undervalued, with a fair value estimate above its current share price. Analyst consensus is optimistic about future growth prospects based on revenue expansion, profit margin improvement, and share count reduction.

Initiating and maintaining a quarterly cash dividend could lead to a perception of stability and maturity in the company's financial practices. This could potentially impact net income stability by distributing more predictable returns to shareholders.

Curious about the financial logic driving this bullish fair value? The analysts behind this narrative are projecting ambitious improvements in revenues, margins, and share count. The full calculation reveals an aggressive price multiple and assumptions that might surprise you. Want to learn which financial levers matter most? Keep reading to see what underpins the community’s price target.

Result: Fair Value of $309.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, unexpected regulatory setbacks or sluggish adoption of new domain services could quickly undermine these optimistic projections for VeriSign’s continued growth.

Find out about the key risks to this VeriSign narrative.Another View: What Does the SWS DCF Model Say?

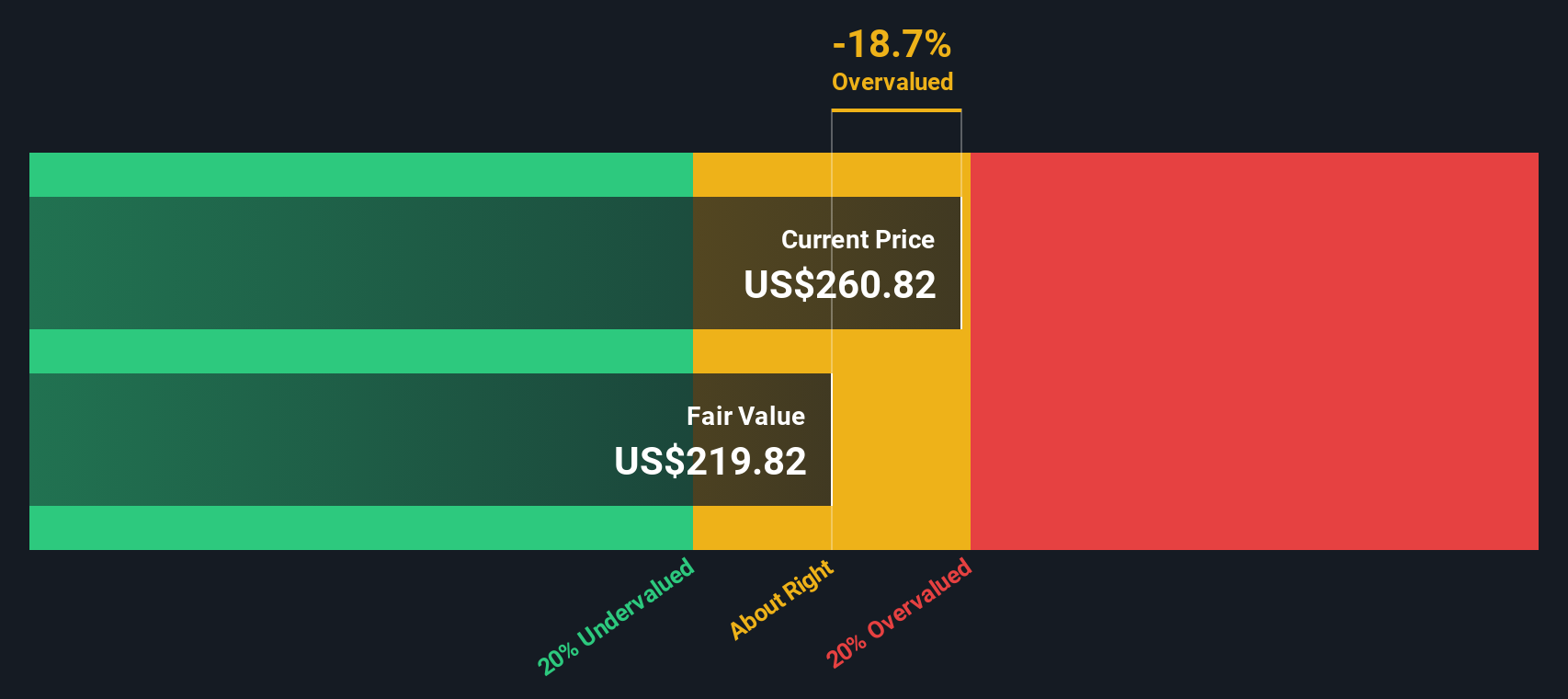

While the market sees value based on price ratios, the SWS DCF model presents a less optimistic picture and suggests VeriSign may actually be trading above intrinsic value. Could one method be missing something important?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out VeriSign for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own VeriSign Narrative

If you see things differently or want to dive into the numbers yourself, you can put together your own narrative in just a few minutes. Do it your way

A great starting point for your VeriSign research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Don’t limit your strategy to just one company when there’s a world of opportunity at your fingertips. The Simply Wall Street Screener comes with powerful ways to zero in on promising stocks. Why let smart ideas pass you by? Check out these unique approaches and find your advantage:

- Tap into next-generation breakthroughs by finding the most exciting opportunities in quantum computing stocks.

- Earn stronger returns by tracking reliable payers featured among dividend stocks with yields > 3%.

- Spot undervalued gems that the broader market may be overlooking, all available through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:VRSN

VeriSign

Provides internet infrastructure and domain name registry services that enables internet navigation for various recognized domain names worldwide.

Good value with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion