- United States

- /

- Software

- /

- NasdaqGS:VRNS

Varonis Systems (VRNS): Assessing Valuation After New AI Data Security Launch for Salesforce Agentforce

Reviewed by Simply Wall St

Varonis Systems (VRNS) grabbed attention after introducing its AI identity protection solution for Salesforce Agentforce at Dreamforce 2025. This launch gives IT and security teams new options to manage data access by AI agents.

See our latest analysis for Varonis Systems.

Varonis Systems has been building serious momentum this year, with the share price returning over 40% year-to-date. The recent debut of its AI security solution for Salesforce added fuel to the trend and supported a steady rise, with the stock climbing 14% in the past three months. Over the last year, total shareholder return stands at 10.7%. However, it is the company’s 131% three-year total return that highlights a pattern of longer-term value creation, even as discussions about valuation intensify amid rapid sector innovation.

With so much happening in the AI and automation space, this could be the ideal moment to broaden your perspective and check out See the full list for free.

Yet with Varonis riding strong performance and fresh innovation, investors now face a key question: is the stock’s upside potential still undervalued, or has the market already priced in its future growth prospects?

Most Popular Narrative: 1.8% Undervalued

Market watchers have been eyeing the gap between Varonis Systems’ narrative fair value of $63.48 and its last close of $62.32. This difference is the basis for the prevailing narrative, which now points to further room for upside. Let’s take a closer look at the rationale behind this outlook.

Expanding global data privacy regulations and mounting cyber threats are compelling enterprises to invest in advanced unstructured data security and governance. Varonis' differentiated platform (with new FedRAMP authorization, SaaS model, and deep cloud coverage) stands to benefit from long-term, recurring revenue tailwinds as security budgets become more data-centric.

Curious how data, regulation, and tech disruption could shape the company’s numbers? The backdrop for this fair value includes bold growth bets and surprisingly aggressive profitability assumptions. The latest narrative breaks down which long-term shifts could unlock a much higher valuation if events play out as projected.

Result: Fair Value of $63.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressure from the SaaS transition and persistently high share dilution could present challenges for Varonis in delivering the expected upside.

Find out about the key risks to this Varonis Systems narrative.

Another View: Market Ratios Suggest Heightened Valuation Risk

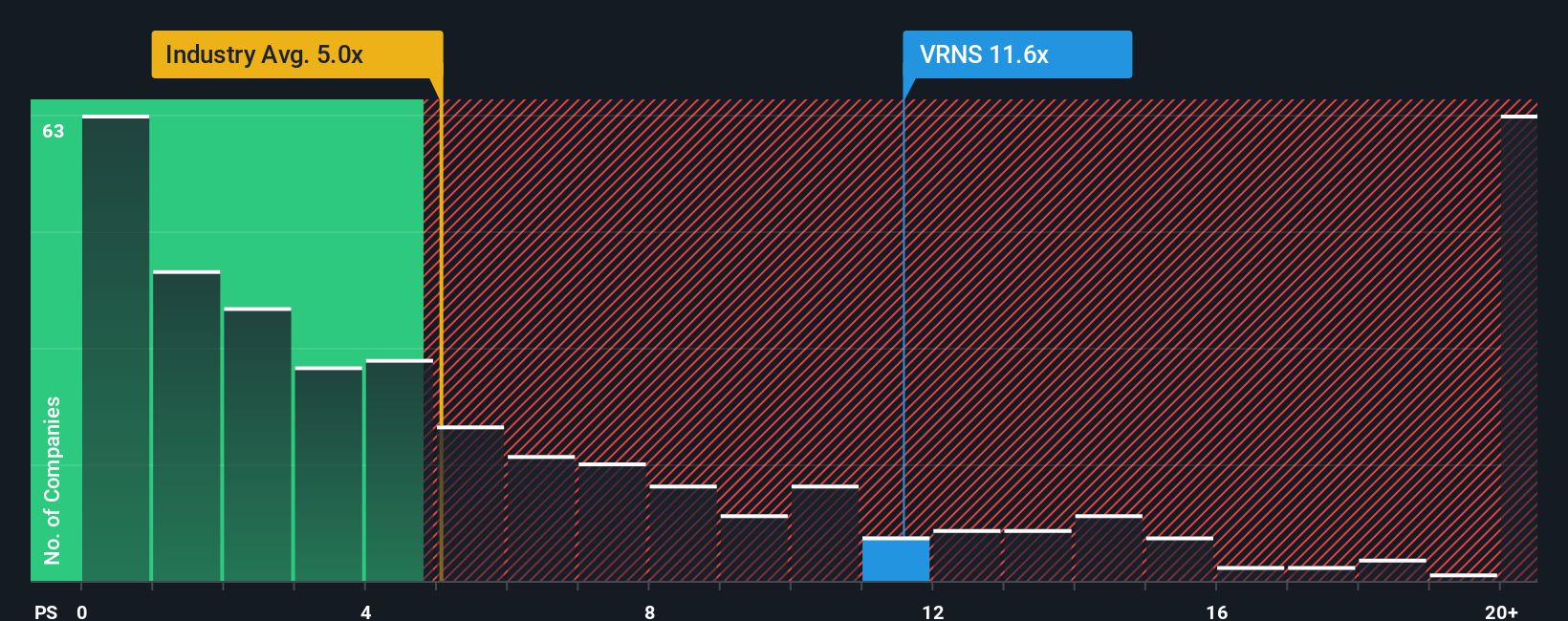

While fair value models indicate Varonis Systems trades below its estimated worth, a look through the lens of price-to-sales reveals a less optimistic angle. The company’s multiple stands at 11.7x, substantially higher than both the US Software industry average of 5.2x and similar peer companies at 6.2x. The fair ratio, which is what the market could shift toward, is 7.3x. This hints at a notable valuation gap. For investors, could this premium signal long-term opportunity, or does it mean the market is already running too hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Varonis Systems Narrative

If you see things differently or want to dig into the numbers yourself, you can piece together your own Varonis story in just a few minutes. Do it your way

A great starting point for your Varonis Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let fresh opportunities pass you by. With a few clicks, you can pinpoint standout companies with unique advantages waiting to be discovered in today’s market.

- Zero in on penny stocks showing strong financial foundations and get the inside track with these 3568 penny stocks with strong financials.

- Tap into the latest breakthroughs in artificial intelligence by scanning these 27 AI penny stocks as they lead the AI charge.

- Target stocks trading below their intrinsic value and sharpen your strategy using these 875 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of world.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Dentsply Sirona Stock: Dental Technology Built for Cycles, Not Headlines

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion