- United States

- /

- IT

- /

- NasdaqGS:VNET

Investors Still Aren't Entirely Convinced By VNET Group, Inc.'s (NASDAQ:VNET) Revenues Despite 36% Price Jump

VNET Group, Inc. (NASDAQ:VNET) shareholders are no doubt pleased to see that the share price has bounced 36% in the last month, although it is still struggling to make up recently lost ground. The annual gain comes to 214% following the latest surge, making investors sit up and take notice.

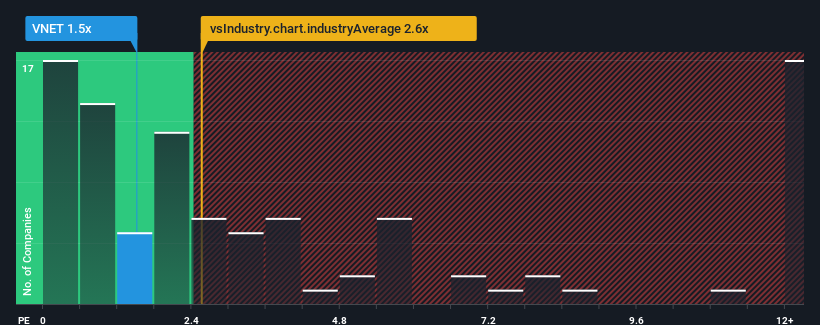

Even after such a large jump in price, VNET Group may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.5x, since almost half of all companies in the IT industry in the United States have P/S ratios greater than 2.6x and even P/S higher than 7x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

We've discovered 3 warning signs about VNET Group. View them for free.View our latest analysis for VNET Group

What Does VNET Group's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, VNET Group has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on VNET Group will help you uncover what's on the horizon.How Is VNET Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as VNET Group's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. Pleasingly, revenue has also lifted 33% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 17% per year as estimated by the twelve analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 17% per annum, which is not materially different.

With this information, we find it odd that VNET Group is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

VNET Group's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of VNET Group's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 3 warning signs for VNET Group (1 makes us a bit uncomfortable!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VNET

VNET Group

An investment holding company, provides hosting and related services in China.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026