- United States

- /

- Software

- /

- NasdaqGS:VRNS

Evaluating Varonis (VRNS) After New Microsoft and AWS Security Integrations Reshape Its Data Protection Story

Varonis Systems (VRNS) is back on radar after rolling out fresh integrations with Microsoft Purview and AWS Security Hub, tightening its grip on data security just as AI driven workloads raise new risk questions.

See our latest analysis for Varonis Systems.

Those Purview and AWS Security Hub integrations land at a tricky moment for investors. The latest 1 day share price return of 2.98 percent to 32.47 dollars comes after a steep 90 day share price return decline of 43.22 percent and a 1 year total shareholder return of negative 32.37 percent, even though the 3 year total shareholder return is still up 35.18 percent. This hints that momentum has clearly faded in the short term, but the longer term story is not completely broken.

If this kind of security focused AI story interests you, it might be worth scanning other software names by exploring more high growth tech and AI stocks that could be riding similar demand trends.

With revenue still growing double digits but margins under pressure, and the stock trading at a steep discount to analyst targets, is Varonis now mispriced by wary investors, or is the market already baking in its next leg of growth?

Most Popular Narrative Narrative: 38.3% Undervalued

With Varonis Systems last closing at 32.47 dollars against a narrative fair value of about 52.63 dollars, the valuation debate turns on how aggressively future growth is being priced in.

Continued SaaS transition and high NRR (notably for SaaS customers), combined with robust upsell momentum across cloud and multi-cloud environments, enhance ARR visibility and predictability, driving durable earnings and margin expansion as the SaaS mix climbs and operational leverage improves post-transition.

Want to see the math behind that confidence? The narrative leans on rapid recurring revenue gains, rising margins, and a punchy future earnings multiple. Curious how those moving parts stack up into that higher fair value? Read on to unpack the projections driving this upside case.

Result: Fair Value of $52.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower on-premise renewals and execution risk around the SaaS migration could derail those upbeat assumptions and cap near-term upside.

Find out about the key risks to this Varonis Systems narrative.

Another Lens on Valuation

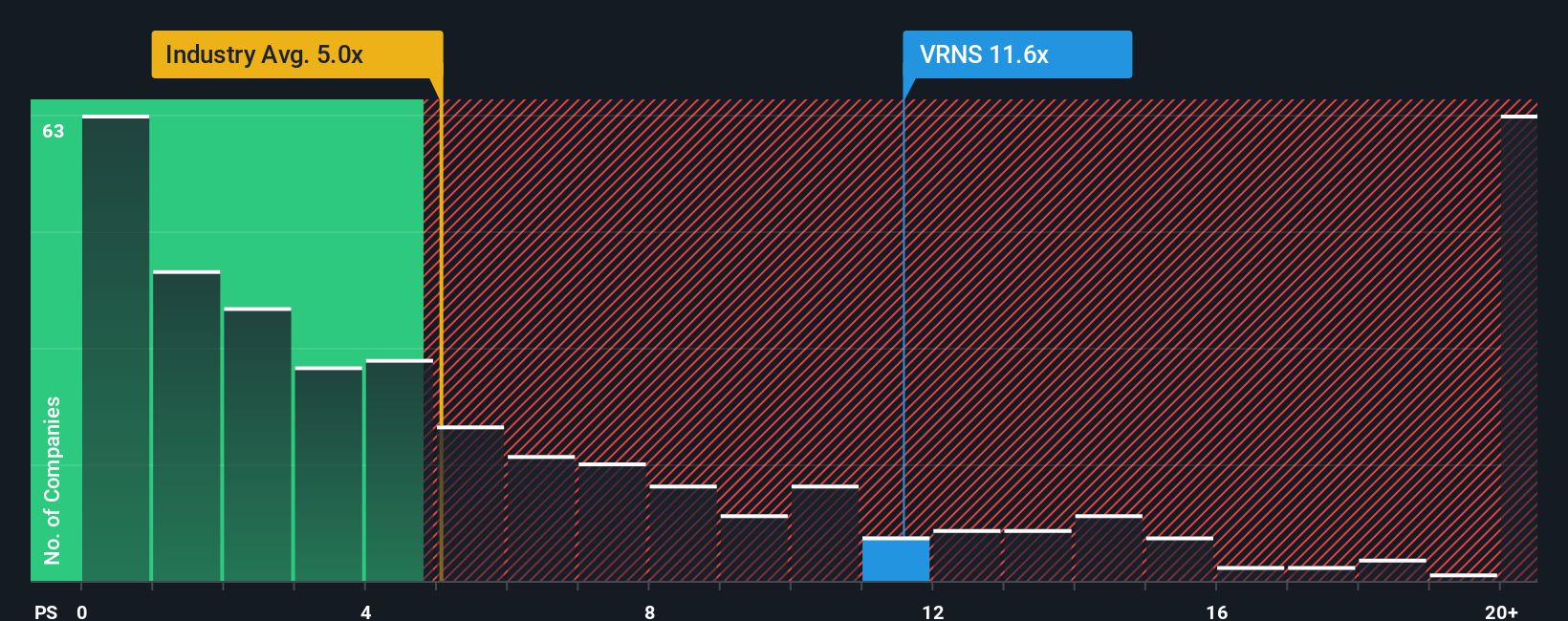

Price to sales tells a different story. Varonis trades around 6.3 times sales, richer than both US software peers at 4.9 times and its own 6 times fair ratio, hinting that even after the sell off, multiple compression risk has not fully cleared. Could the pessimism actually deepen?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Varonis Systems Narrative

If this view does not fully resonate, or you prefer digging into the numbers yourself, you can easily build a custom narrative in minutes: Do it your way.

A great starting point for your Varonis Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one stock story. Sharpen your edge by using Simply Wall Street's screener to spot fresh, data backed opportunities before others react.

- Capitalize on market mispricing by targeting companies trading below their fundamentals using these 897 undervalued stocks based on cash flows to hunt for potential value winners.

- Ride structural growth in cutting edge automation and analytics by scanning these 26 AI penny stocks for businesses powering the next wave of intelligent software.

- Lock in potential long term income streams by reviewing these 15 dividend stocks with yields > 3% that can strengthen your portfolio's cash flow through reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of world.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

The Green Consolidator

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion