- United States

- /

- Software

- /

- NasdaqGM:VERX

Vertex (VERX): Investors Eye Profitability With 12.4% Revenue Growth Forecast Leading Into Earnings

Reviewed by Simply Wall St

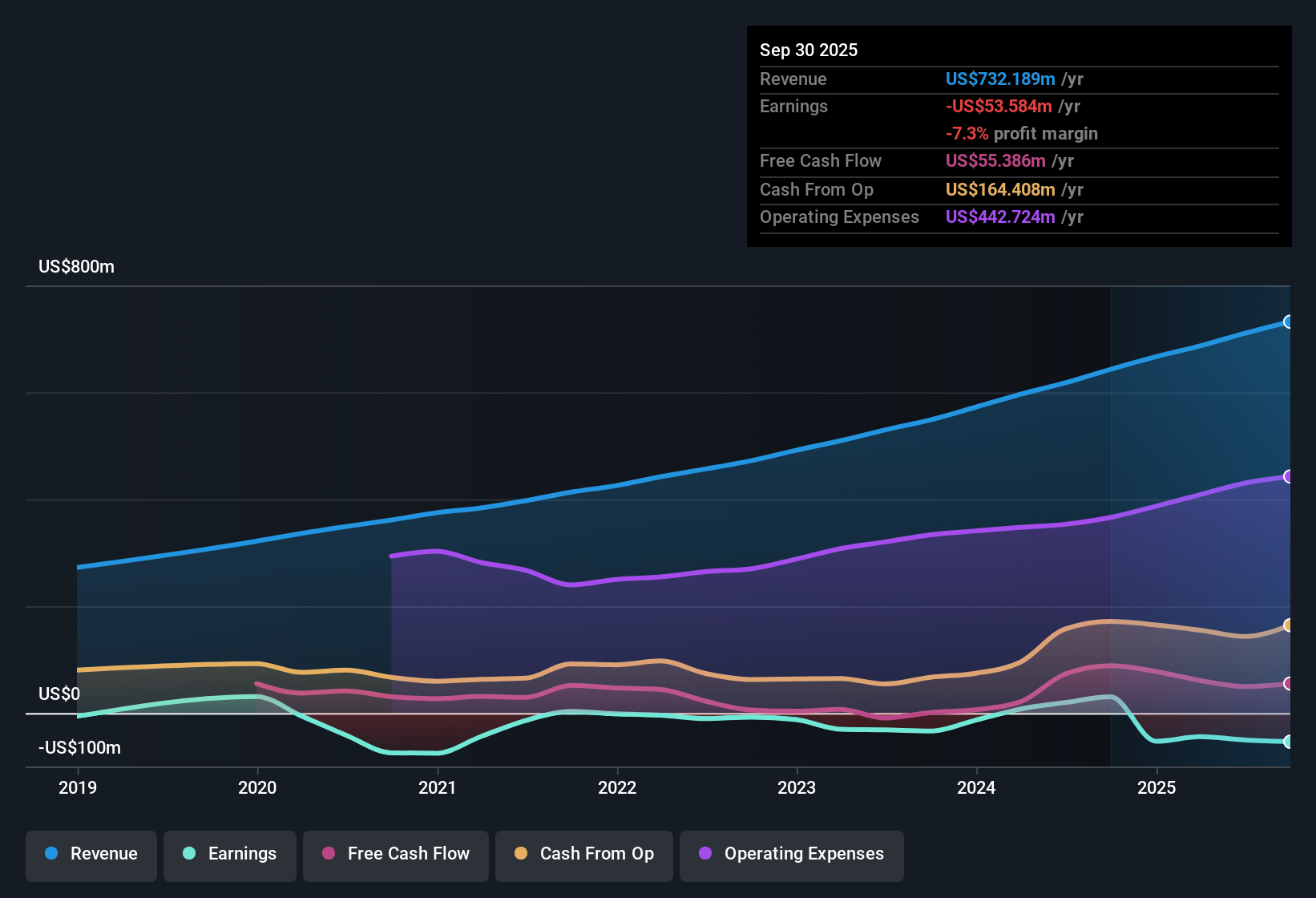

Vertex (VERX) continues its path toward profitability, having reduced losses at an average rate of 16.4% annually over the last five years. Looking ahead, analysts forecast earnings to grow at an impressive 82.67% per year, with revenue growth accelerating to 12.4% per year, surpassing the broader US market’s 10.5% pace. Investors are paying close attention to this growth trajectory as the company remains unprofitable, but the lack of flagged risks and attractive valuation metrics are fueling optimism around the stock.

See our full analysis for Vertex.Now, let’s see how these numbers measure up when compared against the most widely discussed market narratives for Vertex. Some long-held views may be confirmed, while others could be put to the test.

See what the community is saying about Vertex

Profit Margins on the Cusp of Turning Positive

- Analysts forecast Vertex's profit margin to jump from the current -7.1% to 6.7% within three years, highlighting a potential inflection point for the business model.

- According to the analysts' consensus view, margin expansion is set to be driven by higher-margin cloud revenue and improved efficiency.

- The consensus points to internal technology investments and measured expense controls as paving the way for greater margin leverage.

- Efficiency gains, together with cloud revenue making up a larger share of the total business, are expected to steadily lift both EBITDA and net margins over time.

- Projections suggest that earnings will rise from a loss of $50.4 million today to a profit of $71.6 million by September 2028, underscoring the power of these expanding margins.

Customer Wins Powered by Regulatory Tailwinds

- Regulatory mandates for e-invoicing in Europe, particularly in France and Germany starting in 2026, are expected to bring a significant wave of new enterprise customers, strengthening recurring revenue.

- Analysts' consensus narrative highlights that expanding country coverage and frequent tax rule changes are accelerating the adoption of Vertex’s compliance platforms.

- The "land and expand" dynamic is cited as multinationals are rapidly licensing additional regions, helping drive long-term ARR growth.

- Broader moves to upgrade cloud ERP systems, as deadlines loom over the next two years, are anticipated to lift demand for Vertex’s integrations and subscription services.

Valuation Discount Adds Up Against Peers

- Vertex trades at a Price-To-Sales Ratio of 5.1x, lower than both its peer group at 6.6x and the US software industry average of 5.3x. This may signal an attractive current entry point.

- The analysts' consensus narrative notes that with a share price of $22.90 versus a DCF fair value of $38.87, the stock appears undervalued based on its robust growth outlook.

- The consensus price target stands at $36.79, which is about 60% higher than where shares trade today, but reaching it assumes Vertex can meet ambitious profitability targets by 2028.

- Investors should assess whether future margin expansion and recurring revenue growth can justify a future PE multiple well above the industry average.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vertex on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? In just a few minutes, you can build and share your own perspective. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Vertex.

Explore Other Investment Opportunities

While Vertex’s growth outlook is compelling, its profit margins are still negative and the path to consistent earnings remains uncertain compared to peers. For investors who prioritize steady performance, use stable growth stocks screener (2094 results) to spot companies with a record of reliable expansion no matter the market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VERX

Vertex

Provides enterprise tax technology solutions for retail trade, wholesale trade, and manufacturing industries in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives